Welcome to our latest video blog post where we delve into the fascinating world of real estate, exploring the factors driving the new build housing market as we head into 2024. This post features an insightful conversation with Edmonton Real Estate Agent Jay Lewis, Edmonton Mortgage Broker Josh Tagg, and special guest Shannon McCaffray from Alquinn Homes. Together, they provide a comprehensive look at the dynamics shaping the real estate landscape.

In this episode, Josh Tagg offers his expert analysis on the impact of Alberta’s population growth, particularly the influx from other Canadian provinces, on home prices and availability. This demographic shift, unprecedented in its scale, is a crucial factor in understanding the market trends we’re likely to witness in the coming year.

Shannon McCaffray, representing Alquin Homes, contributes a unique perspective on how builders are responding to these changes. She discusses the challenges and strategies involved in pricing and construction in an environment marked by fluctuating demand and supply constraints.

Additionally, the conversation covers important financial considerations for prospective homebuyers, including the intricacies of navigating interest rates and securing favourable pricing amidst a fluctuating market.

This video is a must-watch for anyone interested in real estate, whether you’re a first-time homebuyer, a seasoned investor, or simply curious about the market’s future trajectory. Join us as we explore these vital topics, shedding light on what 2024 might hold for the real estate sector.

Link to Youtube Video to Like and Subscribe!

Jay Lewis: Well, we’re back here again with Josh. We have a guest with us as well. I’m going to introduce her later on. But Josh, it’s been a little bit since we last talked, and I have a quick question for you. Everybody’s talking about how home prices are about to rise. What would you say are some of the factors that we’re going to see that are going to cause that to happen in 2024?

Population Growth from BC & Ontario Fuels Housing Demand

Josh Tagg: Right. You know we typically see prices increase in the spring. We’ve talked about that a lot recently. But coming into 2024, what we are seeing is we’ve had some very consistent population growth coming into Alberta, and of course Edmonton and the Edmonton area is getting its fair share of that with new things coming on board.

Record Sustained Immigration Levels

A lot of that population migration is actually coming from other provinces. So, what I’ve got here to show you is that we saw in the third quarter of this year over 17,000 people come to Alberta. On its own, maybe that number doesn’t mean much.

If we take a look at the next one here that says for the last five quarters in a row, so that’s the last five three-month windows, we’ve seen over 10,000 people every one of those quarters coming to Alberta and that’s something that’s never happened before since records have been kept. This is the highest level of new people to Alberta, most of which are coming from Ontario and BC. It’s not even international immigration, it’s just from other provinces.

It’s the highest level of population increase that we’ve seen in a long time and it’s putting a lot of pressure not only on the rental market but also on home prices because there’s just not enough inventory. That’s really what I think is going to drive a lot of the price increases over the coming year.

Jay Lewis: Yeah, totally. One thing that I’ve really had a lot of conversation with, you know, people from different provinces and and they’re shocked at our prices already. They are used to paying so much more for so much less. They’re just blown away by what they’re paying here, right? So I think if they are coming from Ontario or BC, prices are relatively cheap to them and they’re happy to buy regardless of what the interest rate is doing. So that does make a lot of sense. So basically we got this big pressure on our supply.

New Home Pricing Under Pressure to Increase

And then that’s maybe where Shannon from Alquin Homes can step in and talk to us a little bit about like, you know, why is it that builders raise their prices and what causes them to have to raise their prices in this type of environment? So welcome here, Shannon, and look forward to having this conversation with you.

Shannon McCaffray: Thanks, Jay. Hi, Josh. Yeah, I think typically for us, Alquinn Homes, we see almost every spring there’s always an influx of buyers. This year is going to be quite different, as Josh was explaining how many more people are coming into Canada. In the past couple of months, Jay, you’re right, we’ve seen a lot of buyers come to Alquinn from BC and Ontario. So really what we’re doing is we’re revving up for this next year.

Prices are going to increase and that’s just because of the supply-demand chain that way, all the skilled labourers that we have coming on board. It really is a kind of a, for the builder, it is a fine balancing act to try to balance everything out, but really it’s just a trickling effect of how the prices are going to rise just because of supply and demand.

Jay Lewis: Right. So you, as I understand, would have maybe the same skilled labourers that work for you, correct?

Shannon McCaffray: Yeah. Well, for us here at Alquinn Homes for the last 12 years, we’ve always kept our same trades. We kind of stand by them. We have a good partnership with them. When it does come into having an influx of demand, you know, we do kind of search out those new trades and making sure, but with that comes an increase of price with those skilled trades.

Jay Lewis: Right. So basically, the labor that you have is going to be a shortage just because they can’t handle the new demand that you’re going to experience.

Shannon McCaffray: Exactly.

Materials Cost is Still Elevated

Jay Lewis: Interesting. And so that’s what happens with materials as well then. The amount of materials you’re buying is increased and you’re not the only builder too in the Edmonton area, so everybody’s doing that?

Shannon McCaffray: Yeah, right across the board we see it. Just things that cost and the prices is just, it basically is a higher cost. Just simply, just when we go to buy, even if we buy big bulk purchases, it’s still an increased price that we’re seeing.

Jay Lewis: Yeah. I know the other story that I’ve heard and I’m sure you guys have experienced it as well is like, builders need a healthy profit margin. Healthy doesn’t mean huge, it just means the business can survive. And I think, as I understand the last little while, builders have been at an unsustainable margin, and I suspect that’ll have, you know, that little increase in margins gotta change the price a little bit as well.

Shannon McCaffray: I think coming out of the last couple years, the builders have had to really take a look at that and try to kind of work their way through it. And you know, probably for the last two years, the profit margin hasn’t been as healthy as like a typical builder would want. So you know, that is going to be kind of coming around in the next year or two that will just have to be part of the equation.

Locking in a New Home Price

Jay Lewis: Sure, that makes a lot of sense. So my last question for you then, Shannon, is I’ve had this a lot from potential buyers. They’re like, hey, I need to buy a new house, but if I buy it now, it’s gonna take you, what, eight, 10 months to build the property. So what happens to their price? If they buy it today or tomorrow, like, does their price change, or can they expect that whatever, you know, the negotiator, the final number is, it shouldn’t really change that much?

Shannon McCaffray: No, really, like, when you sign a contract with Alquinn Homes or any other builder, it should really be that your price is locked in so the homeowner knows what to expect on the line meaning builder and the purchaser have agreed at a set price and we go about our job of building you a home and you knowing what price you’re going to pay for that.

Jay Lewis: Right and so part of that is just because you’ve made a deal with your suppliers and your trades and they’ve agreed to build the house for that price, that price is locked in. So Josh, I guess my question comes to you then. If my buyer decides to go ahead and purchase a home, what happens to him? Like does he have to pay the interest rate now or when he closes or what happens there?

Strategic Opportunity with Home Prices and Interest Rates

Josh Tagg: Well, the truth is when somebody is purchasing a brand new home and it’s not ready for eight or 10 or whatever months, in a rising rate environment, that can be kind of a scary thing because not very many lenders will hold an interest rate for very long beyond four months and those that do have premiums on that. So people aren’t necessarily interested in paying that premium and over the last couple of years when interest rates were increasing, it did make it hard on people buying new homes.

Right now we’re seeing the flip of that, right, with the expectation over the coming year of pretty significant drops or discounting from today’s mortgage rates, by buying something brand new that’s not ready for 8 or 10 months, you actually have the advantage of locking in the price now before they come up over the springtime and into 2024. At the same time, riding that interest rate down because we only lock in the interest rate typically about four months before your possession date.

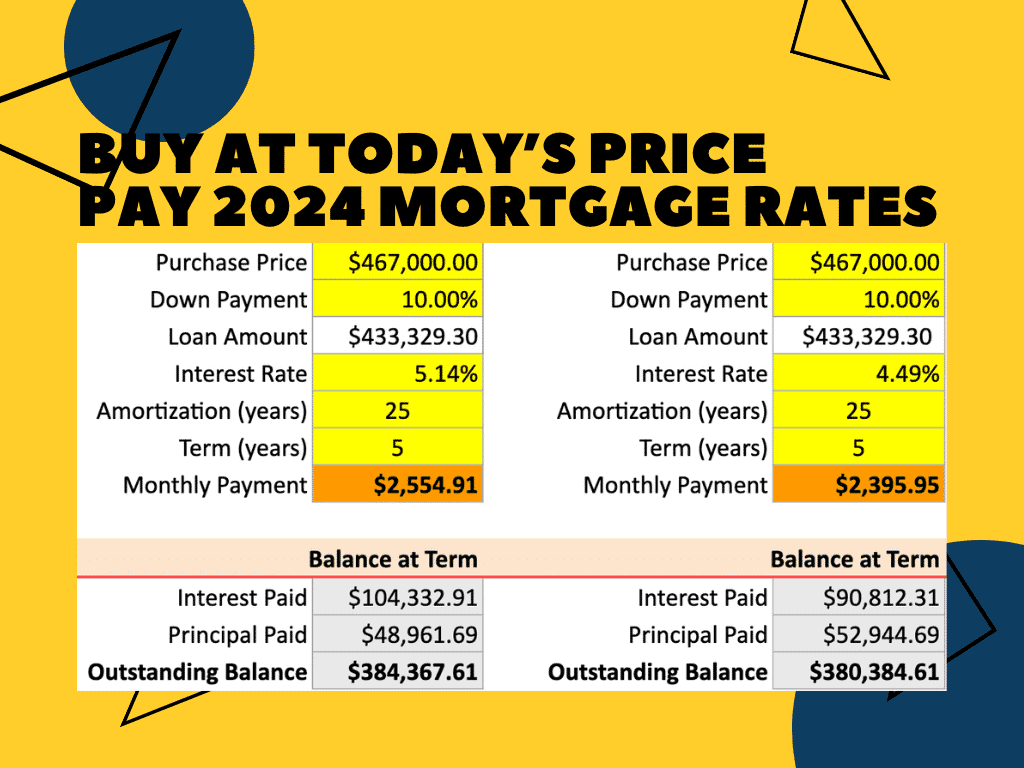

If you were to buy a home at November’s average price of $467,000, put 10% down, right now you’d be looking at about 5.14% as an interest rate and a monthly payment of $2550 per month. Over a five-year period you’d be paying about $104,000 of interest but if we can lock in today’s price, but not actually start making your mortgage payments until the summer or fall of 2024 if we were to see about $150 – $160 reduction in the payment as a result of that lower rate, but we are also going to see almost $14,000 less interest that you would be paying over the 5 years.

You are getting the price in lower, potentially $30,000, $40,000 lower price than you would be paying if you were to wait to buy a home until the rates are lower, but you’re also likely to experience a pretty significant savings in interest by not having to start your mortgage until eight months or so from now.

Overall, I would say that that makes a lot of sense to try to get into something new now as long as you’re confident that nothing’s going to change with your employment situation or anything that would maybe make it so you don’t qualify at a later date for the mortgage, but then it allows you to get in at today’s prices for the homes, but next year’s interest rates for the mortgage.

Wrap-up

Jay Lewis: Well, that’s fantastic. So, I guess that sounds like a really good strategy then. Basically, I guess we should start with Josh and Shannon at Alquin and we’ll get you guys into your new home in 2024.

Josh Tagg: And let me just add, like everything, we of course don’t know the future. Maybe home prices don’t go up, maybe interest rates don’t go down, but these are kind of the best estimates and the best forecast that we have available today.

And so, like always, make sure you click on like for this video, subscribe to the channel for more updates from us, drop a comment if there’s some specific video content that you want to see us share with you, maybe drop that into the comments here on YouTube. And we definitely look forward to adding new content for you over the coming weeks and months. And stay safe out there and happy new year.

0 Comments