In the ever-interconnected global economy, the ripple effects of economic indicators in one country can significantly impact the financial landscapes of others. This reality is especially true for Canadian mortgage borrowers, who often find their financial fortunes tied to economic developments south of the border. The latest U.S. inflation data for October 2023 serves as a crucial point of interest. Coming in below market expectations, it signals a potentially favourable shift for those concerned about mortgage rates in Canada. This article delves into the intricacies of the U.S. inflation data and its consequential impact on Canadian financial instruments, particularly the 5-year Canada Government Bond yields. Understanding these dynamics is essential for Canadian mortgage borrowers seeking to navigate the complexities of interest rates in an ever-evolving economic environment.

U.S. Inflation Data for October 2023

The U.S. inflation data for October 2023 marked a notable departure from preceding trends, offering a glimpse of potential economic recalibration. The annual inflation rate decelerated to 3.2%, a marked decrease from the 3.7% recorded in both September and August, and slightly below the market forecast of 3.3%. This slowdown in inflation reflects a broader economic narrative and has significant implications.

A key driver behind this deceleration was the notable drop in gasoline prices, a volatile component often influencing broader inflation measures. The Consumer Price Index (CPI), a primary measure of inflation, remained unchanged from September, representing the least movement in fifteen months. This stagnation in the CPI was unexpected, as forecasts had predicted a modest rise of 0.1%.

This data signals a cooling off from the heightened inflationary pressures witnessed in the recent past. It’s a development that brings a sigh of relief to policymakers and investors alike, who have been closely monitoring inflation for signs of sustained economic stability. The U.S. Bureau of Labor Statistics’ report suggests a nuanced economic landscape, where inflationary pressures are beginning to ease, albeit at a gradual pace.

For Canadian observers, particularly those in the mortgage market, these figures are more than just economic indicators from a neighboring country. They serve as a bellwether for broader economic trends that could significantly impact interest rates and borrowing costs in Canada.

Impact on U.S. Treasury Yields

The release of the U.S. inflation data for October 2023 had an immediate and significant impact on the U.S. Treasury market, particularly the yields on the 10-year Treasury notes. Following the announcement, the yield on these benchmark securities experienced a noticeable decline, dropping by 13.4 basis points to 4.498% as of 8:32 AM EST.

To understand the magnitude of this shift, it’s essential to grasp what basis points represent. A basis point is a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. One basis point is equivalent to 0.01% (1/100th of a percent). Therefore, a movement of 13.4 basis points is substantial in the bond market, indicating a significant shift in investor sentiment and expectations.

This decline in yield suggests that investors are reacting to the lower-than-expected inflation data by adjusting their expectations for future interest rates and economic growth. Lower inflation typically leads to lower interest rates, as central banks may feel less pressure to raise rates to combat inflation. Consequently, bond yields tend to decrease when inflation is lower than expected, as was the case with the October 2023 data.

For Canadian markets, particularly those concerned with mortgage rates, the movement in U.S. Treasury yields is a critical indicator. The bond market, especially U.S. Treasuries, is often seen as a bellwether for global interest rates, including those in Canada. As such, changes in U.S. Treasury yields can have a ripple effect, influencing the yields on Canadian government bonds and, by extension, the interest rates on mortgages in Canada.

Correlation with Canadian Financial Markets

The reaction of Canadian financial markets, particularly in relation to government bond yields, to fluctuations in U.S. Treasury yields is a critical aspect of understanding the dynamics between these two closely intertwined economies. The U.S. inflation data for October 2023, and its subsequent impact on the U.S. 10-year Treasury yield, exemplifies this correlation.

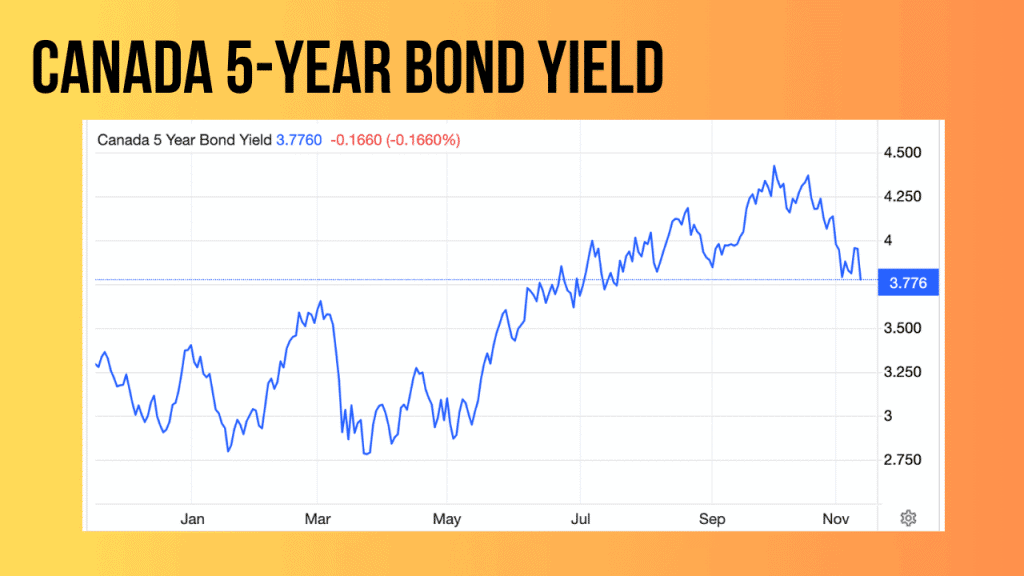

Historically, Canadian bond yields have shown a tendency to mirror movements in their U.S. counterparts. This is partly because both countries operate in a highly integrated North American economy and partly because global investors often view U.S. economic indicators as benchmarks for broader economic trends. In the context of the October 2023 U.S. inflation data, the dip in the U.S. 10-year Treasury yield also signaled a potential downward adjustment in the yields of Canadian government bonds, including the critical 5-year Canada Government Bond.

As of November 14, 2023, the 5-year Canada Government Bond was observed at a yield of approximately 3.849%. This rate is particularly significant for the mortgage market, as it influences the pricing of 5-year fixed-rate mortgages, a popular choice among Canadian homeowners. A decrease in the yield of these bonds, following the U.S. trend, could imply a future reduction in the interest rates for these mortgages.

This correlation underscores the importance for Canadian mortgage borrowers and financial planners to keep a close eye on U.S. economic data. Shifts in U.S. inflation, and by extension, U.S. Treasury yields, can serve as an early indicator of changes in Canadian bond yields and mortgage rates. Therefore, understanding these international economic relationships is crucial for making informed financial decisions in the Canadian context.

This correlation underscores the importance for Canadian mortgage borrowers and financial planners to keep a close eye on U.S. economic data. Shifts in U.S. inflation, and by extension, U.S. Treasury yields, can serve as an early indicator of changes in Canadian bond yields and mortgage rates. Therefore, understanding these international economic relationships is crucial for making informed financial decisions in the Canadian context.

Implications for Canadian Mortgage Borrowers

The developments in U.S. inflation and the ensuing movements in the bond market have direct and meaningful implications for Canadian mortgage borrowers. Understanding these impacts is crucial for those currently holding mortgages, as well as for potential borrowers in the Canadian market.

Impact of Bond Yields on Mortgage Rates

The yield on government bonds, particularly the 5-year Canada Government Bond, is a key determinant of fixed mortgage rates in Canada. Banks and other lenders use these yields as a benchmark for setting the interest rates on their mortgage products. Therefore, a decrease in the 5-year bond yield, potentially influenced by trends in U.S. Treasury yields, could lead to lower fixed mortgage rates in Canada. This is particularly relevant for 5-year fixed-rate mortgages, a common choice among Canadian homeowners.

Current Mortgage Rate Scenario

As of November 2023, Canadian mortgage borrowers have been facing a period of fluctuating interest rates, influenced by both domestic economic conditions and international financial trends. The decrease in U.S. inflation and the corresponding drop in U.S. Treasury yields suggest a potential easing of interest rates in Canada. This could be a welcome development for borrowers, offering some relief from the higher rates experienced in previous periods.

Future Expectations

While the immediate response to the U.S. inflation data has been positive for Canadian mortgage rates, borrowers should remain attentive to longer-term trends. Economic factors such as domestic inflation, employment figures, and the Bank of Canada’s monetary policy will continue to play significant roles in shaping the interest rate landscape.

Case Study: Real-Time Reactions

The real-time market reactions to the October 2023 U.S. inflation data released today provide a tangible case study of how interconnected global financial markets are and how they can impact Canadian mortgage borrowers.

Immediate Market Response

Following the announcement of the U.S. inflation data, there was a notable shift in investor sentiment, as evidenced by the decrease in the U.S. 10-year Treasury yield. This immediate reaction is a testament to the weight that U.S. economic indicators carry in global financial markets. Investors and financial institutions quickly adjust their expectations and strategies based on such data, leading to immediate changes in bond yields.

Canadian Market Reactions

In Canada, the financial markets responded in tandem with the developments in the U.S. The yield on the 5-year Canada Government Bond, closely watched by mortgage lenders and borrowers, showed signs of movement influenced by the U.S. data. This response is a typical example of how Canadian financial instruments are impacted by major economic announcements in the United States.

Expert Analysis

Financial analysts and economists were quick to comment on these developments. Many highlighted the importance of the U.S. inflation data in shaping monetary policy and interest rate expectations. Some analysts pointed out that while the drop in U.S. inflation is a positive sign, it’s crucial to watch for consistent trends over time rather than making conclusions based on a single month’s data.

Mortgage Market Reactions

For Canadian mortgage borrowers, the reaction of the mortgage market to these bond yield changes is of utmost interest. Lenders in Canada often adjust their mortgage rates based on the yield of government bonds. While the immediate effect might not translate into instant changes in mortgage rates, the trend set by these yields often indicates the direction in which mortgage rates are likely to move.

Long-term Implications

While the short-term reactions provide insights, it is the long-term implications that are more significant for mortgage borrowers. Market analysts suggest keeping a close watch on continued economic data releases and trends in both the U.S. and Canada to better understand the likely path of interest rates and mortgage costs.

In conclusion, the real-time reactions to the U.S. inflation data underscore the interconnectedness of global financial markets and their influence on Canadian mortgage rates. It is a clear illustration of how international economic developments can have immediate and tangible effects on individual financial decisions in Canada.

Conclusion

The U.S. inflation data for October 2023, with its lower-than-expected figures, has brought a significant impact not just on the U.S. economy but also on the Canadian financial landscape, particularly for mortgage borrowers. This episode underscores the intricate interconnectedness of global economies and financial markets, highlighting how economic developments in one country can ripple across borders, influencing financial instruments and borrowing costs in another.

For Canadian mortgage borrowers, the key takeaway is the importance of staying attuned to international economic trends, especially those emanating from the U.S. The correlation between U.S. Treasury yields and Canadian bond yields, and the subsequent influence on mortgage rates, is a clear example of this dynamic. While the immediate impact of the October inflation data seems favorable, offering a potential respite from higher mortgage rates, it’s a reminder of the ever-changing nature of financial markets.

As we move forward, it is crucial for Canadian borrowers to maintain vigilance and seek informed advice. Economic indicators, both domestic and international, should be monitored closely as they can offer valuable insights into future mortgage rate trends. Navigating through this complex economic terrain requires a balanced approach, combining awareness of global economic events with a clear understanding of one’s personal financial situation.

In summary, the developments in the U.S. and their impact on Canadian mortgage markets serve as a reminder of the fluidity of economic conditions and the need for adaptability and informed decision-making in personal financial planning.

0 Comments