Last week, I was fortunate enough to attend an event hosted by the Calgary Chamber of Commerce featuring Tiff Macklem, the Governor of the Bank of Canada. In his presentation, Governor Macklem addressed a room full of Calgary business people, including many of my Calgary Mortgage Broker colleagues who have a local understanding of Calgary and Alberta and were looking for answers and information about the Bank of Canada’s Interest rate decisions through a more Alberta-centric lens.

The speech came the day after the Bank of Canada’s most recent interest rate announcement where they made no change to the rate after increasing in both June and July this year.

The primary focus of his speech was on the recent interest rate changes and the impact of inflation on these rates, a topic of great relevance to Canadian mortgages. In this article, I will delve into the key takeaways from Governor Macklem’s speech and explore the implications for the Calgary mortgage market.

Interest Rate Decisions

Governor Macklem began his speech by discussing the recent monetary policy decisions made by the Bank of Canada. He highlighted that the bank had raised its policy rate at both its June and July meetings to a new high of 5%. These decisions were driven by the bank’s concern about persistent excess demand in the economy and underlying inflationary pressures. The goal was to restore price stability for Canadians.

Impact as a Calgary Mortgage Broker

Obviously, a higher interest rate at the Bank of Canada has a direct impact on mortgage rates. As the policy rate increases, variable-rate mortgages become more expensive. But new fixed rate offerings also move – not in lockstep – but in a similar fashion. This means that Canadians seeking mortgages in Calgary, or across Alberta and Canada, may encounter higher borrowing costs, affecting their monthly payments and affordability.

Inflation and Its Impact

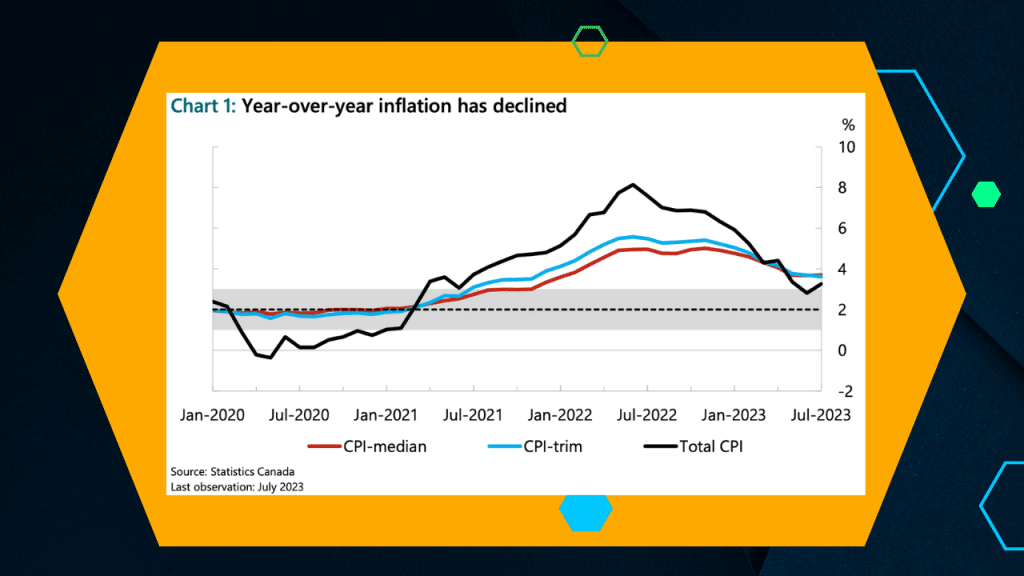

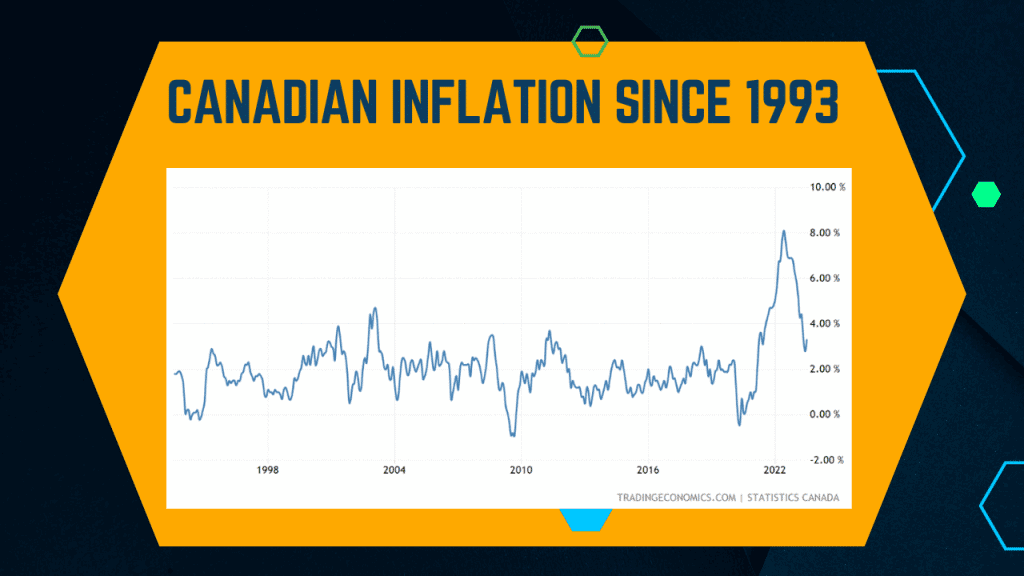

Governor Macklem emphasized the importance of monitoring inflation closely. In July, the Consumer Price Index (CPI) inflation stood at 3.3%, close to the bank’s 2% target when compared to inflation a year ago which hit 8%, but still not close enough. While progress has been made in slowing inflation, the Governor expressed concerns that the pace of progress has slowed.

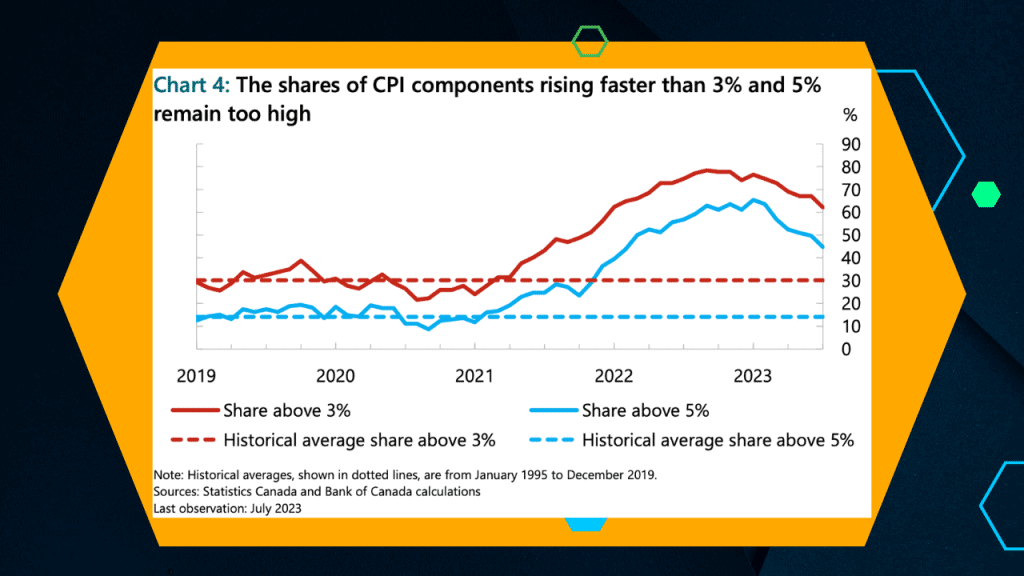

“When inflation is close to target, typically about 30% of components rise faster than 3% and about 15% rise faster than 5%. When inflation rose last year, the share of components rising faster than 3% peaked at almost 80% and 65% were above 5%. Today, about 60% of CPI components are rising above 3% and about 45% are rising above 5%. So we’ve made progress, but larger-than-normal price increases are still broad-based.”

Unpacking Inflation: Calgary Mortgage Broker Explains

Governor Macklem delved into the components of inflation and their implications. He noted that while some factors, such as energy prices, have contributed to the recent slowdown in inflation, prices for essentials like food, shelter, and services have not cooled down as expected. Mortgage interest costs have also risen significantly, up by approximately 30% compared to a year ago.

Impact on Mortgages: The single most substantial contributor to CPI inflation currently is mortgage interest costs, driven by interest rate increases. This means that homeowners with variable-rate mortgages or those seeking new mortgages in Calgary are experiencing the direct effects of these changes through higher mortgage interest payments.

Why the 2% Target

Governor Macklem addressed the question asked by many, including my Calgary Mortgage Broker colleagues of why the Bank of Canada remains committed to its 2% inflation target when inflation is hovering around 3%.

“First, you don’t raise the target just because you missed it. We’ve been targeting 2% inflation since 1995, and the inflation target anchors our economic and financial system. If you get rid of the anchor, or move it when the going gets tough, inflation itself gets less predictable and more volatile. Nobody wants that.

“Second, the 2% target has delivered low and stable inflation and lower unemployment rates on average for 25 years in Canada. Most central banks have a 2% target because, at 2%, inflation is low enough that people don’t need to worry about changes in their cost of living from one year to the next. And we have a lot of evidence that, for many years now and in many countries, 2% inflation has worked to deliver historically superior macroeconomic performance.”

Impact on Mortgages

A commitment to the 2% inflation target ensures stability in the overall economy, which benefits mortgage seekers and homeowners in Calgary and Alberta. Predictable and stable inflation rates contribute to economic confidence, making it easier for individuals to plan for their financial futures, including mortgage obligations.

Conclusion by this Calgary Mortgage Broker

Governor Tiff Macklem’s presentation at the Calgary Chamber of Commerce event provided valuable insights into the current economic landscape and its implications for Canadian mortgages, particularly in Calgary. The bank’s commitment to maintaining price stability through its 2% inflation target underscores the importance of stability in the mortgage market. As interest rates and inflation continue to evolve, prospective homebuyers and existing mortgage holders in Calgary must stay informed and adapt their financial plans accordingly.

0 Comments

Trackbacks/Pingbacks