Headline Inflation Rate: A Steady Hold

source: Trading Economics Canada Inflation Rate

source: Trading Economics Canada Inflation Rate

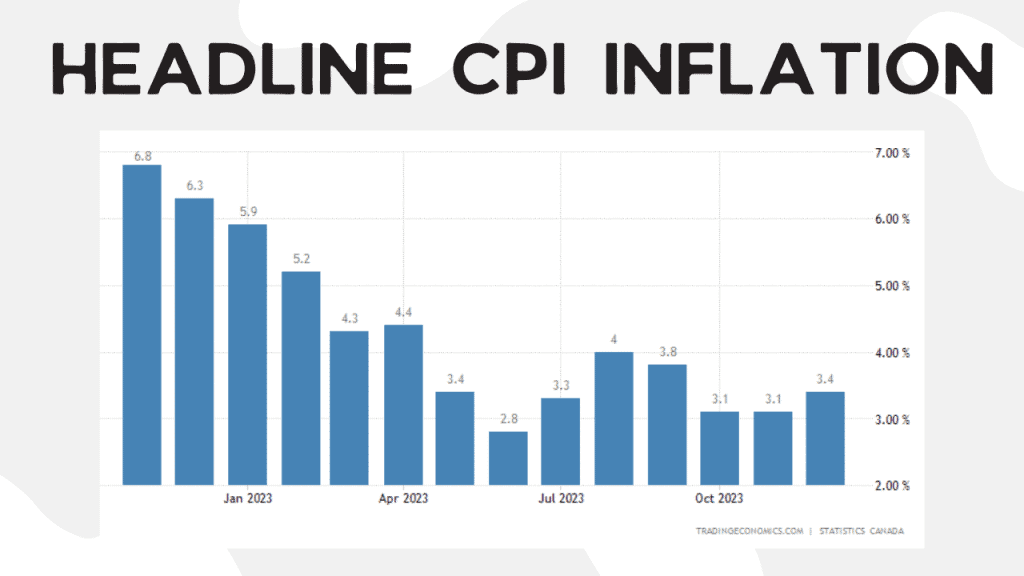

The latest data on Canada’s inflation, released today, January 16, 2024, reveals a nuanced picture of the economic situation. The Headline Inflation Rate, commonly known as the Consumer Price Index (CPI), met market expectations by registering at 3.4% for December 2023. This figure represents a slight increase from the 3.1% observed in both October and November 2023. However, it is worth noting that it is still lower than the rates seen in August and September, which were 4% and 3.8% respectively. The Headline Inflation Rate continues to be a crucial indicator of the overall price movement in the economy.

Core Inflation: The Central Focus

The Core Inflation rate, a key measure for the Bank of Canada, sheds light on a different aspect of inflation. This measure strips out 8 of the most volatile components, including food, energy, and mortgage interest costs. By excluding these fluctuating elements, Core Inflation provides a clearer view of the underlying inflation trends, unaffected by temporary price changes in these sectors.

Significant Decrease in Core Inflation

source: Trading Economics Core Inflation Rate Month over Month

source: Trading Economics Core Inflation Rate Month over Month

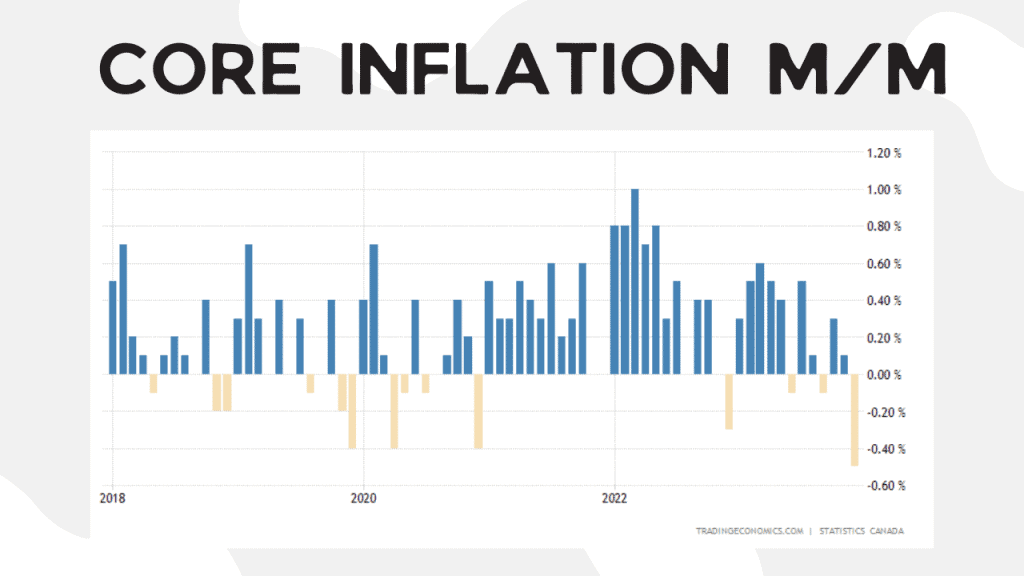

In an unexpected turn, Core Inflation saw a month-over-month decrease of 0.5%. This marks the largest reduction in Core Inflation since January 2018, nearly six years ago. Since 2020, there have only been eight instances of negative readings in Core Inflation, three of which occurred during the early days of the COVID-19 pandemic (March, April, and June 2020).

Annual Change and Historical Context

source: Trading Economics Core Inflation Rate

source: Trading Economics Core Inflation Rate

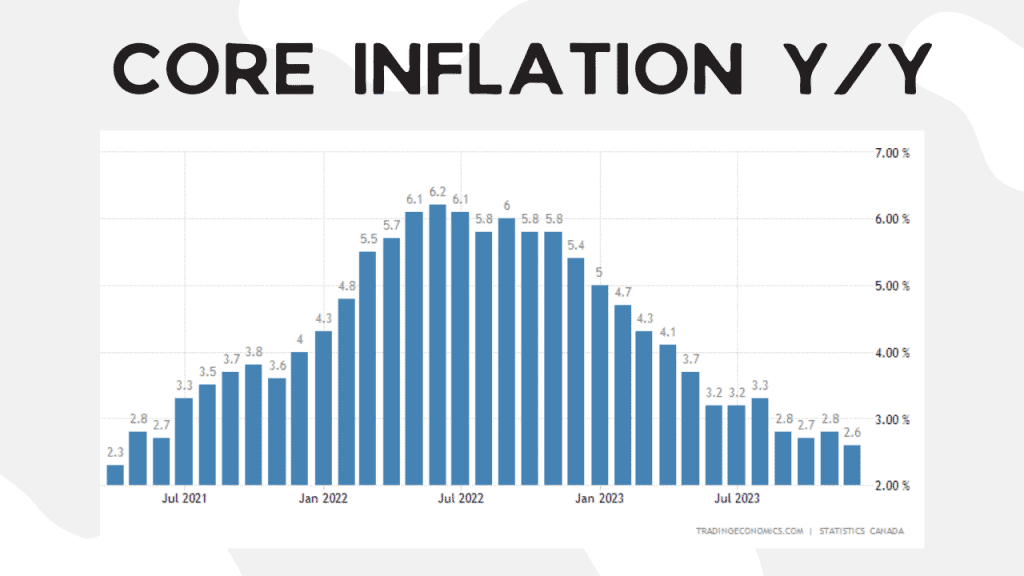

The annual change in Core Inflation is now at its lowest in almost three years. The last time it was this low was in April 2021, when it stood at 2.3%. In contrast, the peak of Core Inflation was observed in mid-2022, during a period when it remained above 5% for 11 consecutive months.

Implications for Interest Rates

Given these developments, the prevailing expectation is that the Bank of Canada might start lowering its interest rates later this year. This anticipated reduction in rates will bring down variable rates, while fixed rates are already on a downward trajectory in anticipation of this policy shift.

Today’s inflation data offers a mixed but cautiously optimistic picture of Canada’s economy. While the Headline Inflation Rate remains steady, the significant decrease in Core Inflation could signal a turning point in the Bank of Canada’s approach to monetary policy, potentially leading to a more accommodative stance in the near future.

0 Comments