Welcome to the inaugural episode of a new video series featuring Bryon Howard or EXP Realty and Josh Tagg of Axiom Mortgage Solutions, two dynamic forces in the world of Calgary real estate! 🏡

As we kick off this exciting journey into 2024, get ready to join Bryon and Josh for a regular video series that promises to be both informative and entertaining. In this first episode, they dissect the four hottest real estate trends reshaping Calgary, offering you expert insights and insider knowledge that will prove invaluable whether you’re a buyer or seller.

From the Calgary inventory crunch to the ever-changing interest rate landscape, you’ll gain a deeper understanding of what’s in store for the real estate market this year. So, hit play, subscribe, and be prepared to embark on a captivating real estate adventure with Bryon and Josh! 🚀🎥

Josh Tagg: Hello everybody and welcome to 2024. We’ve got ourselves a brand new year here. And what I’ve done is I’ve collaborated with Bryon Howard.

Bryon is a top realtor here in Calgary. He’s been around for a long time. He runs the Howard team at EXP Realty. And Bryon, the first of the four things that we came up with for 2024 to watch out for is this inventory crunch that we’re experiencing here in Calgary. How about you tell us a bit about that?

Calgary’s Real Estate Inventory Crunch

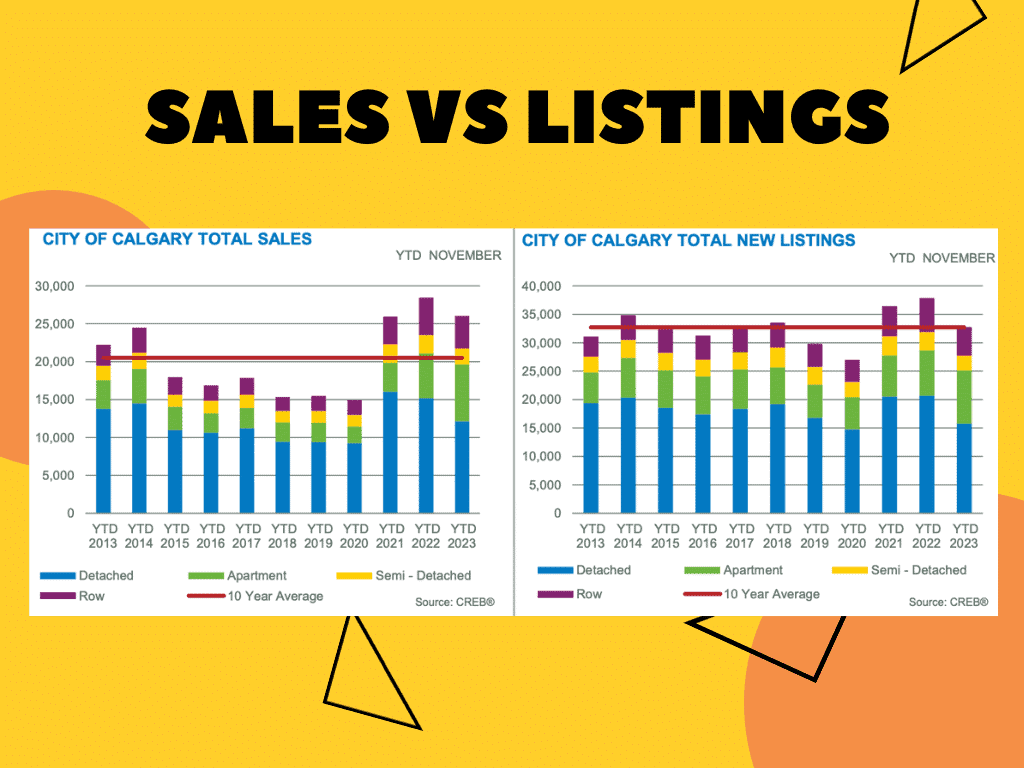

Bryon Howard: Absolutely, Josh. Yes, inventory’s low. We’re currently, very early January here and sales are high and inventory’s low. Now you can see here on the chart on the screen that we’re looking back at Calgary’s total sales on the left and you can see sort of around 20,000 homes sold. basically that average over the last, 10 years. And now the new listings on the right hand side that I’m looking at my right, and we’re up there above 30,000 in terms of the 10-year average.

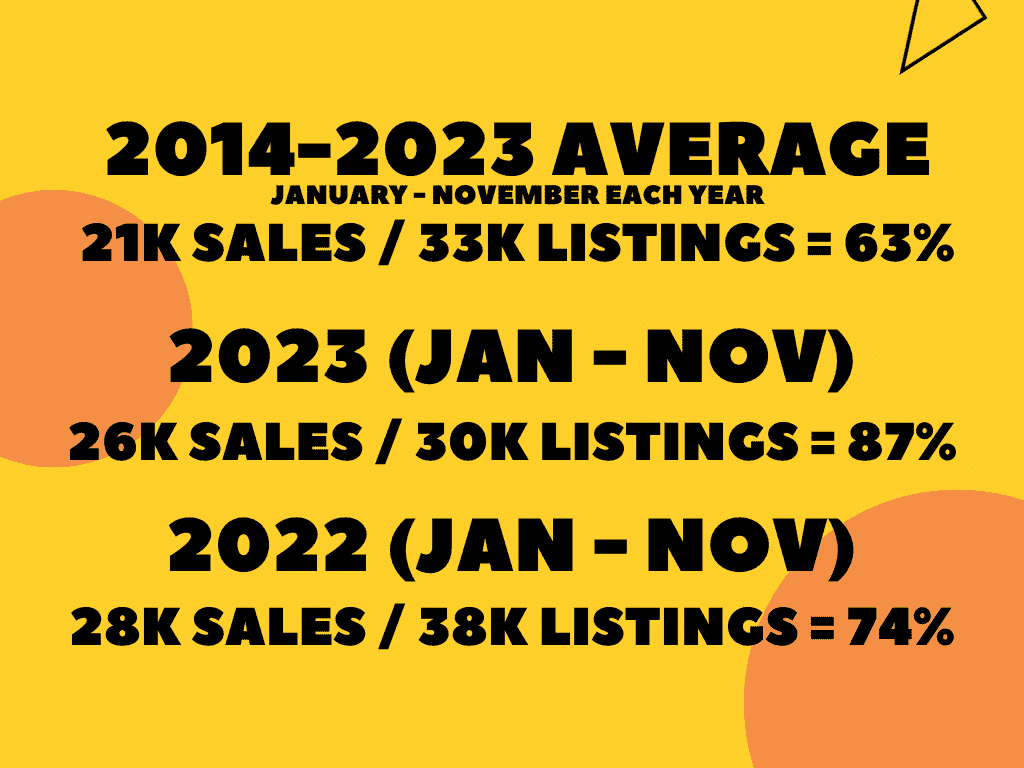

So sales to listings, we see about 70%. Everything that gets listed is selling. So you can see back from 2014 to 2023, 63% of things that came on the market sold. And in 2022, it was 74%. And then in 2023, it was 87%. Everything that gets listed, 87% of it is selling.

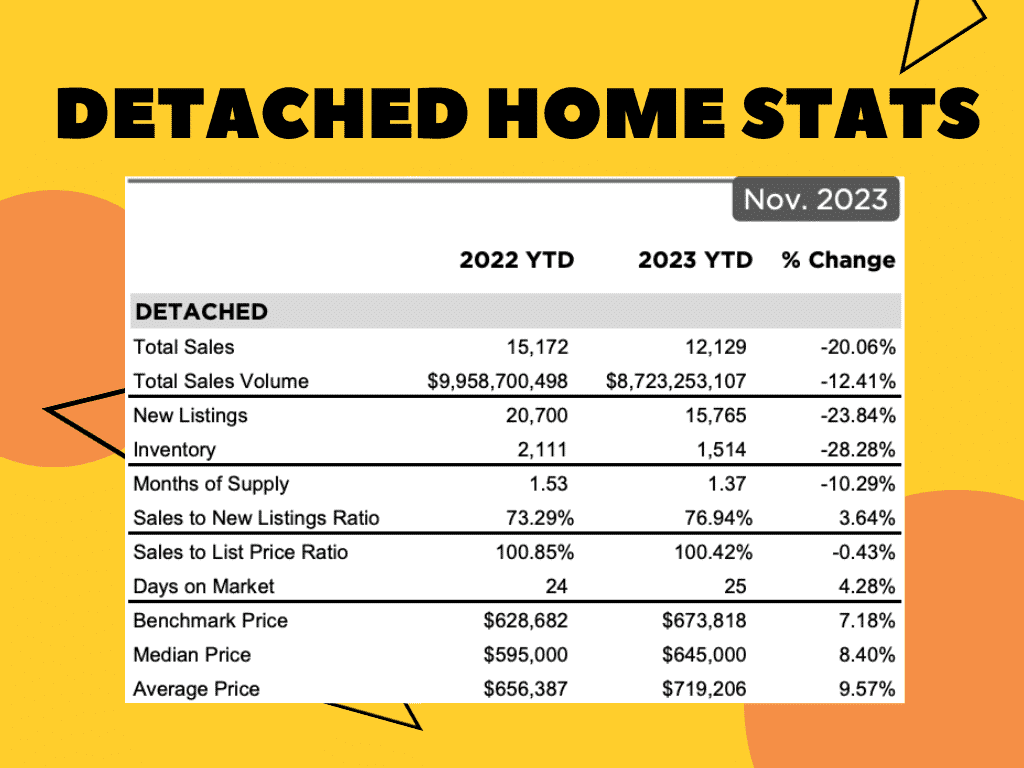

Inventory is low. What does that mean? We have about a month and a half of supply. So absorption rate is through the roof and we’re firmly in a seller’s market. You can see here in our detached homes, in 2022, our median price for detached home was $595,000. In just more recently, that price has gone up almost 9% for a median to $645,000. That’s a detached home in Calgary. Prices are increasing. Over the last 12 months, prices increased every single month.

And here we are entering the new year. with very low inventory. What’s gonna happen?

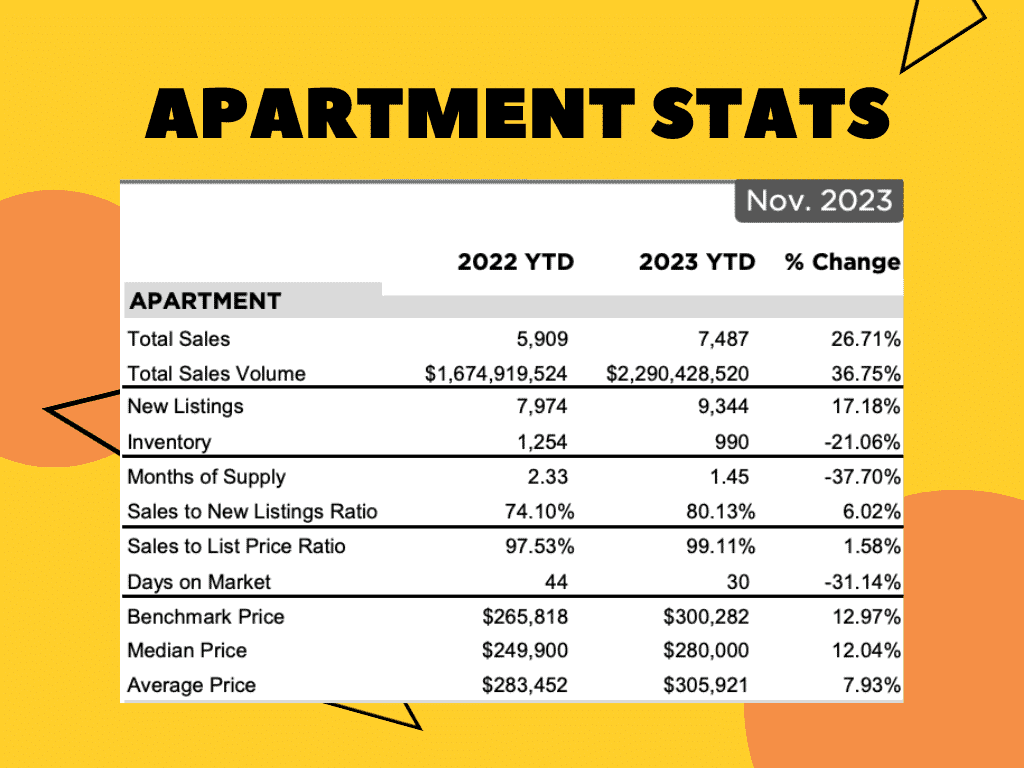

Here we have apartment style condos. Again, 2022, you can see our median price was $249,900. And it went up 12% to a median price to $280,000 in Calgary. It’s really fascinating to see that how big that increase was. The medium price for a condo is fairly affordable at $280,000, especially when compared to the rest of the country.

Josh Tagg: Yes, it’s a, so Calgary is still continues to be one of the most affordable major markets in the country. We have seen lots of increases in prices, and are definitely seeing and experiencing that inventory shortage. This means that when we have new buyers who are ready to go, if you find a home and if it’s priced, you got to move on that here pretty quick, right?

Bryon Howard: 100%. My warning to buyers is to be aware of the market. Find out what’s active pending sold, how quick things are going. And so if you’re prepared to get into this market, you will want to understand it coming in.

Lower Mortgage Rates are Coming

Josh Tagg: Absolutely. Next, you know, everybody’s talking about how rates have come up so much, but now the conversation has shifted and the question isn’t so much if rates are going to go down, it’s when they’re going to start going down. And on the fixed rate side, we’ve actually already seen a lot of downward movement since October when they hit like a 15 or 17 year high. We have rates trending around 5% right now on the fixed side. But on the variable side, there are some economists predicting decreases of up to two percent over the next year to year and a half. So that’s going to be huge. But that does beg the question, Bryon, as interest rates come down, what happens to the prices of homes?

Bryon Howard: They go up in price. As the interest rates come down the home prices will go up. So Josh, what does that mean in terms of timing as we enter the best selling season in Calgary and in Canada, typically we will start to see a price increase over the next two, three months into the spring.

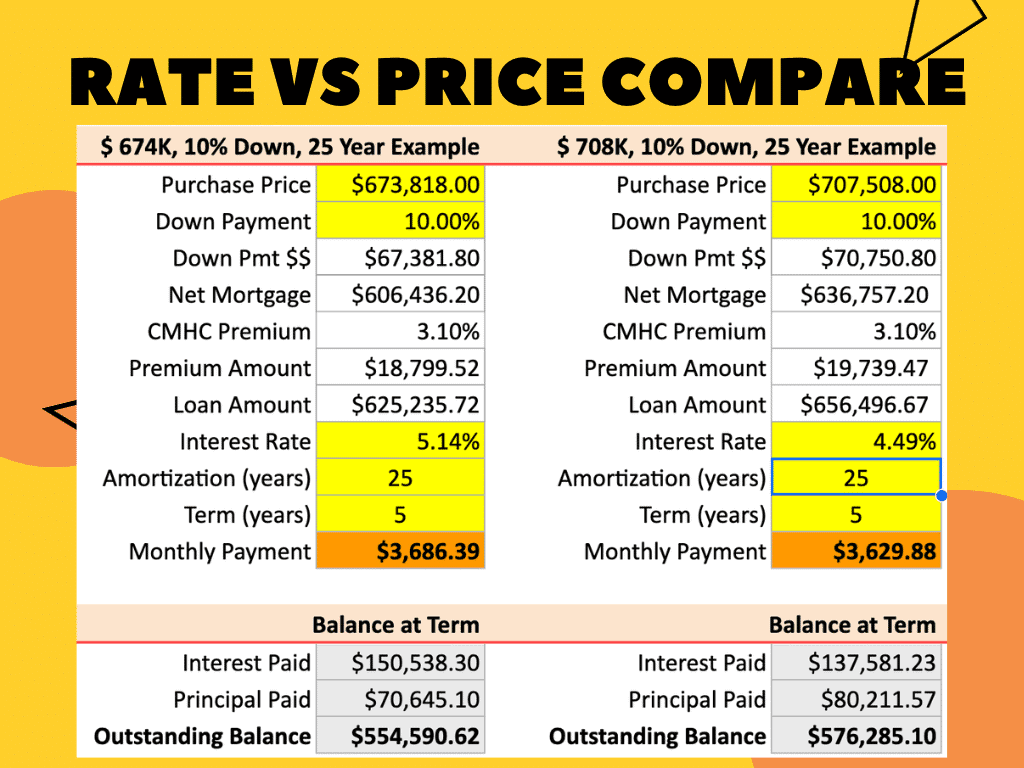

Josh Tagg: I made an example here.What if we bought a house at today’s benchmark price of about $674,000, put 10% down at an interest rate for five years of 5.14% over the next five years, you would actually be paying about $150,000 of interest in five years. But let’s compare that to waiting just a little bit. You know, the highest prices of homes tends to be in the spring. That’s when you’re likely going to see the most inventory. If we even just see a 5% increase in price, that brings it up by nearly $34,000. So about $707,000 would be the price of that same home. So with the same 10% down, but maybe a 4.49% interest rate, the interest that you would pay is going to be less at $137,500, but it’s really only $13,000 less interest. But a much higher home price. So you’re spending $34,000 more for the house in order to save only $13,000 in interest, which I don’t think that makes a lot of sense. So yes, interest rates are going to head down over the next year or two. But along with that, we would expect further increases in price. So I’m not going to say that we should necessarily wait until interest rates are down, right? Because then you’re going to be paying a lot more for a house.

Bryon Howard: Right, so the takeaway if you’re ready to buy, buy sooner.

Josh Tagg: Just, just buy and you know, the discussion can be a bit more detailed. It doesn’t have to be five year term, but I would stay away from the variable rate. And so if we are talking about that, we’ll take a look at shorter terms and ways to minimize how long you’re at that higher interest rate.

The Tight Rental Market in Calgary

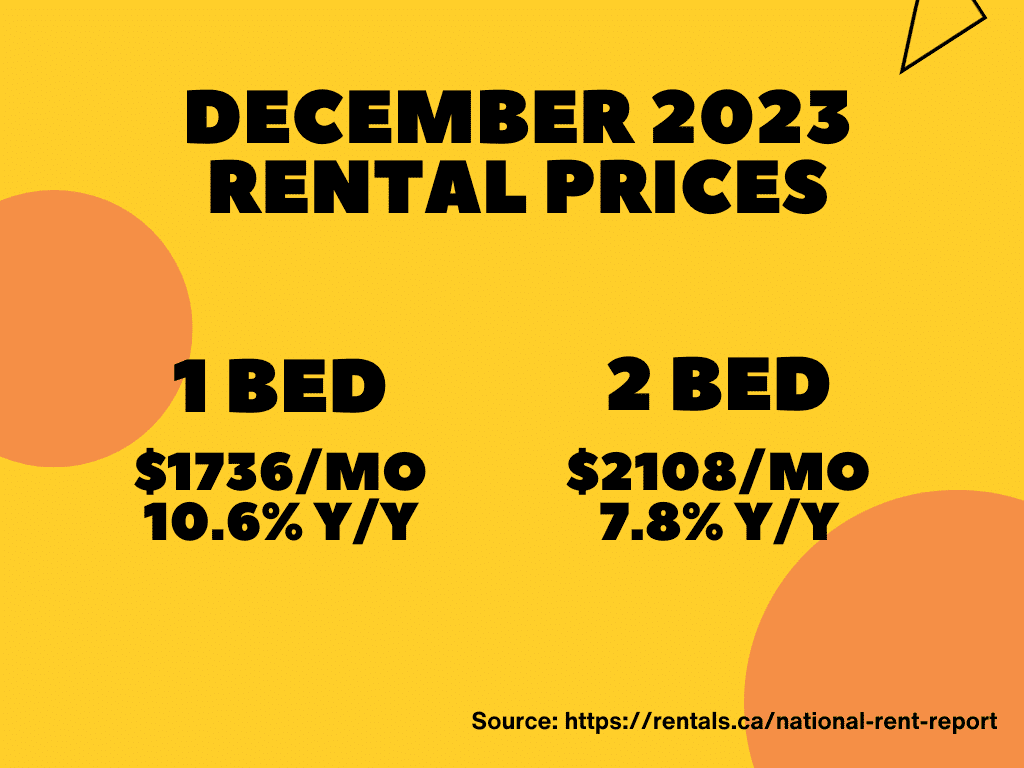

Now, one thing that’s also causing a lot of pressure on house prices is the rental market, right? We’ve seen that get tighter and tighter over the last year or two or three here in Calgary as well. You know, just the average one bedroom rental in Calgary in December of 2023 is up 10.5% from the year before it’s at $1,700 per month, which is just so much.

And we know that there’s no rent controls in Alberta. So your landlord can just increase your rent up to the current market amounts. A two-bedroom condo or two-bedroom place is going for about $2,100 a month, which is up almost 8% from the year before. So as the rental market is tighter and tighter, we’re going to see people wanting to get into apartments, that lower end price point of the market. And Bryon, what do you think we’re going to see with that?

Apartment Condos Now Selling Quickly

Bryon Howard: Well, it’s fascinating to watch apartments. I have been selling real estate here in Calgary since early 2000s. Condos hit the highest price ever way back in 2006 or 2007. And say then in 2013 and 14, we had another high in Alberta. And they finally reached that price point again.

But yes, there’s strong demand for condos which in Calgary are up about 13% over last year, still making them quite affordable at $280,000. And I see stronger and stronger demand for condos. You know, it’s things that are get listed, they’re priced well, they’re selling quickly.

Josh Tagg: Yeah, we’ve seen a 26% increase in apartment sales year over year, right? That’s just massive. And I really think it’s just that the prices have gone up in the other home types. And so not everybody can just go buy a detached home in Calgary anymore.

The expectations have shifted or need to shift for those who haven’t shifted because really that lower end it’s now getting into the market, letting some appreciation happen. And then, you know, as you have equity, as your income situation improves over time, maybe then moving up into the market, as opposed to it used to be even three, four years ago, you could buy a single family home for under $400,000 in Calgary, but now that benchmark price is around $700,000. So it’s significantly more expensive to get into that detached market. And I think we’re going to see a lot of movement into the apartment category here over the next year, for sure.

Bryon Howard: Yeah, I’m feeling it already, you know, those calls are coming.

Josh Tagg: Yeah, any last ideas before we leave everybody with these four trends to watch for in 2024?

Bryon Howard: Sure, well, if you’re a seller or buyer, it’s important, especially as a buyer, to understand these trends. How do you feel about the market? What’s gonna happen in the next year or two? Are you expecting interest rates to go down and are you expecting prices to drop or go up? Well, depending on what you think, nobody has a real crystal ball, but we do have market fundamentals and knowledge. So make your decision, get educated, and we’d love to help, right, Josh?

Josh Tagg: Absolutely, we’re here ready to go.

0 Comments