The BOC Holds Rates Steady

As expected, the bank of Canada held its interest rate today after increasing back in July.

I know that sometimes it feels like the interest rates are not going to stop increasing. Some of us may have flashbacks to, or may have family members that lived through, the 1980s and the incredibly high interest rates from that time. While, I don’t expect that we will see interest rates anywhere near those double digit levels, this has been a very uncomfortable rate of increase over the last year and a half.

Since the COVID-19 induced lowering of the Bank of Canada rate to 0.25%, we have now seen since March 2020 to the bank increase its rate by 4.75%. Is the bank done? The truth is, that remains to be seen.

The Economy Is Slowing Down

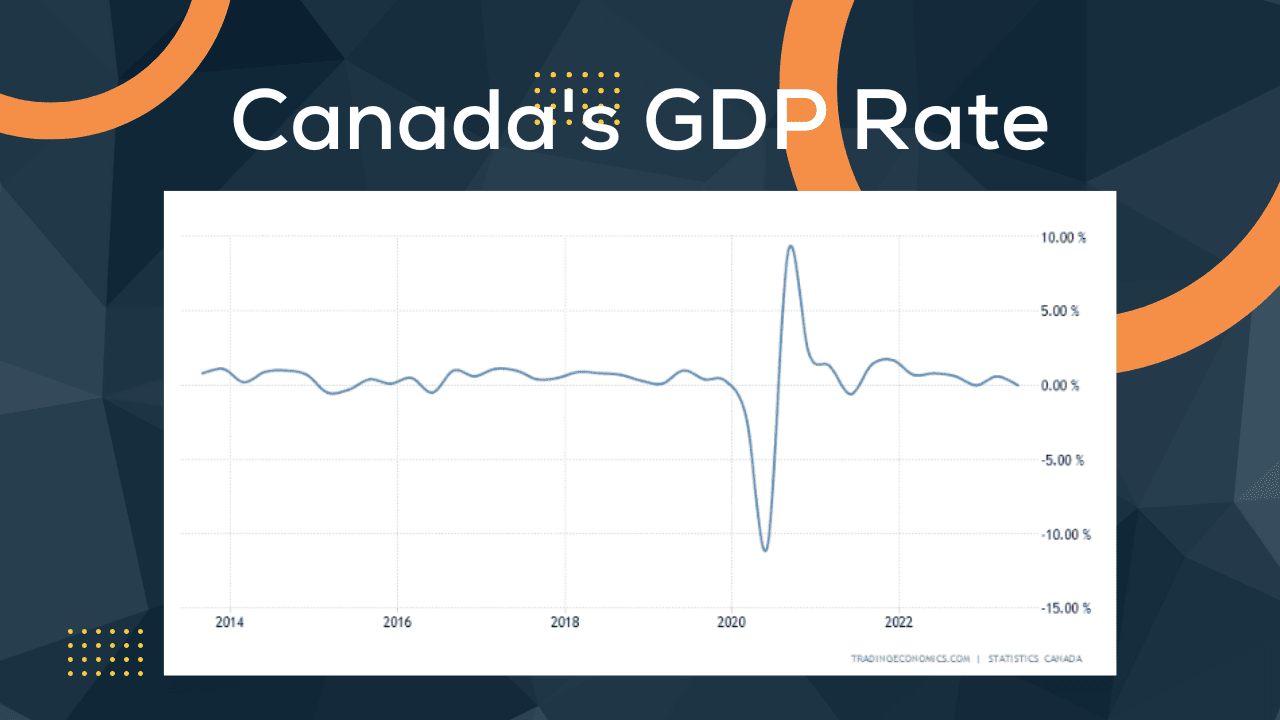

After the two increases in June and July, there has been a lot of information and data released that has really contributed to today’s announcement, and may be enough that we won’t see anymore. GDP Growth for the second quarter of the year was disappointing. Economic growth in Canada has dropped to nearly 1%. The Bank tells us that this is needed to releive price pressures – but it doesn’t feel good to the average Canadian!

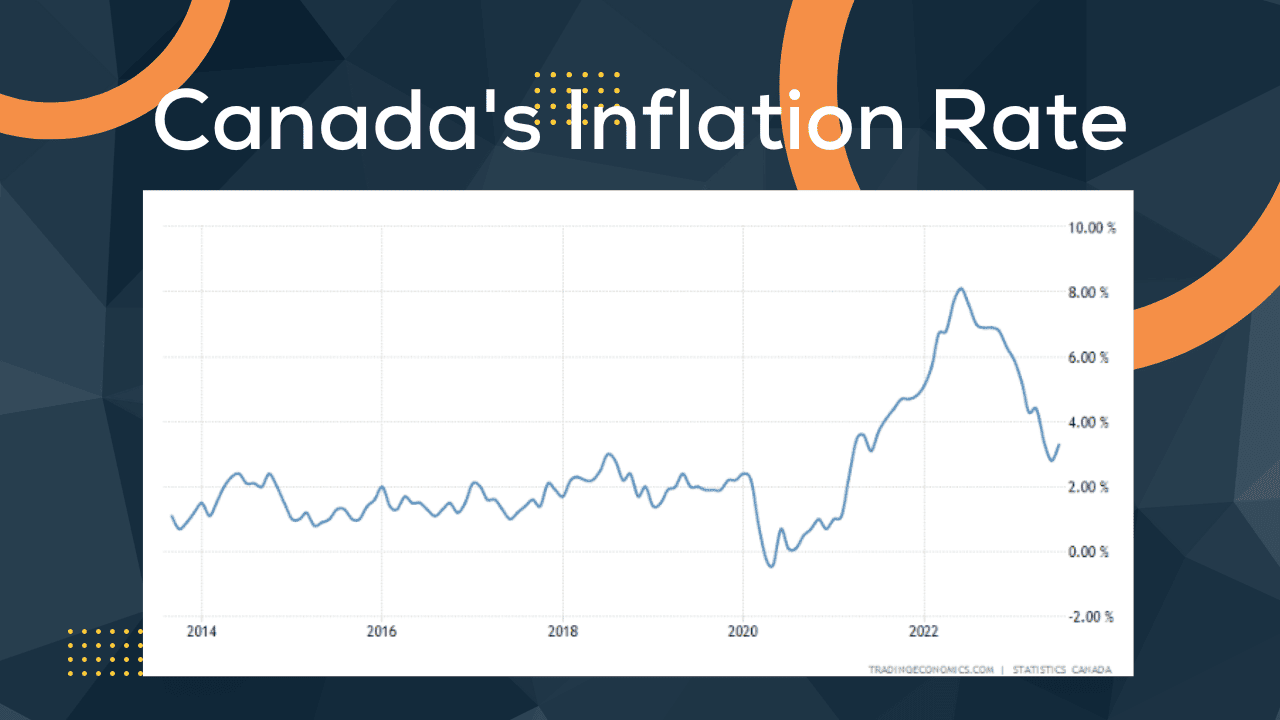

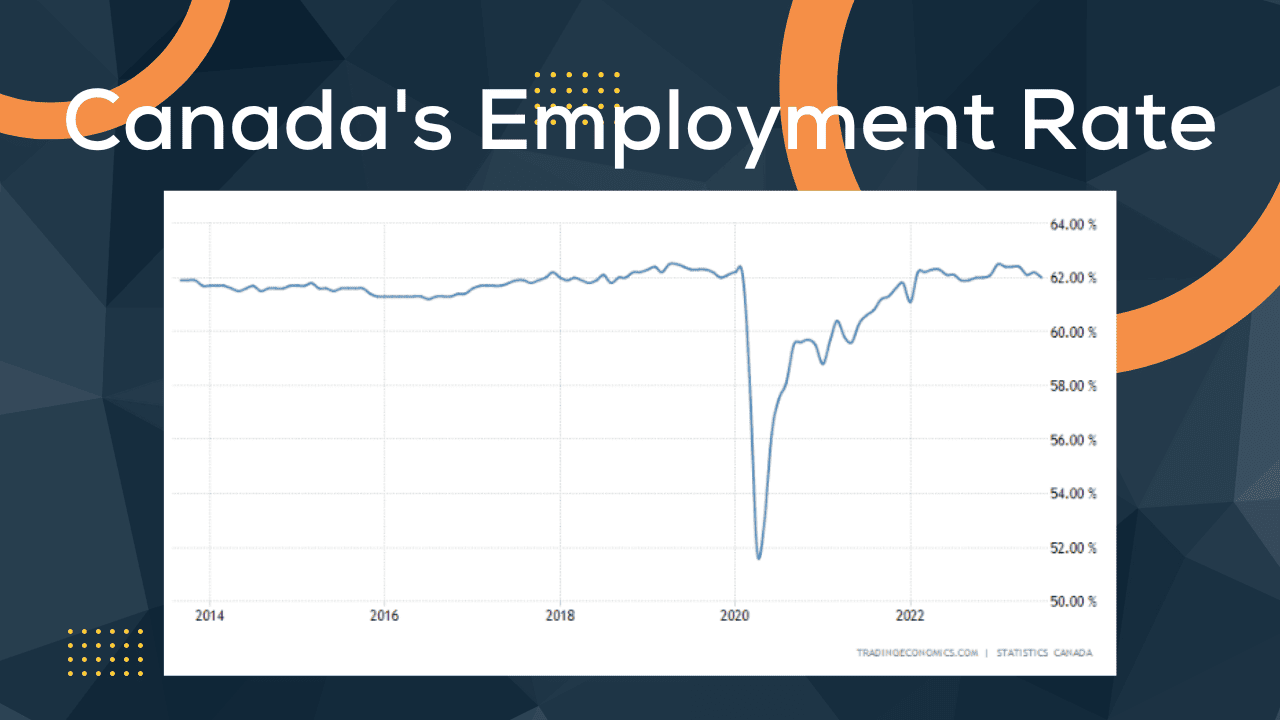

Employment rate is now trending downward and is back below pre-COVID levels. Inflation has been trending downward in Canada and in the advanced economies globally, but shows signs of being sticky at about 3%. And that is the Bank’s big concern. The drop from over 6% down to 3% happened quickly, but the path from 3% to 2% may take a lot longer. Regarding this 3% inflation, the bank tells his that “The longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability.”

David Eby, the premier of BC wrote a letter last week to the Bank of Canada Governor Tiff Macklem urging him to consider the human impact of rate increases and to hold off on any more. This hurts!

Rate Drops Are On The Horizon

Before today’s announcement, Randall Bartlett, senior director of Canadian economics at Desjardins Group, said the GDP data, “reinforces [their] view that the bank is done hiking for this cycle and its next move is likely to be a cut, possibly as early as the first quarter of 2024.”

BMO Chief Economist Douglas Porter wrote a few days ago that “the case for the bank to pause is now overwhelming,” they are not ready to “definitively” rule out more rate hikes because of a “few mild complications.”

But further that “the likelihood that growth will continue to weaken in the second half of the year should eventually clear these temporary complications.”

In conclusion, while the bank is pausing to allow time for more data to come in, and for the lagging effect of rate increases to work their way through the economy, it is still concerned about this sticky inflation. But the concern of further increases is lessening, and hopefully we do start to see some reduction in rates early next year.

0 Comments

Trackbacks/Pingbacks