In this insightful video discussion, real estate experts Jay Lewis and Josh Tagg delve into the timely and crucial topic of home buying strategies in the current market. They explore the interplay between interest rates, housing prices, and market trends, providing valuable insights for potential buyers grappling with the decision of when to purchase a home.

With a focus on the expected market dynamics for the year, including predictions about interest rates and housing market fluctuations, this conversation offers a nuanced analysis of whether it’s wise to wait or act now in the real estate market. Their expert dialogue sheds light on various factors influencing the housing market, making it a must-watch for anyone considering a home purchase in the near future.

Link to Youtube to Like the Video and Subscribe to our channel!

Jay Lewis: So we’re kind of having this little conversation about is it wise to wait to buy a home? And so we’ve kind of been looking at some of the factors that maybe a buyer would consider. And so I guess the first question, Josh, is like, what’s the market expectation for interest rates this year?

Josh Tagg: Over the coming year, there’s a lot of expectation that we’re going to see rates lower than we have for the last couple of years between the likelihood that the Bank of Canada and even the US Fed are going to lower rates starting kind of mid-year, probably in April or May 2024. And the bond markets, which influence the pricing of fixed rates have already been anticipating that. So we’ve seen quite a bit of downward movement already on the bond markets and on the fixed mortgages. We’re expecting them to continue dropping. Three quarters of a percent or a percent over the next year is very reasonable.

Jay Lewis:Okay. So that’s actually good news, right? Affordability or the qualification should be easier. So that’s one sort of pressure that we would consider on our market then is that as the interest rate drops, buyers will be more interested in purchasing with a little more consumer confidence.

Josh Tagg: Absolutely. As the Bank of Canada started raising rates and the fixed mortgage rates started to increase across the country and Edmonton wasn’t any different. Across the country, we saw fewer people buying homes. But when rates were lower a couple of years ago, there was a lot of real estate activity going on across the country and Edmonton too. So I would definitely expect more people who have been waiting on the sidelines because of interest rates to come back into the market as the rates start to drop. Hoping to get into it before the prices go up too much.

Jay Lewis: Right. Yeah. We’ve also just recently had an announcement too, from our premier, Daniel Smith. And she mentioned that she is hopeful for Alberta’s future. That it is looking really bright. Dow has a few partners and they got a bunch of money pouring in here, over $11 billion, if I recall correctly. 6,000 new jobs, 400 of them are permanent for Alberta. Which is amazing! And it’s a really cool technology, net zero petrochemical. And so with this population growth coming in, it’s gonna really put a pressure on our supply here.

Josh Tagg: Yeah, it’s really is a combination of both affordability from interest rate perspectives, the fact that Edmonton is still the most affordable major city in Canada. With new population growth and lower interest rates, I think there’s a really good argument for us to see at least as much increase in prices as we’ve seen over the last couple of years to see that now in 2024 as well.

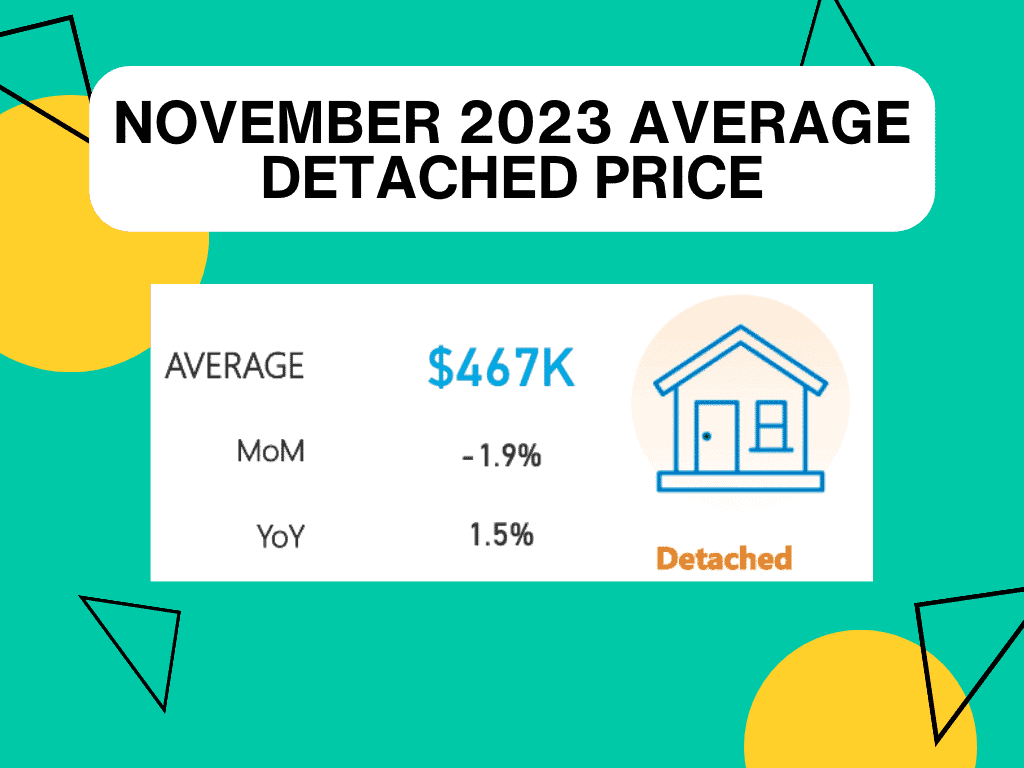

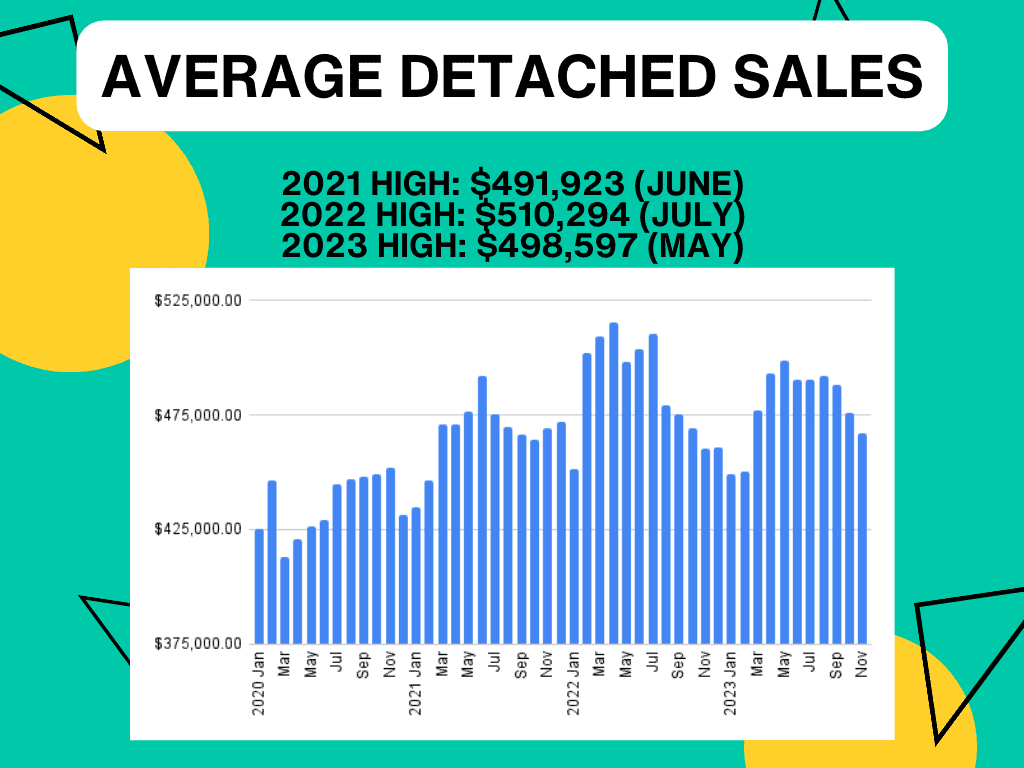

Jay Lewis: Right. Because I think our November prices were still down month over month. Year over year, we’re still up a bit, but still very affordable for a detached home, $467,000. That certainly has changed a bit if we looked over the past, what we’ve seen in our marketplace since 2020 here on this graph shows. But in 2021, we’re going to be able to see that we had a high of $491,900 in June, $510,000 in July of 2022. And that was the result of that interest rate freak out, right? In 2023, we’re at $498,000. So we’re down. We are seeing the highs and the lows and kind of anticipate where we’re going to go. What’s your thoughts on this here, Josh?

Josh Tagg: You know, to see something similar again would not surprise me at all. I’ll discuss briefly, you know, here in 2021 is when we first saw interest rates dip into that kind of 2% range and they stayed pretty steady that year. So it really helped keep the 2021 numbers quite a bit higher than the previous year where rates were higher and pre-COVID higher as well. And then, you know what, they were pretty low. And then as people were worried about interest rates starting to increase we saw people with rate holds and whatnot jumping into the market, coming on strong in early 2022, but then it kind of screeched to a halt. Once those rate holds all expired we saw a definite decrease in property values mid 2022. In the spring of 2023, we saw some lower rates again in the mid 4% range, and we saw some upward movement in values. And then as rates increased again over the fall, we saw the downward.

It’s also typical in the spring to see rates lower, in the fall to see rates higher, 2020 being the different year because of COVID. But we’re going to likely see lower rates this spring as we get into a more normal market, and we’ll likely see some added upward movement on prices of the homes because more people can get into the market at these lower rates.

Jay Lewis: Spring market too, like we’re looking at May, June, July. So the timing is suspect, and here we are in November. We can look back at history and see like buying in November versus May, June, or July kind of makes sense. Yeah. So what does that mean for affordability then? Like should we wait for lower interest? What should we do?

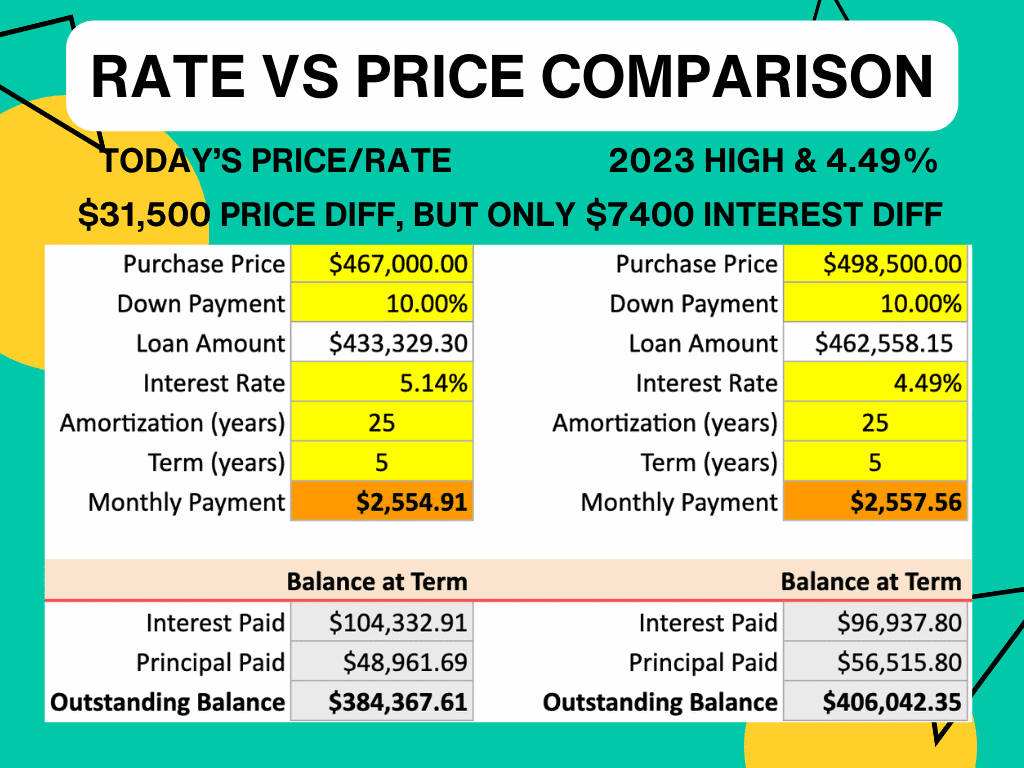

Josh Tagg: Exactly. So what I did, Jay, is I actually put two scenarios together and I’ll show those here for you all. The first one, I took an example where I took today’s interest rate and the November price that you just showed us at that $467,000, that’s the average detached home sale price in Edmonton in November 2023, and I took today’s interest rate at 5.14% Many lenders are a bit above that. There’s not many lower than that. I took a competitive rate from today and compared it to today’s price. Then I took an even lower rate and compared it to the highest point from 2023.

So that’s this one right here in May, right? So if we take that higher price from May of this year at $498,000 and say that’s caused by population increase, caused by lower interest rates, let’s say the rate drops to about four and a half percent, and compare that to buying a house at today’s price, in both cases here at 10% down.

You’ll see on that the middle area where it’s orange, the monthly payment is actually almost exactly the same. So only a few dollars a month difference, but in one case you’re paying about $31 thousand dollars more for the house. But if you buy it at the lower price, you are paying about $7.5 thousand dollars more interest, but take a look at the bottom there at five years from now by buying the cheaper house, but the little bit higher interest rate. You’re looking at about $384,000 that you still have left to pay. Whereas buying the more expensive home at the lower interest rate, sure, you’re paying less in interest, but you still owe more money at the end of five years. So it is costing you here, if this is all accurate, it’s costing you over $20,000 more just to wait six months until prices have increased, even if we see a big decrease in the interest rate.

Jay Lewis: Right. The other thing I was going to just pop up to me right now is like it’s 10% down $46,700 versus $49,800, right? So a little bit less cash to get into the house, even though it’s the higher interest. But you know, what’s really interesting is like we buy this at the $467,000 price instead of waiting until the $498,000 price, in five years when we’re renewing, the houses are going to be worth the same amount of money. So we’re going to make more as a net worth.

Josh Tagg: Exactly. So it helps with the net worth. Homeowners have a higher net worth than renters. We’ve known that for a long time. And based on the numbers I’m looking at today, obviously, we don’t know what’s going to happen in the future for sure. We don’t know the price changes. We don’t know the interest rate changes. But with some simple assumptions here, I think it’s pretty reasonable to show this.

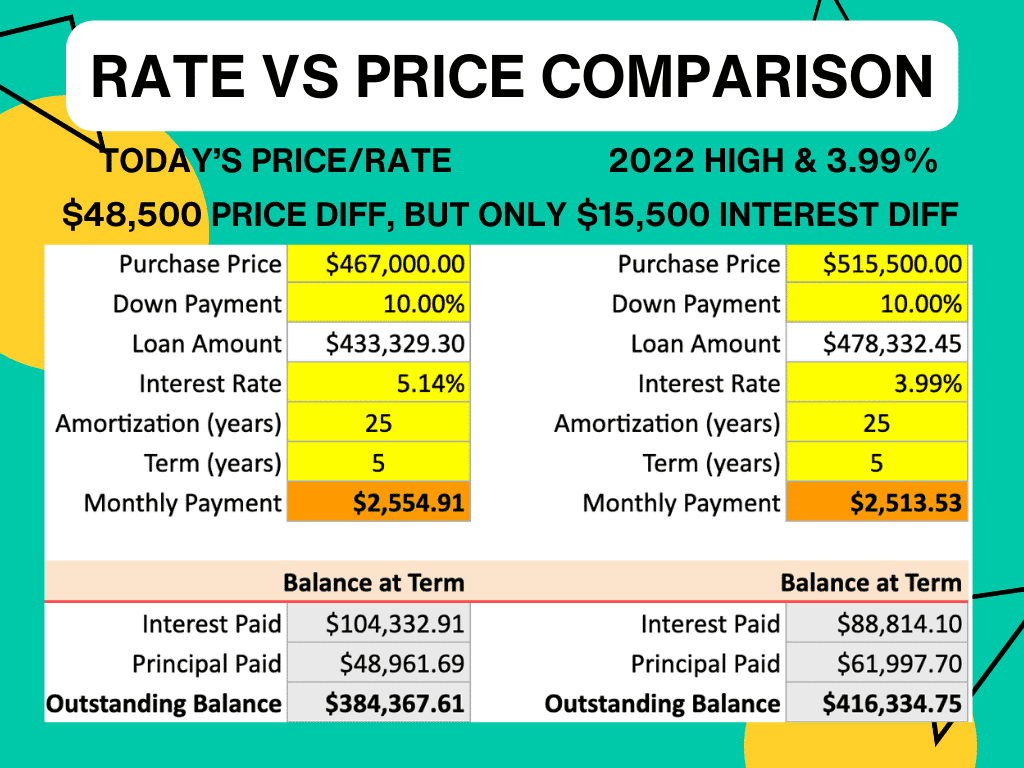

I did one more example. And what I did is I took the highest price that we saw from the summer of 2022 when home prices hit $515,000. But then I offset that with an even more aggressive lowering of the interest rate to 3.99%. So that’s over a percent difference in the rate. And once again, the monthly payment here is nearly the same.

The amount of interest that you would pay, obviously the higher rate, even though it’s on a lower amount is more by $15,000, but it’s an almost a $50,000 difference in the price in that scenario now. So the outstanding balance, even after having almost the same payments for the five-year period, the outstanding balance at the end is over a $30,000 difference still. So there’s two examples where having a lower-priced home, even if for the first five years you’re paying a little bit more interest, it still puts you likely further ahead than it would by waiting for a lower rate but accepting the higher price of a home.

You’ve mentioned to me often, Jay, that you marry the house. You’ve got the house for a long time, but you’re only kind of dating the interest rate. So if the payments are going to be very similar over the next five years, but you’re paying less for the house, I would say you’re likely much better off by buying sooner rather than waiting for the prices to go up as a result of lower interest rates.

Jay Lewis: Yeah. And I mean, I yet to talk to anyone who feels like interest rates are going to go up next year, or even the year after that. I haven’t heard that from anyone. Of course, you know, market expectation says interest should go down. And I have yet to see it where when interest rate drops, housing price drops. Like it’s there, they’re on a yo-yo for the most part, right? Whatever one does, the other one does the opposite. So I would say that all indicators point that we’ll see lower interest, but higher house price.

Josh Tagg: And that’s very likely, you know, Edmonton has a lot of room for upward growth in the prices before it becomes unaffordable. And that is going to attract people to Edmonton. It’s going to bring in more younger first time home buyers than some of the other markets in Canada have. And overall, I would say that Edmonton is well positioned for some increase in value as, as the interest rates drop. So, you know, I’m looking forward to see what happens over the coming year. So I’m, I’m sure you are too, Jay.

Jay Lewis: Yeah.

Josh Tagg: And let’s see if we can continue giving great advice to those who are considering purchasing a home here.

Jay Lewis: This was awesome. I’ve often wondered about this and it’s great to see it black and white here, right? Huge difference in price, but at the end of the day, it’s almost the exact same per month. And that’s how our qualifications are based on. So it makes a lot of sense. So yeah, thanks for that, Josh.

0 Comments