In the ever-fluctuating world of finance, the recent trends in bond yields have captured the attention of economists and investors alike. Since October, there has been a notable downward pressure on bond yields, leading to a consequential drop in fixed mortgage rates. This trend, however, is as changeable as the winds of economic fortune. As of early 2024, we are witnessing a reversal, with bond yields on the rise again. The question on everyone’s mind is simple yet complex: Why are these bond yields rising now?

Background: Recent Trends in Bond Yields

To understand the current shift, we must first look back at the recent past. Since October, the financial markets have observed a steady decline in bond yields. This decline played a crucial role in reducing 5-year fixed mortgage rates, which, for the first time since the summer of 2023, dipped below the 5% mark. This trend brought a sigh of relief to borrowers but also raised questions about its sustainability.

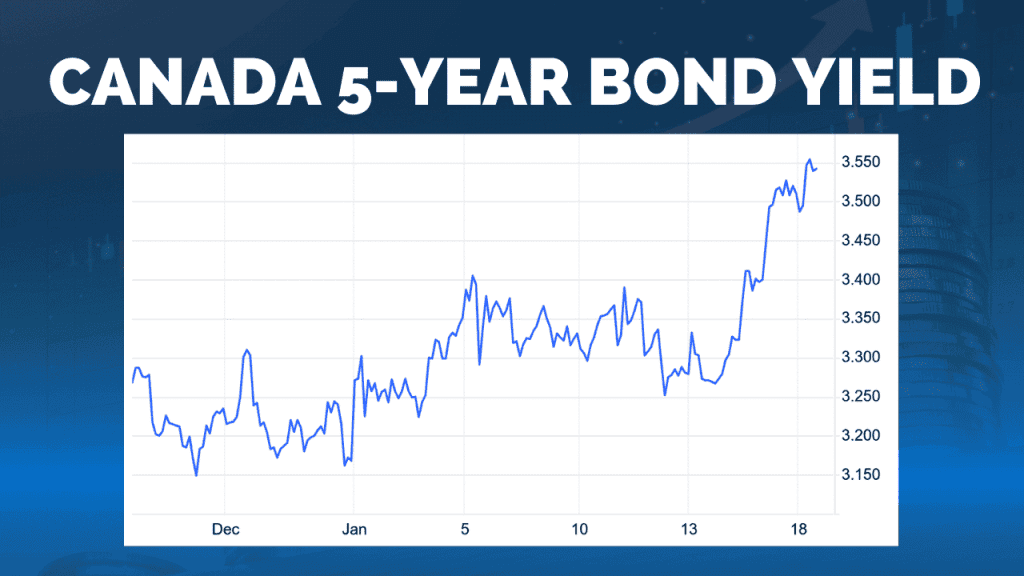

Fast forward to the period between January 15 and January 18, 2024, and the narrative begins to change. The Canada 5-year bond yield, a key indicator in the bond market, has seen an increase of approximately 25 basis points, or a quarter of a percent. This increment may seem minute in isolation, but in the world of finance, it’s a significant shift, signaling a potential change in the economic tide.

source: Trading Economics

source: Trading Economics

The Tale of Two Economies: US and Canada

The root of this shift can be traced back to the contrasting economic performances of the United States and Canada. The year 2024 has started on a positive note for the US economy, showing promising data across various sectors. However, the situation in Canada paints a different picture, with less optimistic economic indicators.

This disparity is pivotal in understanding the bond yield dynamics. The Canadian bond market, particularly the Government of Canada Bond yield, is closely tied to the US 10-Year Treasury. As a result, any significant changes in the US economy, positive or negative, tend to have a ripple effect on Canadian bond yields. It is this interconnectedness that explains the recent upward trend in Canada’s bond yields, influenced heavily by positive economic data from the US.

US Economic Data Impacting Bond Yields

A key piece of data influencing this trend is the US Initial Jobless Claims number. On a recent date, this figure was reported at 187K, significantly lower than the market consensus of 207K and below the previous number of 203K. This data is a strong indicator of the health of the US labor market, suggesting robust economic activity and lower unemployment rates.

The correlation is straightforward: stronger US economic data often leads to expectations of higher interest rates in the US, which in turn increases bond yields. For Canada, this means that its bond yields are indirectly swayed by these US economic indicators. Consequently, as long as the US continues to show positive economic signs, it is likely to exert upward pressure on Canadian bond yields, potentially delaying any rate decreases that the Bank of Canada might have considered.

As we delve deeper into this complex interplay between US and Canadian economies, one thing becomes clear: the world of finance is intricately connected, and understanding these connections is key to deciphering the movements in bond yields. As we move forward into 2024, keeping a close eye on these economic indicators will be crucial for investors and policymakers alike, shaping decisions and strategies in an ever-evolving financial landscape.

Canada’s Economic Situation

Turning our focus to Canada, a deeper analysis is warranted to understand the country’s current economic climate. A particularly enlightening perspective is provided by a recent article from BNN Bloomberg, which delves into the state of Canada’s economy in relation to its immigration levels. Notably, Canada’s population growth has surged to an impressive 3.2%, a rate that traditionally should mirror economic growth. However, the reality is strikingly different. Despite this rapid population increase, Canada’s economic growth has not kept pace, lagging behind at levels far below the expected 3.2%. This discrepancy raises questions about the underlying strength of the Canadian economy and its capacity to sustain and leverage this population boom.

Immigration and Economic Complexity

The influx of immigrants is reshaping Canada’s economic landscape in several ways. For the Bank of Canada, this presents a complex challenge. The record-breaking immigration rate, fueled largely by an unplanned spike in foreign students and temporary workers, has significantly distorted key economic statistics. This surge has inflated the population growth rate to one of the fastest in the world, complicating the central bank’s ability to assess the true restrictiveness of interest rates.

For instance, the Bank of Canada’s decision to raise its overnight rate to five percent in response to unexpected consumption strength now seems questionable. Was this increase justified, or did it overlook the population surge’s role in driving demand? This dilemma reflects the bank’s struggle to interpret economic data in the context of unprecedented demographic changes.

Housing Market and Inflation Challenges

The impact of immigration extends to various sectors, notably housing and inflation. The influx of over 1.2 million new residents within a year has propped up the GDP and bolstered consumer demand. However, it has also led to higher home costs and contributed to rising unemployment rates. Mortgage interest and rents, significant contributors to inflation, are directly affected by this population growth. While in the short term, this might appear beneficial, the long-term implications could be more complex, potentially leading to economic imbalances.

Per-Capita Analysis of Economic Health

Several economists, including Stefane Marion from the National Bank of Canada, argue that the population increase is masking underlying economic weakness. When adjusting for population, Canada’s economy hasn’t seen growth since the second quarter of 2022, around the time the Bank of Canada initiated its rate hikes. More telling is the GDP per capita metric, which has fallen back to levels last seen in 2017. This indicates that, on a per-capita basis, the economic well-being of Canadians might be declining, a trend often masked by aggregate economic data.

Labour Market Trends and Economic Forecasts

The labor market further illustrates the complexities introduced by immigration. Any employment gains must now be contextualized within the expanding labor force, which grew by 3% at the end of last year. For example, in 2019, the Canadian economy added an average of 22,000 new jobs monthly, keeping the unemployment rate stable. Contrast this with last year, where around 36,000 jobs were added each month, yet the unemployment rate rose.

Looking ahead, economists surveyed by Bloomberg anticipate Canada’s unemployment rate to climb to 6.7% later in the year – a significant jump that could signal recessionary conditions. However, this increase might be more reflective of labor-force growth than economic downturn. In fact, despite a slowing economy in 2024, Canada is likely to continue adding jobs, albeit at a pace skewed by the expanding labor force.

As we continue to unravel the complexities of Canada’s economic situation, it becomes increasingly evident that traditional economic indicators may no longer provide a complete picture. The unique circumstances of Canada’s demographic and economic landscape demand a more nuanced analysis, one that takes into account the diverse factors influencing the nation’s financial health. As we proceed into the final section of our analysis, we will explore the potential long-term effects of these dynamics on Canada’s economy and what this means for future monetary policy decisions.

Long-Term Effects of Population Growth on the Economy

The long-term consequences of Canada’s population growth on the economy merit serious consideration. This demographic shift is not just a statistical anomaly; it has real implications for the country’s economic structure and future. One of the most pressing concerns is labor productivity. According to economists like Randall Bartlett from Desjardins, the reliance on an expanding labor force rather than capital investments has led to a decline in labor productivity. This trend, observed for six consecutive quarters, is a significant factor in the ongoing debate about the effectiveness of Prime Minister Justin Trudeau’s economic policies.

Furthermore, the sudden population surge caught the Canadian government somewhat unprepared. The lack of sufficient investment in infrastructure to support this influx is likely impeding broader productivity. These challenges extend beyond mere numbers; they reflect a deeper issue in the nation’s economic planning and resource allocation.

Economic Weakness Mask ed by Population Growth

The influx of new residents, while contributing to nominal GDP growth, is concurrently masking underlying economic weaknesses. After adjusting for population growth, Canada’s economy hasn’t expanded since the second quarter of 2022. This stagnation becomes more evident when considering GDP per capita, which has regressed to levels seen in 2017.

This scenario presents a paradox. On the one hand, additional demand has stabilized home prices, thus protecting the housing assets of millions of Canadians. This has supported wealth levels, even in the face of higher interest rates, suggesting that a crucial monetary channel to combat inflation may be muted. On the other hand, the economic growth per person has been lackluster, indicating that the average Canadian might not be better off.

Recession in a Per-Capita Sense

Economists like Bartlett suggest that, in a per-capita sense, Canada has been in a recession for a while, even if this is not apparent in the aggregate data. The distinction is crucial; it highlights the gap between perceived economic health based on traditional metrics and the actual economic experience of the average citizen. This discrepancy is essential for understanding the broader economic narrative and for framing monetary policy decisions.

Conclusion

In summary, the rising bond yields in Canada, influenced heavily by positive economic data from the US, are only a part of a much larger, more complex economic story. The interplay between the US and Canadian economies is intricate, with the fortunes of one closely impacting the other. However, within Canada, the situation is further complicated by unprecedented population growth, which has muddied the waters for economic analysis and policy-making.

As we navigate through 2024, it is crucial for investors, policymakers, and the public to understand these nuanced dynamics. The health of the Canadian economy, when viewed through the lens of traditional indicators, might appear robust. However, a deeper, more granular analysis reveals underlying challenges and potential vulnerabilities.

The tale of rising bond yields in Canada is not just a story of economic indices but a narrative of demographic shifts, productivity concerns, and the need for nuanced economic policies. As Canada moves forward, the key will be to adapt to these evolving dynamics, ensuring that economic growth is not just a matter of numbers, but translates into tangible improvements in the standard of living for all Canadians.

0 Comments