The Bank of Canada Bumps Rates AGAIN!

Will this be the FINAL Rate Increase of the year?

Need Some Mortgage Advice?

Our Quick Take

The Bank of Canada raised its interest rate today, after holding it steady for a few months. The Canadian economy performed better than expected, with more people spending money and the GDP going up. Real estate markets are hot in some cities, while unemployment remains low. Prices for goods and services increased in April, and the Bank hopes they will go down in the summer. It’s a fight against inflation, but things will improve over time.

Nip it in the Bud!

Inflation Continues to be Stubborn!

Today after holding tight since January, the Bank of Canada pressed play on its fight against inflation and increased its interest rate by another quarter percent.

This marks a full 4.5% increase since it began just over a year ago. This brings a typical variable rate mortgage holder up to about 6% interest. For many that means the payment will increase yet again.

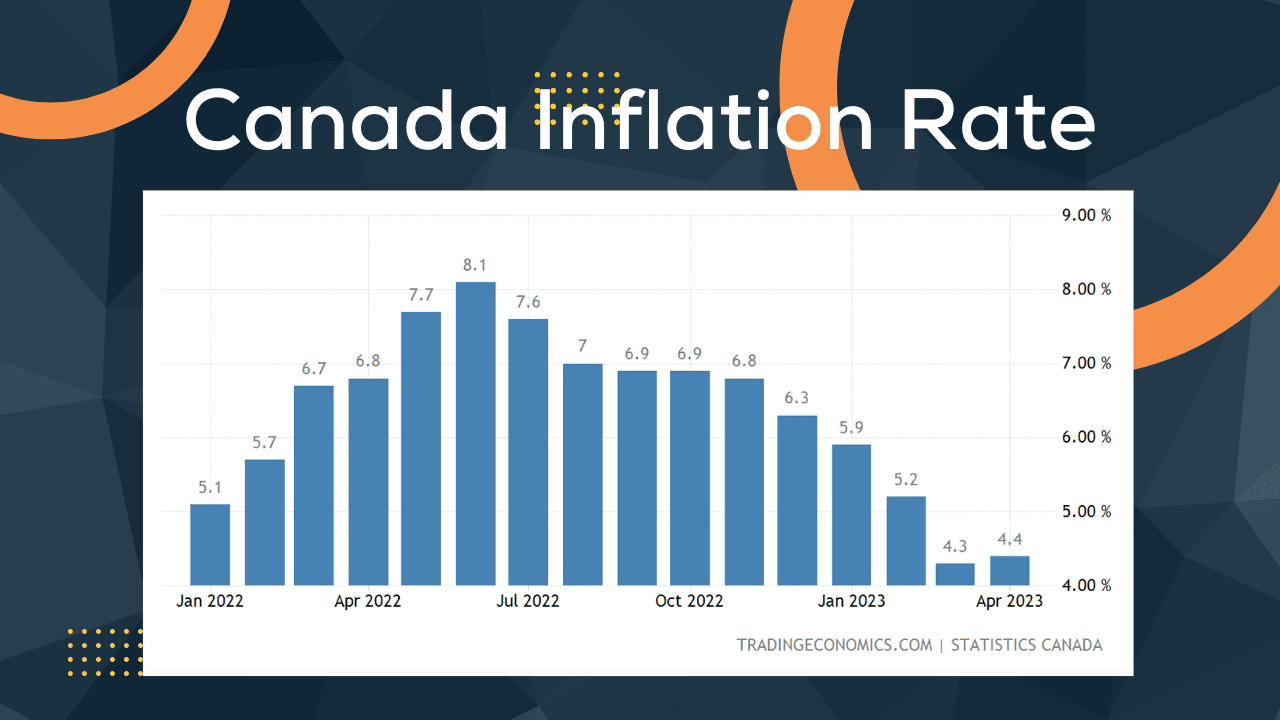

Globally, inflation continues, but it’s slowing down a bit. Prices of many things are still higher than they should be.

Here in Canada, after several months of declining inflation since October last year, April saw a small uptick in inflation which, combined with GDP and Employment Numbers, has the Bank and Economists concerned.

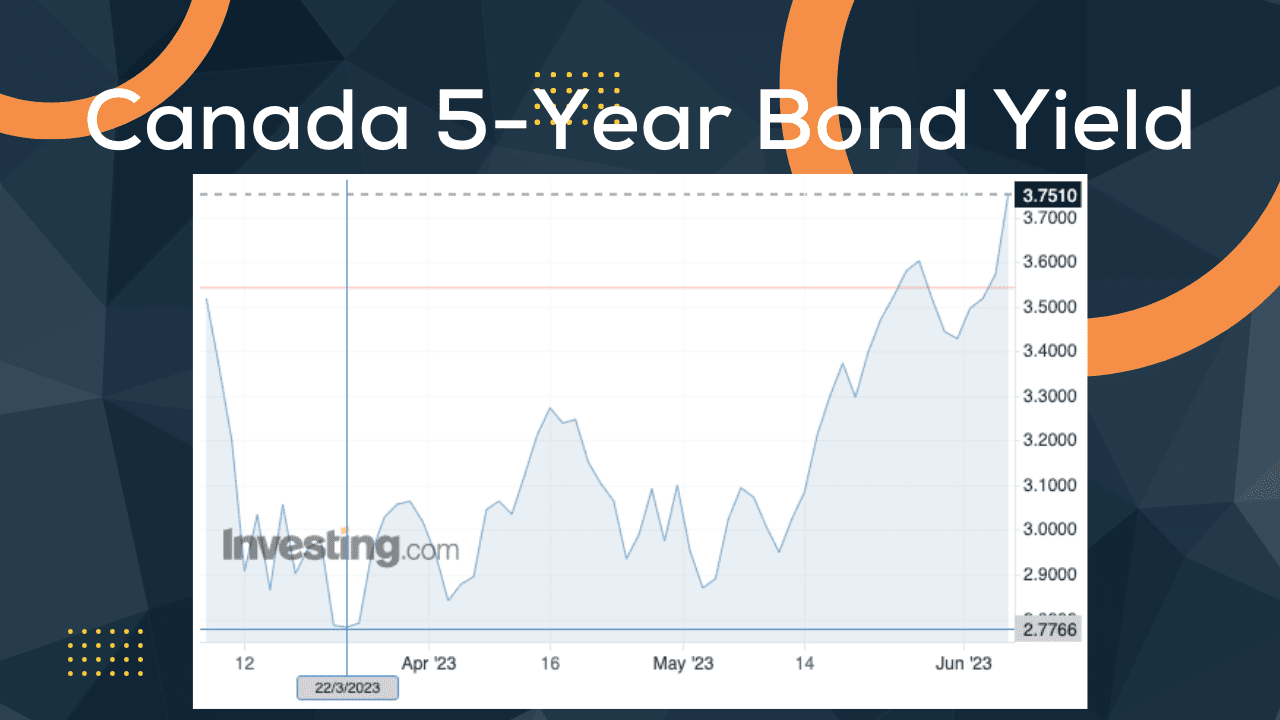

Canada’s Bond Market has Increased Substantially!

Bond markets already anticipated this increase and since a low point at the end of March, we have seen the bond rates increase nearly a full percentage point and we find ourselves nearly at the same peak that we last saw at the end of October last year.

Fixed mortgage interest rates have been increasing over the past month. Most rates are back above 5%, and the rates lower than that might not be around for long.

In Canada, the economy did better than expected in the first part of this year. The total value of all the things we produced and bought, called GDP, went up by an annualized rate of 3.1%. This is still higher than any time in the 20 years before the start of the COVID Pandemic 3 years ago. People are spending more money, and it wasn’t just in one area. Demand for services, like going to a hair salon or a restaurant, started to go up again. Purchases of big ticket items like houses and vehicles have been increasing.

Anybody trying to purchase a home in Calgary in the last few months has experienced a very hot Real Estate market. In Calgary, the volume of home sales are only about 9% lower than they were a year ago, but with low inventory, the average prices of houses, duplexes and townhomes are up 11%. Condo Apartments are up over 6% from a year ago.

Edmonton Remains Affordable!

For those fortunate enough to be looking for homes in Edmonton, it remains the most affordable major market in Canada! Home prices are basically the same as last year for houses and duplexes – but are increasing month over month – meanwhile townhomes and condos are down from both a year ago and from April as well.

Unemployment is hovering about 5%, the lowest level in the past 50 years.

Inflation Notches Up a Bit

So, let’s talk about prices. In April, the prices for many things went up, and it was the first increase in ten months. Even though Energy Prices went down that month, The prices for goods like food and clothes, for services, like getting a haircut or personal training, also went up. That’s because people wanted those services, and there aren’t enough people to provide them. The Bank of Canada expects the prices to go down a bit in the summer as energy costs get cheaper and last year’s price increases are no longer counted. But there’s still a concern that prices might stay higher than they should be for longer than we want.

This is some of the “WHY” behind the Bank of Canada’s decision to increase its interest rate. The hope is that by making it a little harder for people and businesses to borrow money because they think there’s still too much demand for things. They want to make sure prices stay stable and don’t go too high.

In addition to raising the interest rate the bank is reducing the amount of money in circulation through its quantitative tightening program. The bank has stopped buying bonds and isnt buying new ones when the existing bonds mature. The Bank will continue to monitor everything to make sure everything is going according to its plan and that prices start to remain steady

So to summarize. The fight against inflation isn’t over yet. But we can still be optimistic that it is nearly over. As the increases in 2022 are further into the past, then the year over year numbers will decline if we keep it under control.

I know this is unsettling. If you are concerned about your own situation and want to discuss it specifically, please reach out and my team and I are happy to help you!

0 Comments