Welcome to our latest video where we delve into the fascinating world of Edmonton’s real estate market! In this insightful session, Josh Tagg and Jay Lewis provide a detailed analysis of the real estate trends for November, offering crucial information for anyone with an interest in the housing market. Whether you’re contemplating your first home purchase, considering an upgrade, or simply keen on understanding market dynamics, this video is tailor-made for you.

Our experts break down the latest data, examining changes in property values and sales volumes, and discuss the impact of various factors like property types and interest rates on the market. They also shed light on Edmonton’s unique position as an affordable housing market in Canada, offering predictions and insights into future trends.

This video is not just about numbers and statistics; it’s about understanding the heartbeat of the Edmonton real estate market. So, whether you’re a seasoned investor, a first-time buyer, or just a curious observer, there’s something here for everyone. Watch now to stay informed and make smarter decisions in the ever-evolving world of real estate! 🏠💼📈

Josh Tagg: Hello, everybody, and it’s great to see you and be here again today. This week, we’re going to do something a little bit different. We now have the November data for real estate sales in Edmonton. That data is now available. And so, Jay and I are going to talk a little bit about what’s been going on with real estate sales, real estate prices, and all of those things that are interesting to those of you looking to get into the housing market or looking to maybe upgrade the home that you have in the real estate market. Jay, welcome. Good to see you again.

Jay Lewis: Hey, Josh. Thanks for having me. Yeah, there are some interesting numbers that have come out here in November. And so, we’ve had lots of questions and I think the long and short of it is that we’ve kind of had a normal November. But let’s dive into some of the numbers here that people like to hear about and learn about. So typically, everybody asks, hey, how’s the market? And when they ask me that question, they’re asking about the prices, right?

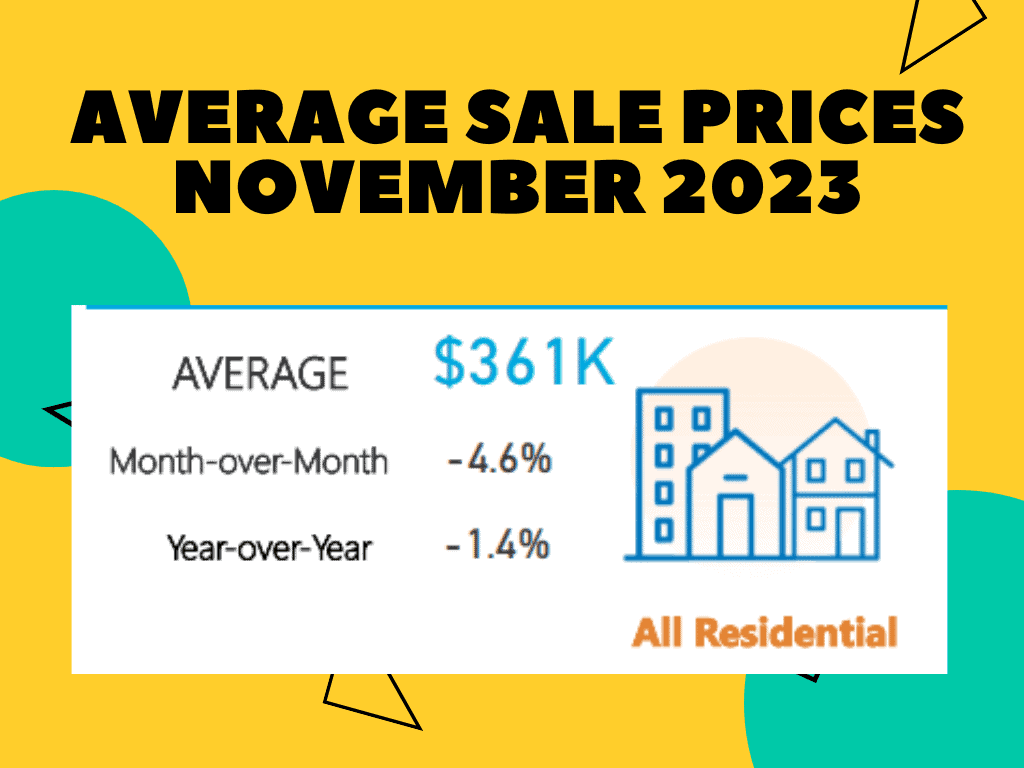

So what we found month over month, so from October to November, we lost about 4.6% in value. Year over year, we’re about 1.4%, super normal, this is what happens. And as we go through some of these slides, maybe we’ll be able to paint a little bit of a different picture. Of course, average is all residential property types. So maybe if we talked about breaking them down into the different types of property values, it’ll paint a clearer picture as well.

Josh Tagg: Yeah. As you can see, where we’re showing everything is always kind of misleading, right? Because we see that sometimes we have more detached homes selling, especially when prices are lower, but as prices go up, then we start to see more of the smaller, more entry style homes coming on and being purchased.

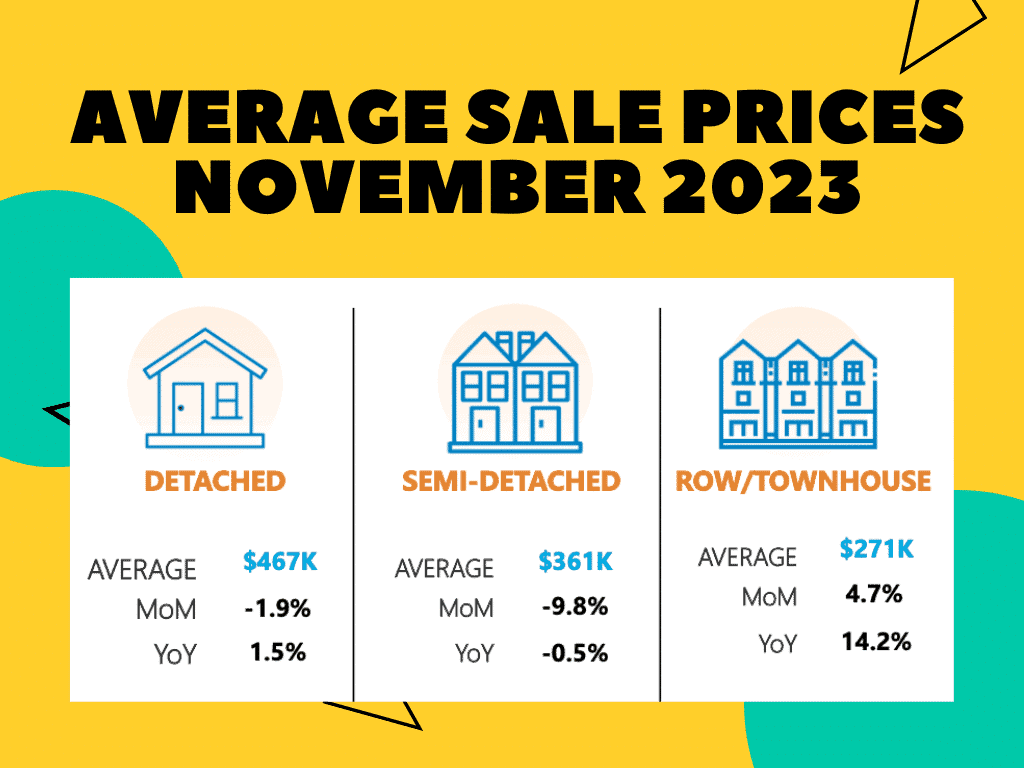

Jay Lewis: Yeah, absolutely. And honestly, it’s about affordability right now and what people are able to get qualified for. There’s a big spread, you know, a detached home. So that just means that it’s not attached. It’s not a duplex, it’s a single family, right? So those are $467,000 valuation and price.

If we go to a semi-detached, which is like a duplex, $361,000, so already we’re over $100,000 difference, right? We go into a row house or a townhouse, so these can be condominiumized and or not, right? And they’re $271,000, so there’s a $200,000 spread. Interestingly in the sale prices though, if you look at the row or townhouse, there’s a lot of pressure on this market. Up almost 5% month over month. Year over year, 15%. So you know if you bought a townhouse a year ago, you’d look like a rock star at 15% gain, right?

Semi-detached, down 10%. Year over year, you only lost a half a percent. Interesting, detached homes down almost 2% but yet still up one and a half percent over the year. So it’s about affordability and it’s about you know what can we buy with the money that we got.

Josh Tagg: So if we take a look at the amount of sales happening in the market, what is it that you can tell us about that and how that’s impacting the decisions that people are making.

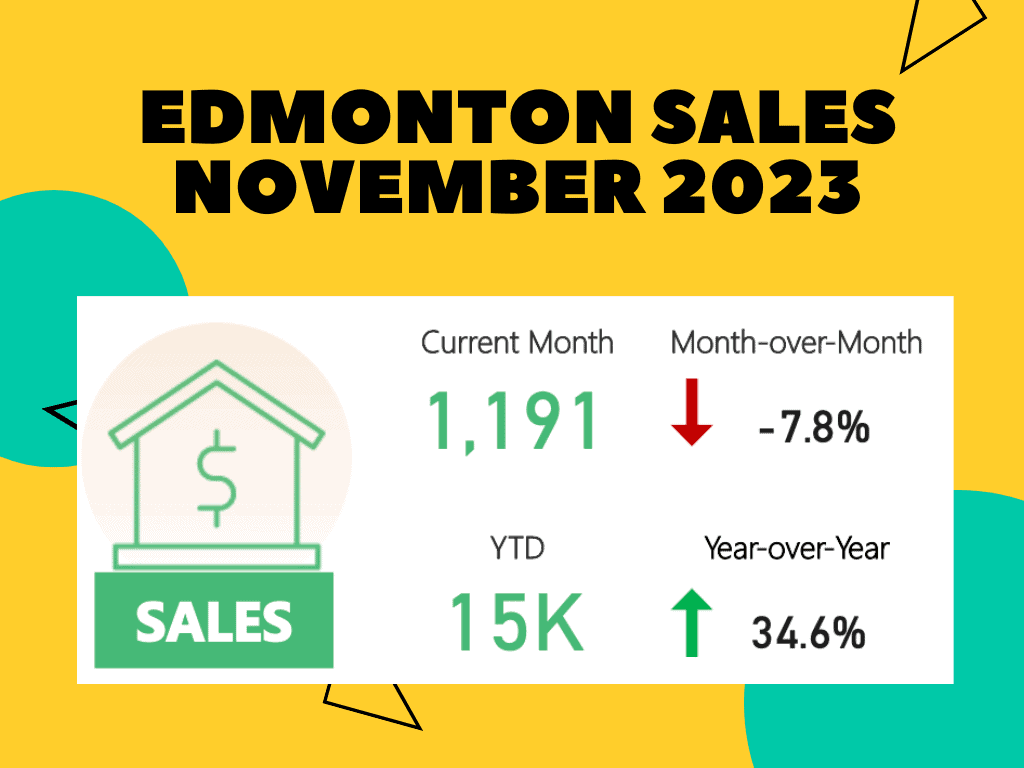

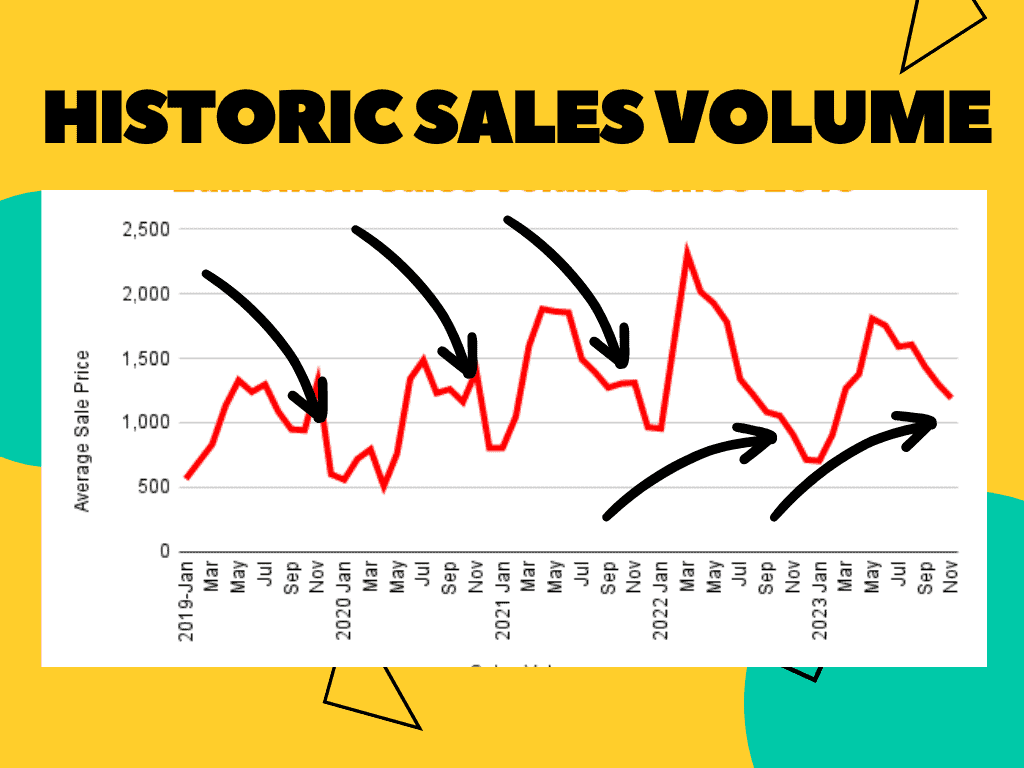

Jay Lewis: Right, so no one likes a red arrow, it looks scary. Month over month we’re down 8%, but year over year we still got this big net sales gain. This is very normal. So in November we start to see it stop, Christmas is coming, and so we start to see the volume drop a bit, right? So if we go all the way back to 2019, the market’s exactly acting like it always has, kind of peaked and then it starts to come down for December, we’re gonna cool off. So the November has done what it’s supposed to do and what it’s always done really for the past five years, right?

Josh Tagg: Jay, it says here that the number of sales for the year, so I guess that means January to November of this year compared to January to November of last year, as much as it looks like the volume is down a little bit right now, a 34-35% increase year over year. Can you maybe speak to what’s happened in the market in the two years that makes it so that as much as I see there’s a really high point there in early 2022, how is it that we’re seeing so many more sales for the year to date as a whole?

Jay Lewis: If you look at peak and valleys is what we’re really talking about, right? Like high to the low, and this is the span in between. 2022, we had this huge uptick, and then we dropped over that year a considerable amount. So if we look at what’s happened in 2023, it’s far more gradual and far more normalized. 2022 was a outlier year that we had, that’s really what it is. So the curve or the amount of the high to low is significantly more in 2022 than 2023.

Josh Tagg: As a mortgage broker, what I see on here is a very tight correlation with what’s going on in the interest rate environment. We can take it all the way back to 2021 even. In the early part of 2021 and throughout most of that year, we saw interest rates under 2% for a five-year fixed term, which was historically the lowest it had ever been. Even if we were looking at kind of the previous 10 years, rates had been kind of closer to that 3% range for most of that period of time.

Then what we saw is inflation started becoming more of an issue in 2021, and then by March of 2022, that was where the peak high point of the number of sales happened. As soon as the Bank of Canada started doing their interest rate increases, and we are already seeing fixed rate increases happening, that is quite the downward slope there in 2022. It almost looks like that was engineered by fiscal policy by the Bank of Canada.

Jay Lewis: Yeah, it’s emotions too, right? Because there’s a lot of people in 2021 that had rate holds, they weren’t sure what was going to happen and then when they’re like, okay, interest rate is rising, we’re jumping into the market, that’s the spike. But when I look at this, I just say like, it looks like we’re returning to a normal market that, you know, COVID and interest and all that stuff, we’re gonna slowly see that impact leave and we’ll be back to a typical market.

Josh Tagg: And we’re still seeing volume, it looks like here in 2023. If I try to compare that bump to say the 2019 bump, which was obviously the full year prior to COVID arriving on the scene, it looks like we’re still up from that point.

Jay Lewis: Yeah, there’s so much optimism and there’s so much things happening here that in Alberta, of course, right, we got the advantage. Edmonton has got so much things happening.

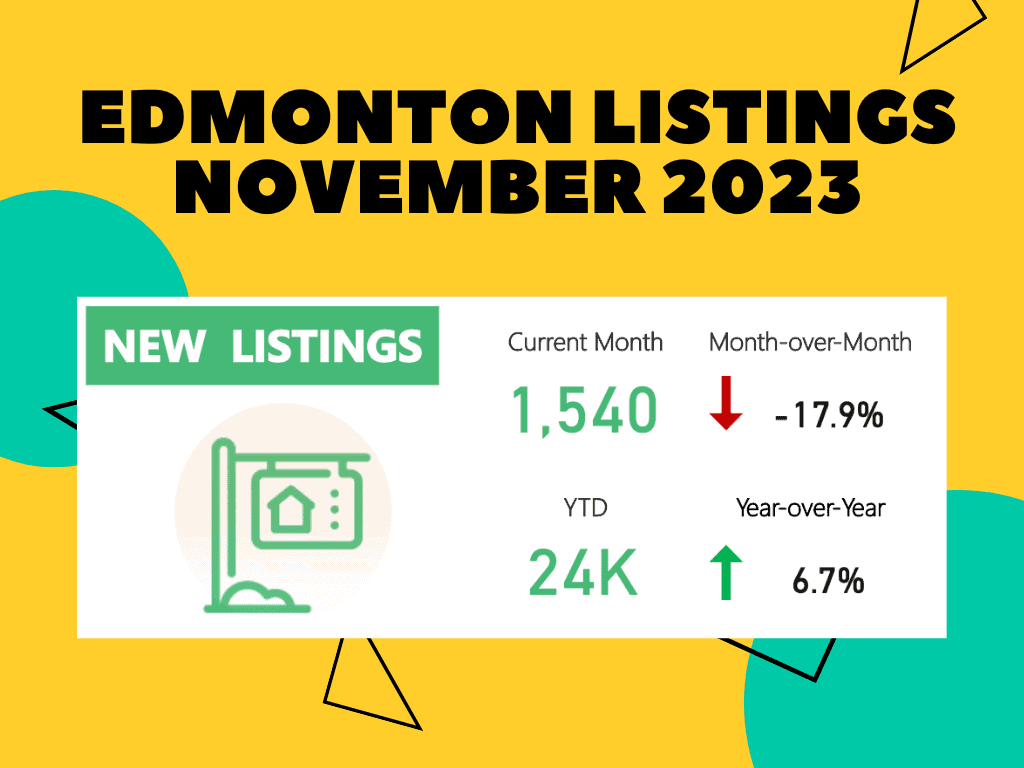

Josh Tagg: Okay, so what can we say about the inventory? What’s going on as far as listings?

Jay Lewis: Right, so this is the number of new listings that we’ve had. A huge drop from last month, which again is typical. Year to date, we’re still up, right? So we’ve had more listings, about 6% or 7% almost. But yeah, month over month, they’re gonna drop. People are like, you know what, I’m not selling before Christmas. We’re just gonna wait and see what happens for the new year. So yeah, we’re down a bit.

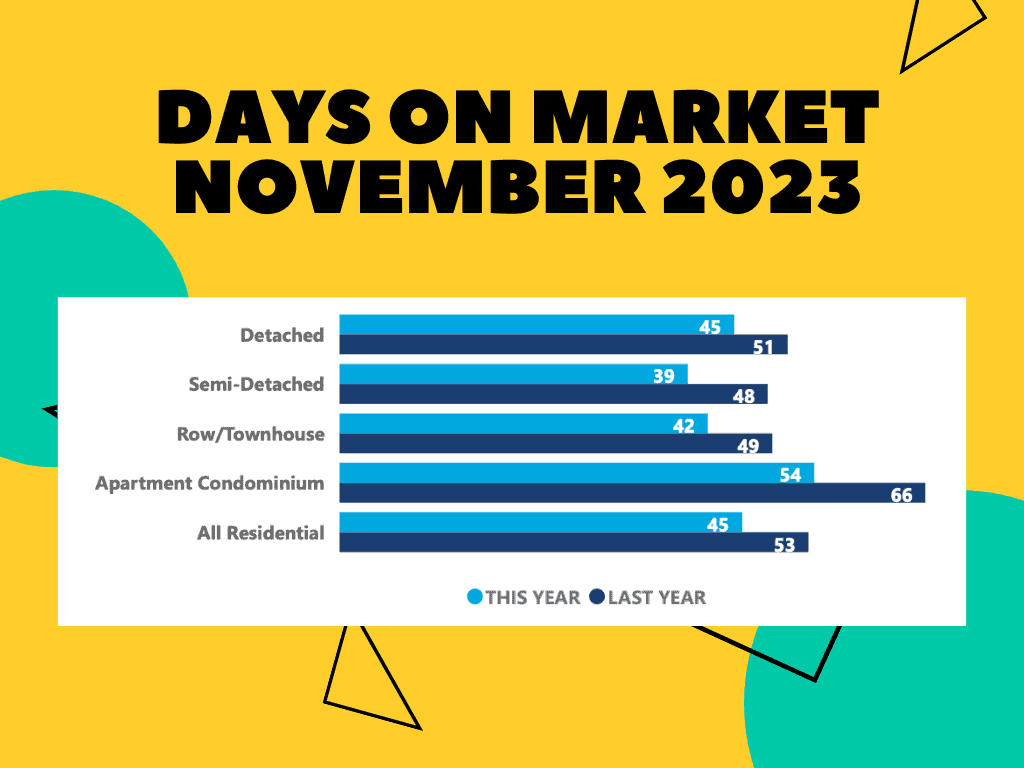

Days on market is directly attached to that. So as our listings drop, buyers have less choice. And so they tend to act sooner. And the opposite effect, we wanna be in for Christmas. So we need to pull the trigger on something, sometimes they settle, right? Or make a quicker decision, just they have less to pick from. And they wanna be home for Christmas.

Josh Tagg: Perfect, I see a really cool story here as well in that things are selling quicker now as interest rates seem to be stabilizing. Obviously November’s always what it is in November later in the year when things start to slow down but it looks like things are selling faster now and I think if we look back at these other ones just one more time, the total number of sales is up significantly year over year, but the total number of listings isn’t up. I guess it is up as a percentage, not as much, right?

Jay Lewis: But as the total inventory is starting to get chewed down, that number will normalize again, right? So we did have some excess coming in to this year that we’ve eaten up. So we’ve lost some inventory overall.

Josh Tagg: As purchases slowed down later in 2022, we had a kind of too much inventory in the market and that’s re-normalizing. So it looks like going into 2024 that we’ll see things a little bit more normal. I know on the interest rate perspective, we’ll talk about that in another video here soon, we are definitely expecting interest rates to start to come down and just like we can see on those historic numbers as interest rates are lower, we tend to see more activity on the purchasing side.

Edmonton remaining really the last really affordable major housing market in Canada. There’s a lot of reason we’re going to see people moving to Edmonton. We’ll talk about that on another video soon as well. But would you agree there’s a really good argument that Edmonton’s values are gonna stay pretty stable and with the upward pressure?

Jay Lewis: Yeah, we’ll talk about this more later, even from my own personal experience. This is mirroring what happened to me when I left Calgary and came to Edmonton so many years ago, and it’s setting itself up to do what it’s done. History seems to repeat itself. Of course, you can’t take that to the bank because there’s anomalies that come in, but it looks like 100%, yeah, I’d agree. So that’s where we’re at with that.

Josh Tagg:

Well, Jay, you know, it’s been great chatting with you again like always, as your wealth of information. It’s really cool looking at the data, at the information, and knowing that we’re sharing good expectations with our clients.

0 Comments

Trackbacks/Pingbacks