Canada’s fixed mortgage rates witnessed a significant shift this week as major banks across the country reduced their advertised fixed mortgage rates, some by as much as 70 basis points (0.70%). This move follows a trend where numerous lenders have already been adjusting their rates in response to a notable decline in bond yields, a key factor in fixed mortgage rate pricing.

Major Banks finally join the Rate Reduction

The rate reduction is no longer limited to a our non-bank financial institutions. Now, most of the big banks have also lowered rates across various mortgage terms. Most notable is the popular 5-year term, where insured mortgages (those with less than a 20% down payment) now sit at or below 5.24% with most banks and lenders, and uninsured ones are widely available 5.65% or lower. Some lenders are offering extra discounting to 4.99%.

What’s Driving These Rate Cuts?

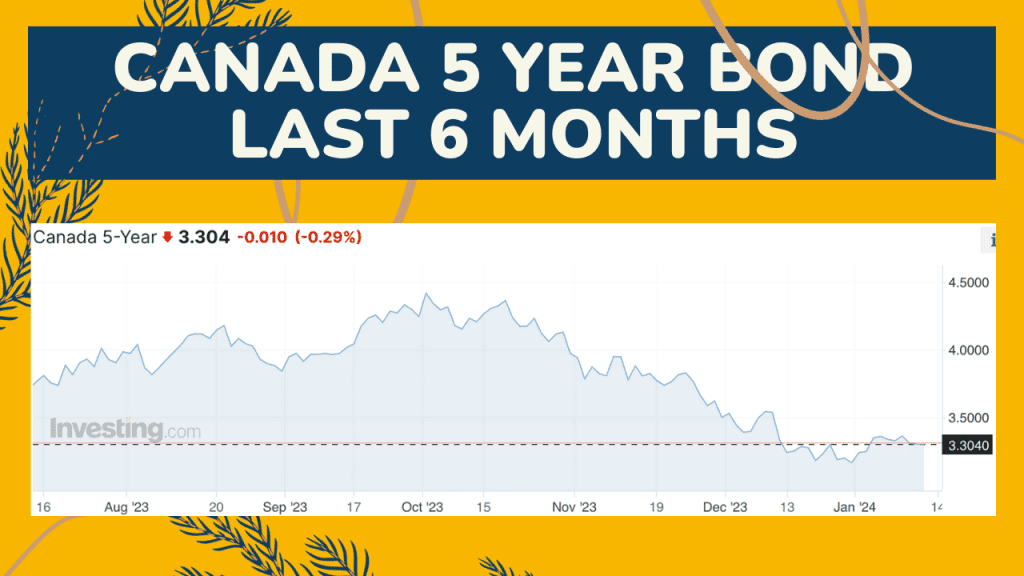

Since October, mortgage rates have been on a downward trajectory, echoing the decline in Government of Canada bond yields, which have dropped over a full percentage point since their peak in early October. Industry observers interpret the recent rate adjustments by major banks as an alignment with the current bond yield levels.

source: https://ca.investing.com/rates-bonds/canada-5-year-bond-yield – screenshot at 2pm Friday January 12, 2024

source: https://ca.investing.com/rates-bonds/canada-5-year-bond-yield – screenshot at 2pm Friday January 12, 2024

These rate cuts are a reaction to the prolonged high spread and bond yields staying low for an extended period. After having profit margins trimmed while rates increase, many banks and lenders were hesitant to lower rates much until they were confident the bond yield would stay lower.

The Future of Variable Rates

While fixed rates might continue to decrease, the scope for further reductions could be limited. Current fixed mortgage rates have largely factored in expected rate cuts by the U.S. Federal Reserve and the Bank of Canada (BoC) in 2024. However, variable mortgage rates, still sitting between 6.2% and 7.2% are anticipated to decline as the BoC rolls out expected rate cuts.

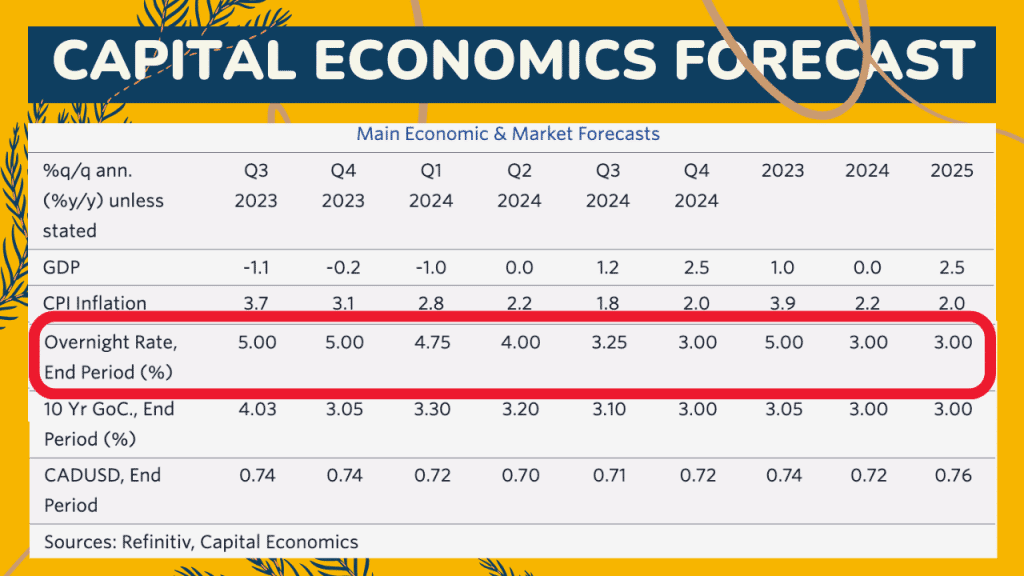

While some economists including Capital Economics predict the Bank of Canada will drop it’s rate by 200 basis points, or 2%, over the coming 12 months, the market is generally expecting about half of that. A drop of one percent over the course of the year would still leave the variable rate for most mortgage holders above 5.2%.

Any borrowers opting for variable rates must believe that these rates will eventually fall below the fixed rates available today, with enough time remaining in their term to make up for the initial higher cost.

Strategies for Mortgage Seekers

For those in the market for a mortgage, variable rates might be an option worth considering, especially for those who can handle payment risk and are willing to wait. Bond markets are already predicting a significant chance of rate cuts by the BoC in the coming months.

One and two year terms remain very expensive and may not perform better than opting for a variable rate. For those renewing or concerned about payments, a 3-year fixed term might offer a more favourable rate around 5.5%

In summary, the Canadian mortgage market is experiencing a notable shift with the reduction of fixed mortgage rates by major banks and other lenders, influenced by the decrease in bond yields and market anticipation of monetary policy changes. As the landscape evolves, borrowers are advised to carefully consider their options, weighing the benefits and risks of fixed versus variable rates in this dynamic environment.

0 Comments