UGH! Bank of Canada Summer Rate Jump

Will this be the FINAL Rate Increase of the year?

Need Some Mortgage Advice?

Our Quick Take

The Bank of Canada raised its interest rate again this week, hopefully for the last time this cycle! The Canadian economy continues to perform better than expected, with more people spending money and the GDP going up. Real estate markets are hot in some cities, while unemployment remains low. Prices for goods and services increased again in June, but inflation has dropped further, but the Bank of Canada is concerned the trend won’t continue!

The Gamble: Some Pain Now? Or More Later?

We Just Can’t Catch A Break!

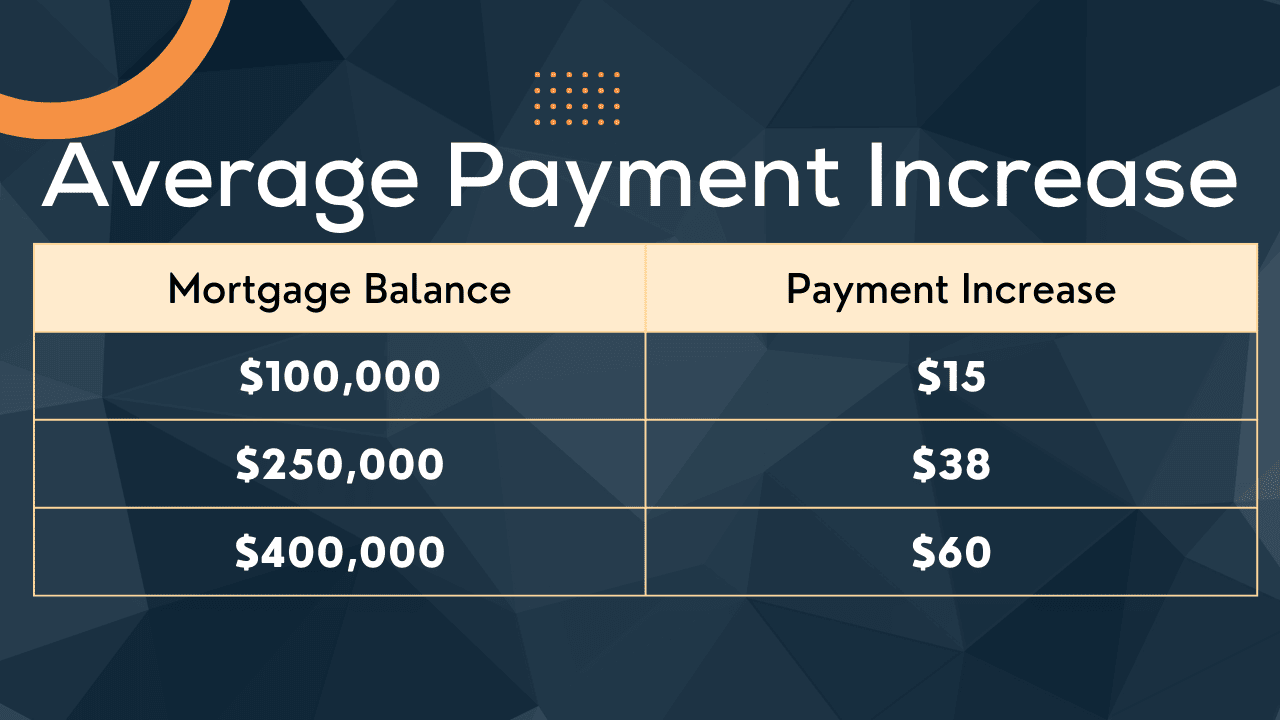

It is frustrating, but there are reasons to believe this is the last one. The Bank of Canada increased its overnight rate by a quarter percent today which brings the retail prime rate to its point since April 2001 – 22 years ago.

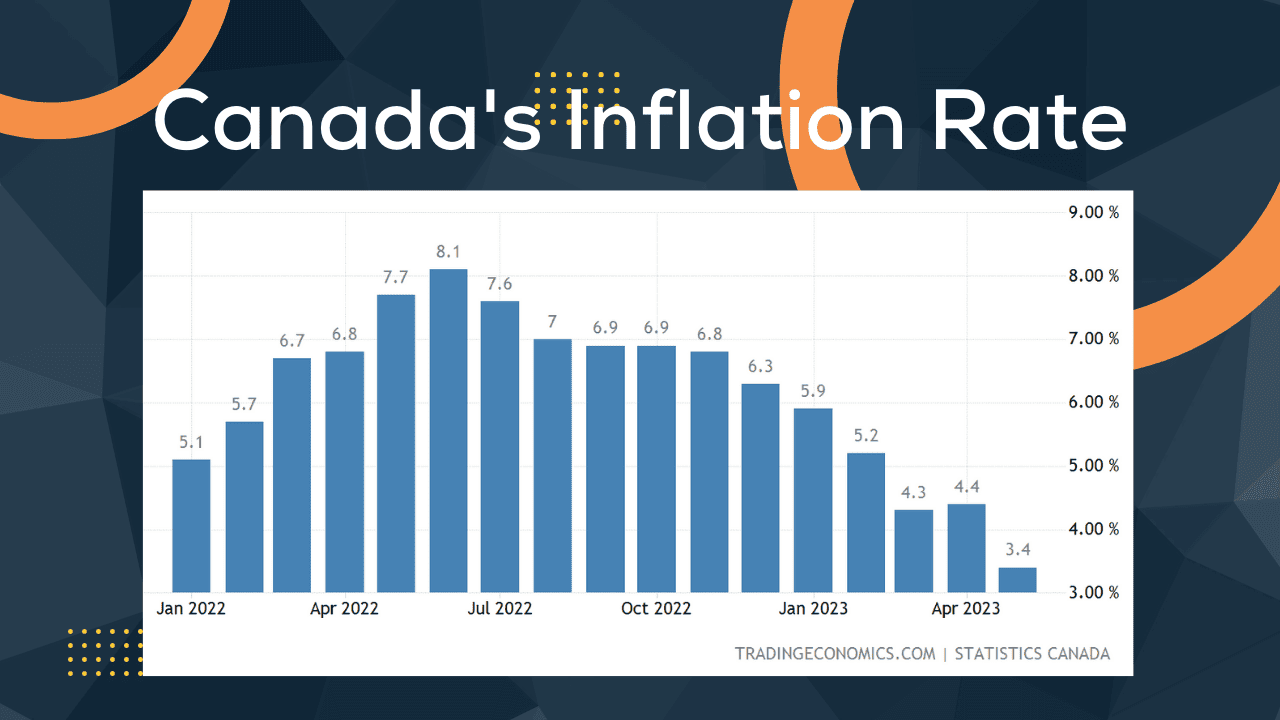

In June the Bank increased its rate a quarter percent after April inflation numbers showed a small uptick. After the announcement we got May inflation and jobs numbers and inflation had dropped as well as employment I hoped this would stop the bank from one more increase, but economists and the Bank had other ideas.

20 of 24 Economists Expected This!

Leading up to today’s announcement, 20 out of 24 economists polled by Reuters said they expected this rate increase, but also that it would be the last one. Changing from forecasts earlier in the year, the timeline for likely rate drops is pushed further into 2024 and economists don’t think inflation will hit the Bank’s 2% target until 2025.

For those in fixed rate mortgage, this doesn’t impact you unless your mortgage renewal is coming up soon.

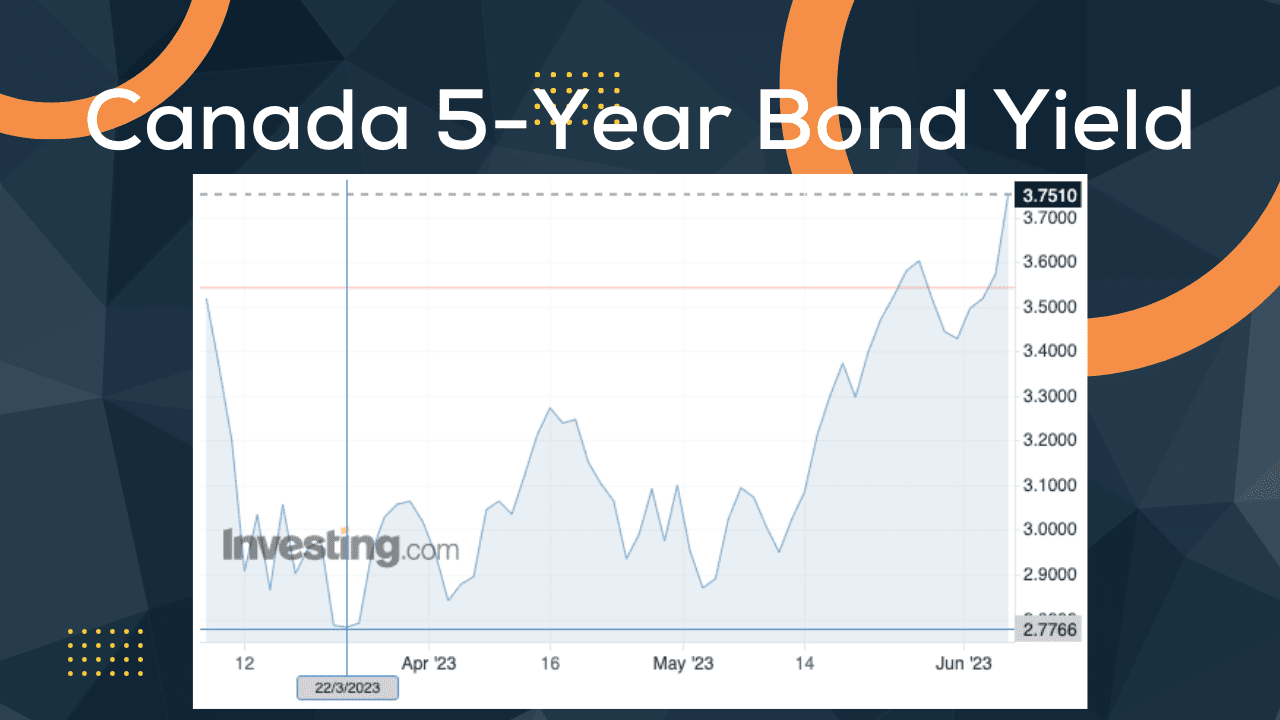

For anyone looking to get into a new mortgage, we have seen fixed rates increase over the past 4 weeks with most new mortgages now having a rate above 5%, although as of today we can still do 4.99% in certain cases. Reach out if you want to look at locking in any rate with the idea of a purchase or renewal in the next four months.

The Reasons Behind the Increase!

The central bank has been grappling with a delicate balancing act, trying to rein in inflation without stifling economic growth. Governor Tiff Macklem suggested that residual pandemic savings may have delayed the impact of their efforts to curb inflation. That’s right, he is blaming you for saving money! Even though inflation in Canada eased to 3.4 percent in May, more than half of the components in the consumer price index basket continued to rise at a rate exceeding five percent.

Philip Petursson, Chief Investment Strategist at IG Wealth Management, believes the next 12 to 18 months will determine whether this additional rate hike was the right decision. He pointed out that the central bank did not rule out further action, indicating that borrowers should remain cautious as uncertainties loom over the path ahead.

However, as interest rate effects continue to permeate through the economy, the Bank of Canada expects economic growth to slow, with an average of around one percent from the second half of this year until the first half of 2024. It projects real GDP growth of 1.8 percent in 2023 and 1.2 percent in 2024, indicating a move into modest excess supply early next year before growth picks up to 2.4 percent in 2025.

Regarding inflation, the Bank expects it to hover around three percent for the next year before gradually declining to two percent in the middle of 2025. The return to the target is slower than previously forecasted, raising concerns about progress toward price stability.

As always, my team and I are looking ready to hear from you and look forward to answering any questions that you may have.

0 Comments

Trackbacks/Pingbacks