As we approach the end of 2023, Canada’s housing and mortgage landscape is experiencing significant shifts. Here we will share the findings of the Housing and Mortgage Market Review published this week by Mortgage Professionals Canada.

A key factor influencing the market is the national inflation rate, which, as of October 2023, has shown a notable slowdown to 3.1% annually. This decrease is largely attributed to a 6% monthly reduction in gasoline prices. Such a slowdown in inflation, coupled with a stagnating GDP growth and an increase in the unemployment rate, paints a picture of an economy gradually downshifting. This economic context suggests that the Bank of Canada might continue its pause to rate hikes, with market predictions leaning towards a hold not only at its Decemebr 7, 2024 announcement, but until April 2024 followed by a potential reduction of rates by 75 basis points by the end of the next year. One respected economist, David Rosenburg is calling for a 2% drop over the next 18 months! This anticipated pause is crucial for mortgage holders and potential home buyers, signalling a potentially less volatile lending environment in the near future.

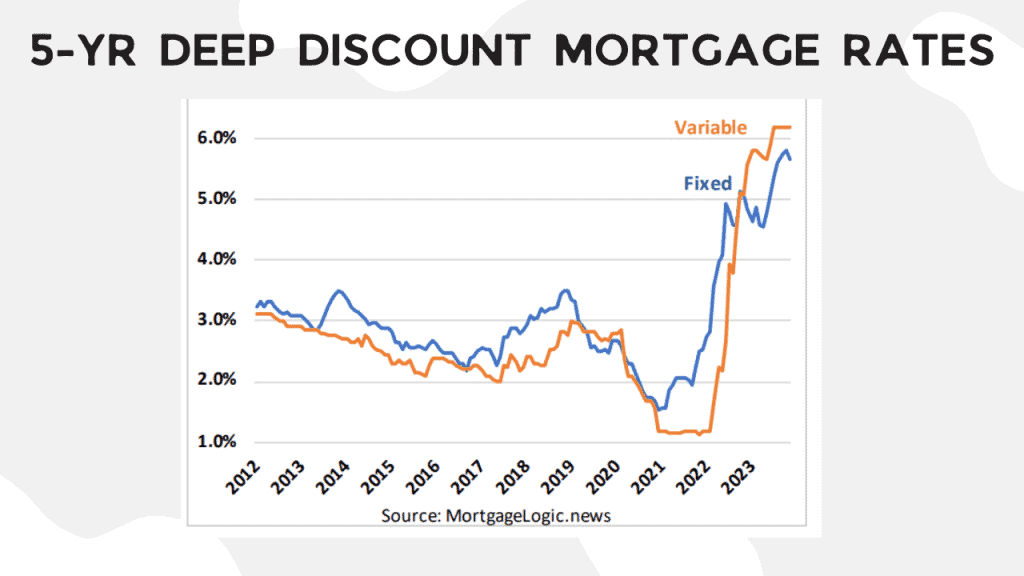

Mortgage Rates: High but Expected to Decline

Despite the fall in government bond yields, a primary influencer of fixed mortgage rates, these rates have stubbornly remained high. However, there is a silver lining. The report anticipates a potential decrease in mortgage rates by 10-20 basis points in the upcoming weeks, provided the bond yields stay constant. This slow adaptation of mortgage rates to bond yields is characteristic of the lending institutions’ trend of swiftly reacting to increases but being more gradual in adjusting to decreases. This delay in the adjustment of mortgage rates is a critical aspect for prospective borrowers to consider, as it impacts the affordability of mortgages and the timing of entering the housing market.

5-Year Fixed Discounted Mortgage Rates

A Closer Look at Loan Growth and Mortgage Originations

In a market where rates are still perceived as elevated, household borrowing has naturally been affected. The report indicates a fall in loan growth to just 2.9% year-over-year as of September 2023 – the first time it has dropped below 3% since 1983. Moreover, mortgage growth has slowed down to 3.2% year-over-year and a mere 0.2% on a monthly basis. These figures underscore a cautious approach by consumers towards borrowing amidst uncertain economic conditions. Furthermore, mortgage originations have been significantly below their peak, with a prediction of remaining subdued for the next year. This trend reflects the market’s response to the previous period of high growth and the anticipation of a wave of mortgage renewals coming in 2025.

Housing Affordability and Home Sales Trends

In an environment of fluctuating mortgage rates and economic uncertainties, there has been a modest improvement in housing affordability. October 2023 saw a slight decrease in the average monthly mortgage payment for a typical home in Canada, a welcome relief for many. However, this improvement has not yet translated into a rejuvenated housing market. Nationally, home sales have declined significantly, with Alberta experiencing an 8.3% decrease. This decline in sales reflects the broader pressure exerted on demand due to strained affordability, despite the minor relief in mortgage payments.

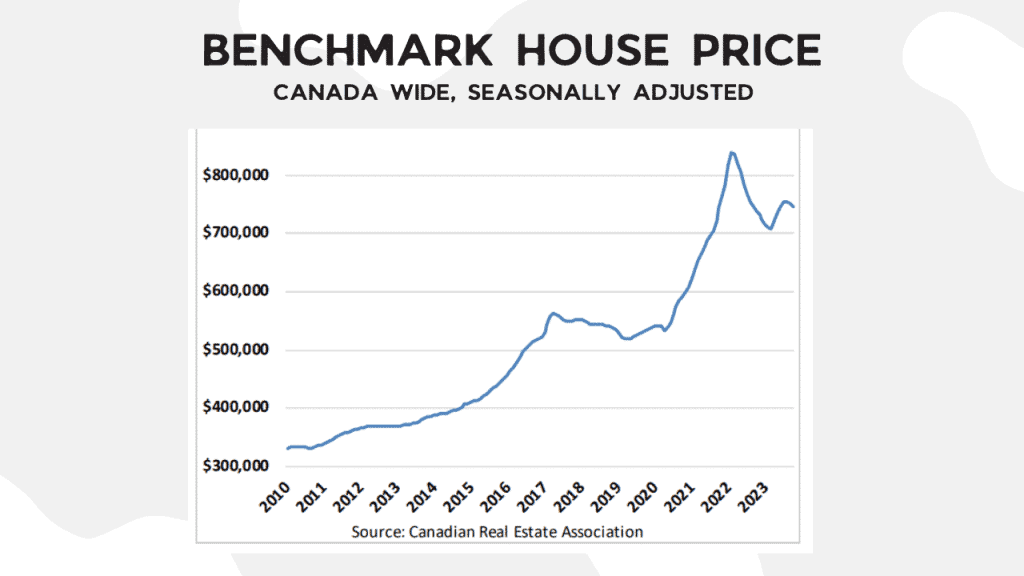

Canadian Benchmark Home Prices

The Buyer’s Market and Price Dynamics

The current real estate market is increasingly favouring buyers in all major markets except for Calgary. For the first time since 2012, the sales-to-new listings ratio has dipped below 50% nationally, indicating a shift in market dynamics. This change has put downward pressure on house prices, evidenced by a 0.8% monthly decline in the MLS House Price Index in October. It’s important to note, however, that the Canadian real estate market is not monolithic. Regional variances are stark, with major cities in southern Ontario contributing to national trends of weakness, while regions like Alberta and Eastern Canada are showing relative resilience.

Regional Focus: Alberta’s Unique Market Scenario

In Alberta, and particularly in Calgary and Edmonton, the housing market dynamics diverge from the national trends. Despite the national downturn, these regions have maintained a relatively stable market, with Calgary continuing to see upward growth. This distinction is crucial for prospective homebuyers in Calgary, Edmonton, and elsewhere in Alberta. The local market in Calgary and Edmonton has its unique drivers and challenges, and while national trends provide context, they do not fully define the local market conditions.

Navigating the Housing Market in Uncertain Times

As we look towards the end of 2023 and into 2024, the Canadian housing and mortgage market presents a complex landscape influenced by national economic trends and regional market dynamics. For Calgary and Edmonton residents, it’s essential to recognize that while national trends like inflation rates, mortgage rates, and overall market sentiment provide important context, the local market dynamics in Alberta can differ significantly. Staying informed about both national and regional trends will be key to making informed decisions in this ever-evolving market.

0 Comments