Economists, mortgage brokers, and Canadians are all looking forward to rate drop announcements from the Bank of Canada. There are predictions of a rate drop as early as April 2024. The US Fed last week discussed possible rate drops in it’s announcement too which is only adding to that expectation.

However, in an address last week, Bank of Canada governor Tiff Macklem said that it is still too early to talk about rate cuts. The Bank needs us to help reign in spending and inflation, and if we think it is over, and return to our spending habits expecting rates to drop, it may have the opposite effect and force rates to stay higher for longer.

The Path to Price Stability

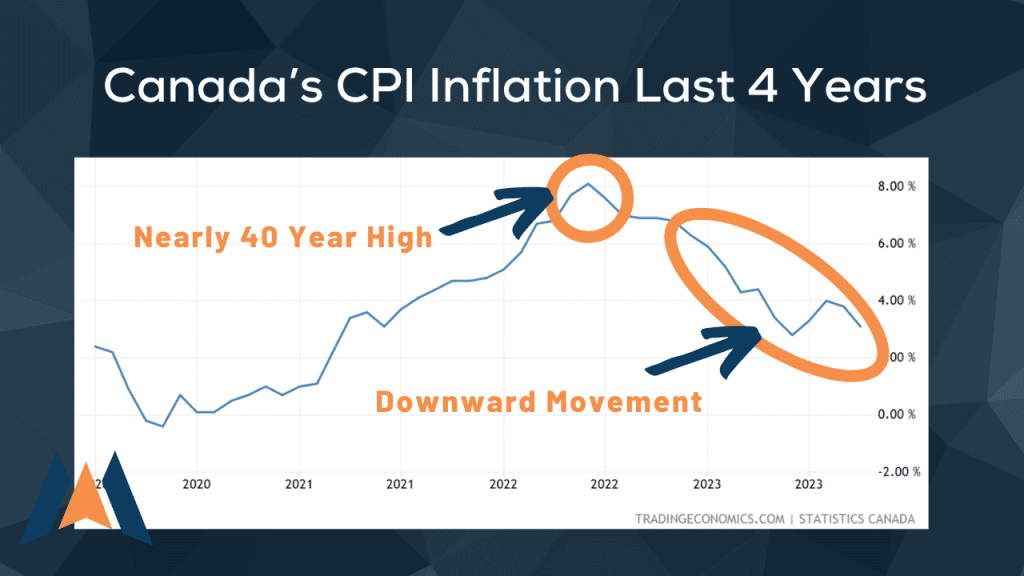

The Bank of Canada has been striving to achieve price stability, a challenge compounded by global economic uncertainties. Their primary target is maintaining inflation at around 2%, but recent trends have seen inflation rates deviate from this goal. The Bank’s approach involves carefully calibrated monetary policies aimed at curbing inflation without stifling economic growth. These efforts are pivotal in ensuring long-term economic stability but require a delicate balance to avoid adverse effects on the economy.

Lessons Learned and Looking Ahead

Reflecting on the past year’s economic challenges, the Bank of Canada has gleaned valuable lessons that are shaping its future strategies. One key learning is the critical importance of maintaining inflation targets for overall economic health. The Bank has had to respond assertively to the spike in inflation and is committed to returning to the 2% target. This commitment is seen in their forward-looking strategies, which are tailored to adapt to evolving economic conditions while striving for price stability and sustainable growth. Regarding whether we will get to the target, he cautiously said that “The 2% inflation target is now in sight, and while we’re not there yet, the conditions increasingly appear to be in place to get us there.” He also added that he expects we will be getting close to the 2% target by this time next year.

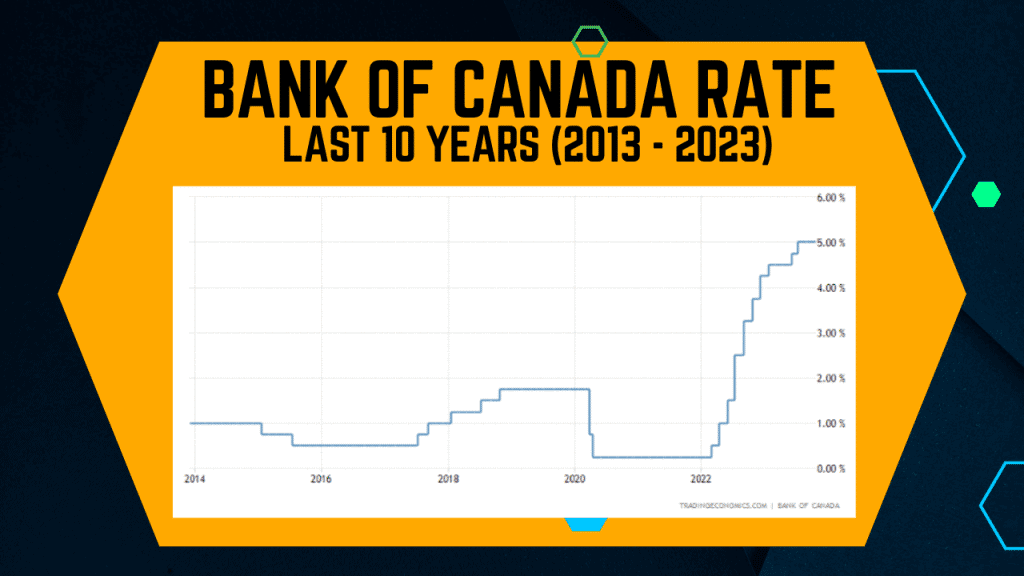

Source: Trading Economics https://tradingeconomics.com/canada/interest-rate

Governor Tiff Macklem’s Stance on Rate Cuts

Governor Tiff Macklem has expressed caution regarding immediate rate cuts, saying “I know it is tempting to rush ahead to that discussion, but it’s still too early to consider cutting our policy rate.” This stance is shaped by the need to ensure that inflation is on a sustained downward trajectory before considering easing policy. Macklem’s approach reflects a careful balance between managing inflation and supporting economic recovery. His comments suggest a gradual approach to monetary policy adjustments, aligning with the broader goal of long-term economic stability.

Comparison with Global Economic Trends

Internationally, central banks are adopting varied approaches to monetary policy. For instance, the U.S. Federal Reserve’s stance differs from the Bank of Canada’s, with the Fed signaling potential rate cuts. Such differences underscore the unique economic challenges and strategies of each country. The Bank of Canada’s approach, distinct from its global counterparts, emphasizes careful monitoring and response to domestic economic indicators.

Public and Market Reactions

The market and public have shown mixed reactions to the Bank of Canada’s policies and Governor Macklem’s comments. While some market participants anticipate eventual rate cuts, there’s an understanding of the need for a cautious approach given the complex economic environment. The Bank’s communication and policies continue to be a focal point for economic analysis and public discourse.

In summary, the Bank of Canada, under Governor Macklem’s leadership, is navigating a challenging economic landscape with a focus on long-term stability. While rate cuts are not imminent, the Bank’s actions will be crucial in steering the Canadian economy towards its inflation targets and sustainable growth. The coming months will be telling as the Bank balances global influences, domestic pressures, and market expectations.

0 Comments