The financial landscape of Canada has been a roller coaster over the past few years, especially with the unprecedented times brought about by the global pandemic. As we navigate through 2024, the Bank of Canada’s interest rate announcements have become pivotal events, closely watched by homeowners, investors, and economists alike. The most recent announcement on March 6th, 2024, has been particularly insightful, offering clues about the future of Canada’s economy and interest rates.

The Announcement Breakdown

On this pivotal day, financial experts Jay Lewis and Josh Tagg teamed up to dissect the Bank of Canada’s decision and its implications for Canadians. As expected, the Bank of Canada held its interest rates steady, continuing the trend seen in recent announcements. This decision was largely anticipated given the significant rate increases over the last two years, totaling nearly 5% from the lows during the COVID-19 pandemic.

Josh Tagg provided a detailed analysis, emphasizing the Bank’s observation that employment growth has been trailing behind population growth, and signs that wage pressures may be starting to ease. These developments are crucial as they play a significant role in inflation dynamics and ultimately, in the Bank’s interest rate policy.

Understanding the Economic Indicators

Employment and Wage Pressures

The Bank of Canada has consistently expressed concern over rising wages, as they lead to increased spending, demand, and subsequently, inflation. The recent announcement highlighted a potential easing of these pressures, a positive sign from the Bank’s perspective. However, it’s a double-edged sword, as slower job growth can have its drawbacks, even if it contributes to deflationary pressures in the short term.

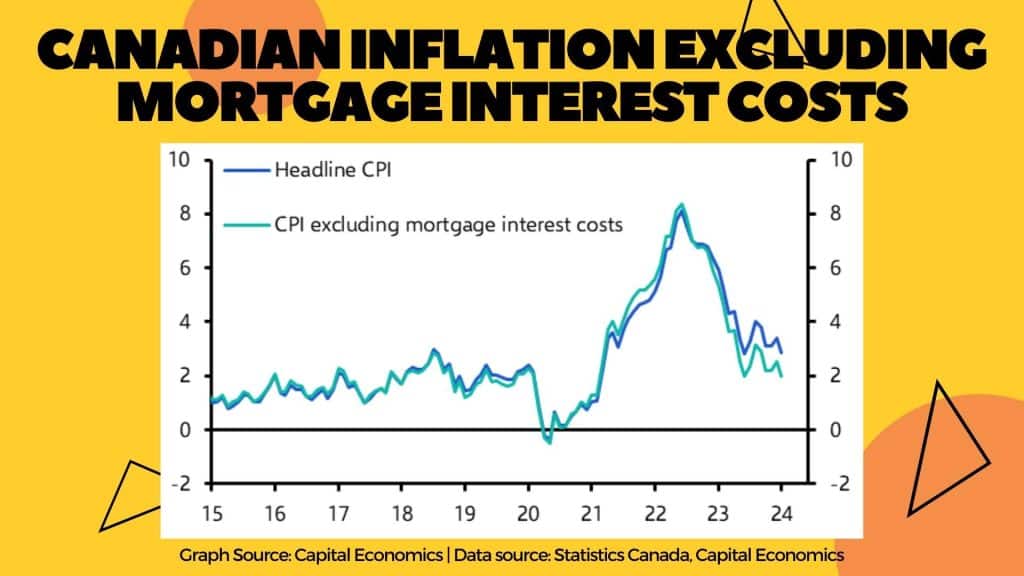

Inflation and Mortgage Interest Costs

Another focal point of the discussion was the impact of mortgage interest costs on inflation. Josh Tagg pointed out an important distinction in inflation measures – the headline CPI inflation versus a version that excludes mortgage interest costs. The latter measure is closer to the Bank’s 2% target, suggesting that the central bank’s rate hikes have been effective in curbing inflation, albeit at the expense of higher mortgage costs for Canadians.

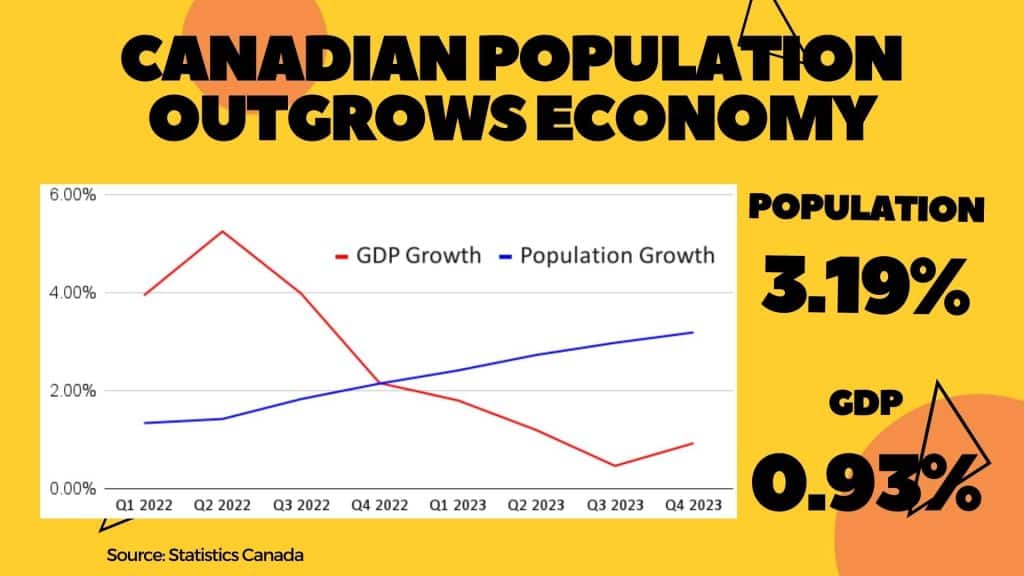

GDP Growth vs. Population Growth

A critical piece of the economic puzzle is the relationship between GDP growth and population growth. Recent data shows that while Canada’s GDP is growing, it’s not keeping pace with the rate of population increase. This mismatch indicates that on a per-person basis, the economy might be contracting, a situation that could nudge the country towards recessionary conditions in specific regions, despite national figures suggesting modest growth.

Looking Ahead: Interest Rate Predictions

Josh Tagg shared insights into the future of interest rates, pointing to June 5th as a potential date for the first rate cut of the year. With several more announcements scheduled for 2024, experts anticipate a cumulative reduction of around 1% in the Bank of Canada’s interest rate by year-end. This prediction is based on current economic indicators and the Bank’s recent messaging, suggesting a cautious yet optimistic approach to monetary policy moving forward.

In the next section of this blog post, we will delve deeper into the implications of these predictions for homeowners and potential buyers, along with strategies to navigate the changing financial landscape. Stay tuned for expert advice on mortgage planning, investment opportunities, and how to prepare for the anticipated shifts in Canada’s economy.

Navigating the Housing Market: What This Means for You

The Bank of Canada’s interest rate decisions have a direct impact on the housing market, influencing both mortgage rates and housing affordability. With the anticipation of rate cuts later this year, potential homebuyers and current homeowners are keenly watching for the optimal time to make their move.

Mortgage Planning in a Shifting Market

For those looking to refinance or secure a new mortgage, the predicted interest rate drops could mean more affordable borrowing costs. However, timing is everything. Jay Lewis and Josh Tagg emphasize the importance of staying informed and working with financial advisors to lock in rates at the right moment. For buyers, the impending rate decreases may also mean a surge in housing demand, potentially driving up prices. Balancing the desire for lower rates with the risk of higher purchase prices will be key.

Investment Opportunities Amidst Economic Shifts

Investors should also be on alert, as changes in interest rates can influence various sectors of the economy. Real estate, in particular, may see fluctuations in investment returns as mortgage rates adjust. Diversifying investments and seeking opportunities in industries less sensitive to interest rate changes can provide stability in uncertain times.

Preparing for Future Economic Conditions

Despite the optimism surrounding potential rate cuts, Canadians should remain cautious. The economic indicators highlighted by the Bank of Canada suggest a complex financial environment, with slow GDP growth on a per-capita basis and ongoing inflation concerns. Building an emergency fund, reducing debt, and planning for long-term financial goals are prudent steps in preparing for any economic scenario.

The Road Ahead

As we look forward to the rest of 2024, the Bank of Canada’s interest rate announcements will continue to be significant milestones in Canada’s economic recovery post-pandemic. The insights provided by Jay Lewis and Josh Tagg shed light on the intricate balance the Bank must maintain to foster economic stability while managing inflation.

For Canadians, staying informed and proactive in financial planning will be essential in navigating the challenges and opportunities ahead. Whether you’re buying a home, investing, or simply managing your personal finances, understanding the implications of the Bank’s decisions can empower you to make smarter, more informed choices.

As we anticipate the next rate announcement, remember that the economic landscape is ever-changing. By keeping a close eye on developments and seeking expert advice, you can position yourself to thrive in Canada’s dynamic financial environment. Stay tuned for more updates and analyses as we continue to navigate these interesting times together.

0 Comments