As we embark on a new year, the Canadian housing and mortgage landscape is showing signs of significant transformation. This article delves into the insights from the latest Housing and Mortgage Market Review by Mortgage Professionals Canada, providing a comprehensive outlook for 2024.

Economic Indicators and Their Impact

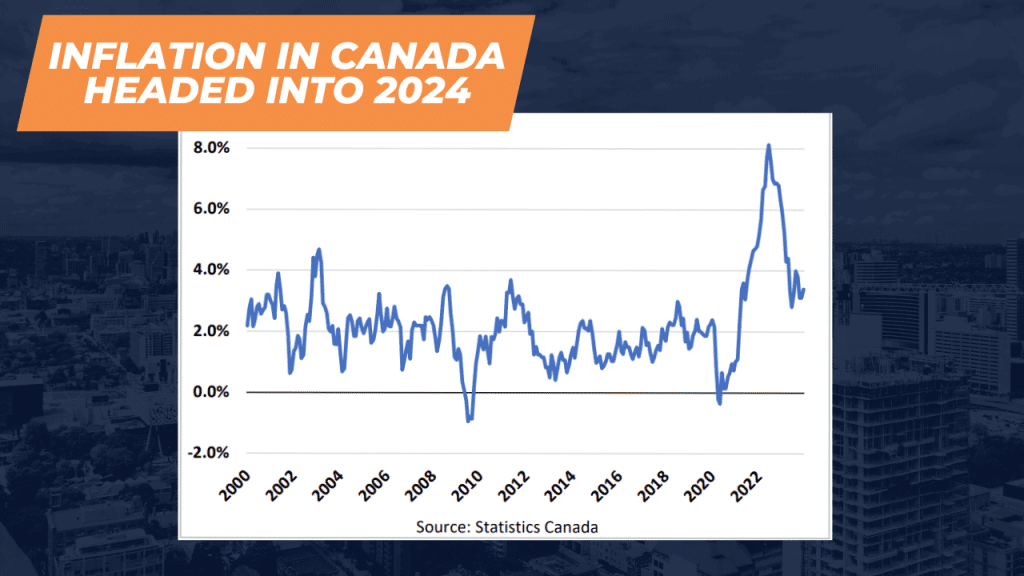

Entering 2024, Canada’s economy demonstrates a clear trend towards deceleration in inflation, with the Bank of Canada poised to adjust the overnight rate downwards by a full percentage point throughout the year. This adjustment is a response to a decelerating inflation trend and a population growth that has shattered records, increasing by 1.2 million people or 3.2% in the past year, nearly five times the OECD average.

The end of 2023 saw the national inflation rate slightly uptick to 3.4% in December from 3.1% in November, amidst signs of economic slowdown. The GDP contraction by an annualized rate of -1.1% in Q3 and a rise in the unemployment rate to 5.8% signal a cautious economic environment. However, the anticipated rate cuts from April 2024 suggest a potential revival in consumer confidence and mortgage market activity.

Anticipated Rate Cuts and Their Influence on the Mortgage Market

Market Dynamics: Sales and Prices

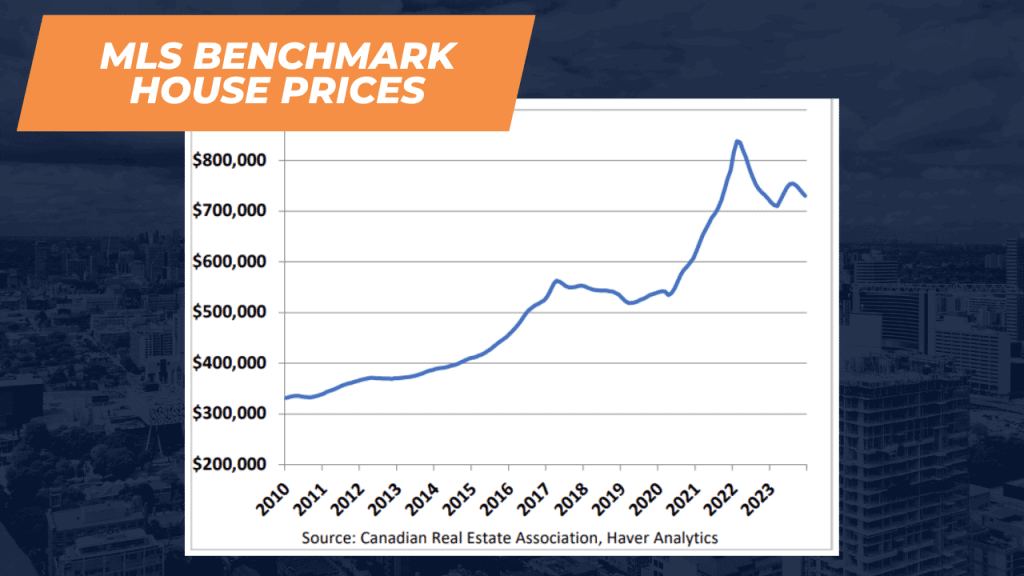

The final quarter of 2023 witnessed a 6.2% drop in national home sales, with significant declines in British Columbia and Quebec. Despite this, a surge in sales activity in December hints at a resilient market poised for recovery. This rebound is further supported by the sales-to-new listings ratio climbing to 58% in December, indicating a shift towards a more balanced market.

House prices ended the quarter 3.8% lower, reflecting a market adjustment. However, with mortgage rates declining and a robust population growth fueling demand, a stabilization in prices is anticipated as we progress into 2024.

Loan Growth and Mortgage Originations: A Slow Recovery

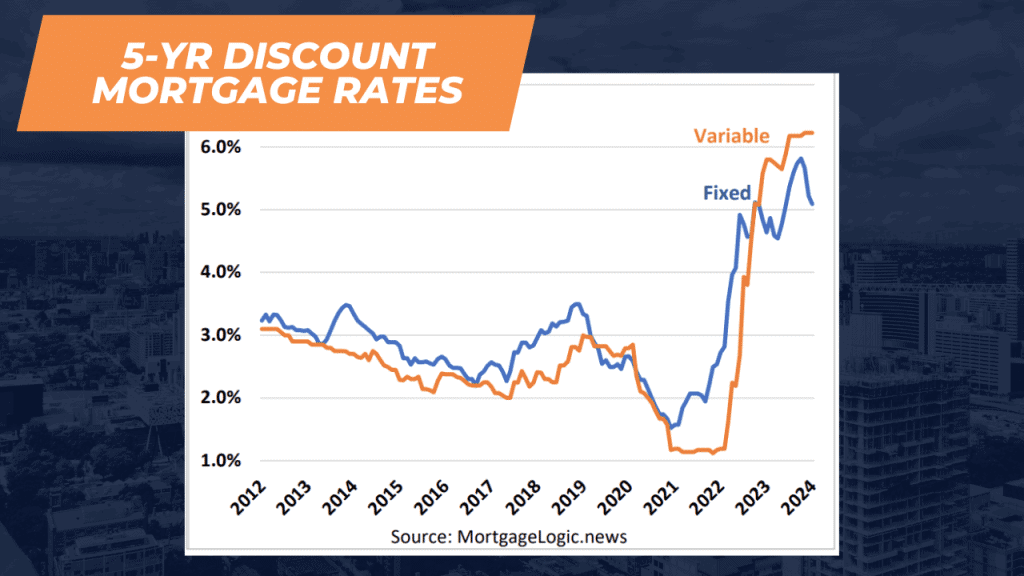

Mortgage growth remains subdued, with a mere 0.25% increase in November and a 3.4% rise over the past year, marking the slowest annual growth since 2001. Despite a year-over-year drop in mortgage originations in November, an uptick in variable rate loans suggests borrowers are preparing for future rate cuts, potentially revitalizing the mortgage demand in 2024.

Challenges and Opportunities Ahead

The Canadian housing market is navigating through a period of transition, influenced by evolving economic indicators, mortgage rate adjustments, and significant population growth. These factors present both challenges and opportunities for buyers, sellers, and investors alike.

As mortgage rates are expected to decline, coupled with ongoing population growth, the market dynamics suggest an impending improvement in affordability and demand. However, the construction sector’s slow response to the burgeoning population increases the risk of a supply crisis, particularly for single-family homes.

0 Comments