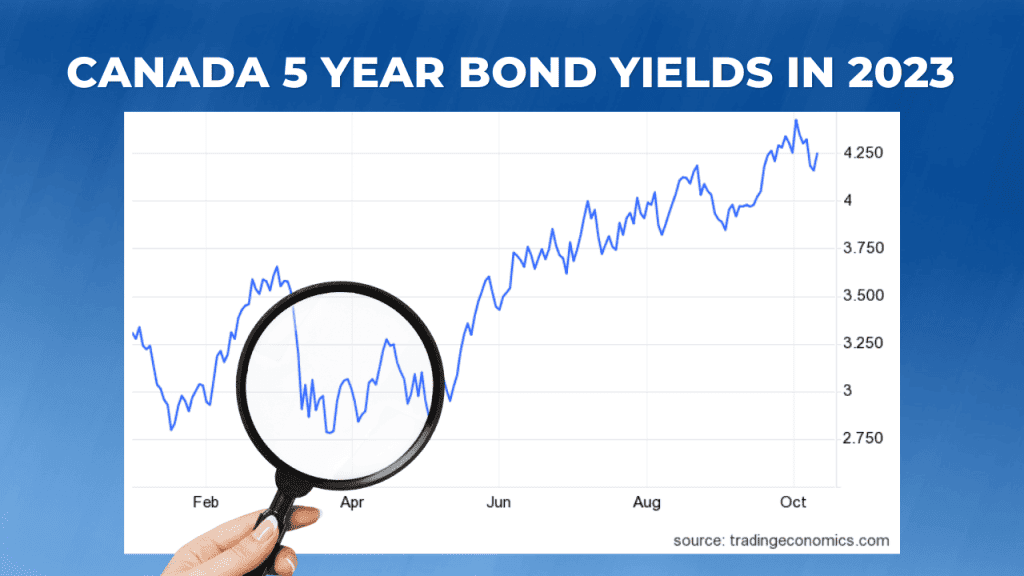

2023 has been a year of continual interest rate increases. In the springtime, after some banks in the United States failed, we saw a significant drop in the bond yields that influence the pricing of Canadian fixed-rate mortgages. While still higher than in previous years, this lower rate environment stuck around until June . Since June as the Bank of Canada has continually reminded us of slower-than-ideal progress on managing inflation, and as it has set expectations for rates to remain higher for longer, the Bond market has responded.

The 2023 Canadian Bond Journey

The bond yield hit its lowest point of the year on March 24, 2023, at 2.65%. Fast forward to October 3, and it peaked at a staggering 4.46%. However, the trend didn’t sustain, and by October 11, it receded to 4.12% — a third of a percent decrease in just eight days.

With the bond yield’s surge leading up to its October peak, lenders responded by increasing their fixed mortgage rates, mostly in the range of 25 to 30 basis points. This translates to a quarter to almost a third of a percentage increase in mortgage rates. Given the bond yield’s recent dip, some lenders have started to reduce their rates slightly or entice borrowers with promotions. As of now, the most competitive rate available is 5.69% for a 5-year fixed mortgage with insurance. If the downward trend continues or stabilizes, consumers might benefit from further reductions in rates.

Why are Bonds Increasing Again?

A significant influencer in this bond yield dynamic is the Bank of Canada (BoC). Its “higher for longer” narrative has seemingly pushed the bond yields upward. Earlier predictions suggested that the BoC would begin to reduce its rate in the first quarter of 2024. However, new insights from major banks project the first dip in rates not until the third quarter of 2024, and only two 25 basis point reductions are expected throughout the year.

After the BoC’s September 6, 2023, rate announcement, there was speculation regarding another 25 basis point hike before 2023 concludes. Whether this potential increase will manifest on October 25, December 5, or not materialize at all remains a matter of conjecture.

Persistent inflation has proven to be a challenging hurdle for the BoC, as it strives to achieve its 2% target. With this inflationary pressure, it seems plausible that another rate hike might be on the horizon before the year concludes. The US Federal Reserve’s potential decisions regarding interest rate hikes could also sway the BoC’s stance, primarily to shield the Canadian dollar from devaluation.

The BoC’s ultimate goal with its rate decisions revolves around managing inflation. If inflation exceeds the 2% target, the BoC escalates the benchmark rate. Consequently, banks heighten interest rates on loans and mortgages to curb borrowing and spending, which in turn, reins in inflation. On the contrary, if inflation lags behind the target, the BoC might slash the policy rate to spur economic activity. This leads banks to cut interest rates, thus bolstering borrowing and expenditure.

In essence, the BoC’s strategy seeks to uphold the highest sustainable employment levels, simultaneously fostering output growth by ensuring inflation remains predictable and minimal. By achieving the 2% inflation target, the economy can operate at its peak productive capacity without igniting inflationary pressures.

In conclusion, the Canadian bond yield’s movements have directly influenced mortgage rates this year. Borrowers and investors should remain vigilant, as the interplay between the bond yield, inflation, and BoC’s decisions will shape the financial trajectory in the upcoming months.

0 Comments

Trackbacks/Pingbacks