The Big, Scary ZERO. Canada’s GDP growth (or lack thereof) is proving to be more than a little disconcerting. A 0% growth rate, as the numbers currently stand, means that the Canadian economy is not expanding at all. While many had low expectations, with predictions of a +0.1% growth, the reality is even bleaker than anticipated. This stagnation is particularly perplexing when considering the backdrop of the US Treasury Yield and its minimal downward shift on the announcement of this news.

Population Growth vs. GDP Growth: Are Canadians Getting Poorer?

Canada’s recent population metrics are nothing short of remarkable. In mid-2023, the nation celebrated a significant milestone – a population of over 40 million. From the shores of Vancouver to the bustling streets of Toronto and the picturesque landscapes of Quebec, Canada’s population has seen an impressive growth rate of 2.9%. Such demographic expansion paints a vibrant picture of a country on the rise, potentially attracting immigrants, boasting a higher birth rate, and offering a quality of life that many find alluring.

Yet, in the midst of this growth, there looms a shadow that cannot be ignored – the stark stagnation of our GDP.

In traditional economic models, a growing population, especially in developed nations, often correlates with an increase in demand for goods and services, more innovation, and, therefore, an expected rise in GDP. The logic is straightforward: more people equate to more consumers, which leads to more production and subsequently more economic output. Hence, it’s natural to wonder: shouldn’t our GDP be on an upward trajectory, mirroring our population growth?

This discrepancy between a surging population and a stagnant GDP raises the unsettling question of economic dilution. Essentially, if the country’s wealth, as measured by GDP, is not growing while its population is, then the average wealth per person (or GDP per capita) may decrease. This could indicate that Canadians, on average, are becoming less economically prosperous, even if the country’s total wealth remains unchanged.

Several factors might contribute to this phenomenon:

1. Quality of Jobs: While job numbers might be increasing, it’s crucial to look at the kind of jobs being added. Are they high-paying jobs contributing significantly to the economy, or are many of them lower-wage positions that don’t add as much to the GDP?

2. Aging Population: An aging demographic might be contributing more to the population numbers than younger, working-age individuals. An older population might not be as economically active, leading to a less significant contribution to the GDP.

3. Consumer Debt: A population grappling with significant debt might not be spending as much, hence not fueling economic growth as one might expect from larger population numbers.

4. Economic Infrastructure: Perhaps the economic infrastructure hasn’t kept pace with the population boom, leading to inefficiencies and hindrances in economic productivity.

5. External Factors: Global economic conditions, trade challenges, or international policies could be impacting Canada’s economic output, regardless of its internal population growth.

The scenario paints a complex picture for policymakers. On one hand, they have a growing populace, which traditionally signals potential for economic expansion and increased global influence. On the other hand, the current economic metrics indicate potential challenges in ensuring prosperity is widespread and not just concentrated.

In conclusion, while Canada’s population growth is undoubtedly a sign of a thriving nation in many respects, it’s imperative not to overlook the GDP stagnation that accompanies it. This disparity serves as a stark reminder of the challenges of managing and distributing economic prosperity in a rapidly changing demographic landscape. As Canadians, understanding this dynamic is crucial for anticipating future economic trends and ensuring the nation’s growth benefits all its residents.

Jobs Galore, But No GDP Boost

The year 2023 started on a hopeful note for many Canadians on the job front. In a span of just nine months, from January to September, the nation witnessed the creation of an astounding 387,800 jobs! For many individuals and families, this signifies more opportunities, better prospects, and a beacon of hope in uncertain economic times. However, a deeper dive into the nation’s economic metrics brings forward a perplexing anomaly. Despite such significant job creation, Canada’s GDP, the broadest measure of economic prosperity, has not seen the expected positive surge. This glaring imbalance between burgeoning employment numbers and stagnant economic productivity is causing ripples of concern among economists and policymakers.

The potential fallout from such a scenario could be multifold:

1. Inflationary Pressures: One of the immediate concerns that arises from high employment but stagnant GDP is inflation. Typically, when more people have jobs, consumer demand increases. If the production of goods and services does not keep pace with this demand due to low productivity, prices could rise, leading to inflation. This scenario is particularly concerning for everyday Canadians, as it might mean that while more people have jobs, the cost of living could also be increasing, neutralizing the benefits of employment.

2. Job Quality: The sheer number of jobs is not the only important metric; the quality of these jobs is equally, if not more, significant. Are the newly created jobs high-paying, full-time positions with benefits and growth potential? Or are many of them part-time, gig-based, or low-wage jobs that don’t significantly contribute to economic output? The latter scenario could explain the GDP stagnation, as these types of jobs might not provide workers with the income necessary to drive consumer spending and economic growth.

3. Productivity Concerns: Even with increased employment, if the overall productivity of the workforce doesn’t rise, GDP will remain stagnant. This might indicate inefficiencies in the way businesses operate or could point to a mismatch between workers’ skills and job requirements.

4. External Influences: While domestic job creation is robust, Canada’s trade relationships, global economic factors, or international events might be impacting the nation’s GDP. A decrease in exports or challenges in trade agreements could offset gains made through domestic job creation.

5. Sector-Specific Growth: It’s essential to identify where the job growth is concentrated. If most jobs are in sectors that do not substantially contribute to GDP or are currently facing challenges (e.g., industries relying heavily on exports or facing global competition), the overall economic impact might be minimal.

6. Consumer Confidence: Even with increased employment, if Canadians are wary of the economic future, they might be saving more and spending less. Such consumer behavior would lead to decreased demand and thus, dampen GDP growth.

The paradox of substantial job creation without a corresponding GDP boost is a complex challenge for Canada in 2023. While the employment numbers provide optimism, it’s clear that the quality and nature of these jobs, combined with broader economic dynamics, play a crucial role in the nation’s overall economic health.

A Deeper Dive into GDP Stagnation

September’s preliminary data shows some alarming trends:

- Declines in mining, quarrying, oil, and gas extraction sectors.

- Utility production has also taken a hit.

- Conversely, there’s an uptick in construction and public sector output.

Notably, despite the overall stagnation, some areas, such as mining, quarrying, and oil and gas extraction, have seen growth, largely due to increased oil prices stemming from OPEC’s output cuts. However, sectors like manufacturing, food services, and retail trade have taken hits, pulling down the overall GDP numbers.

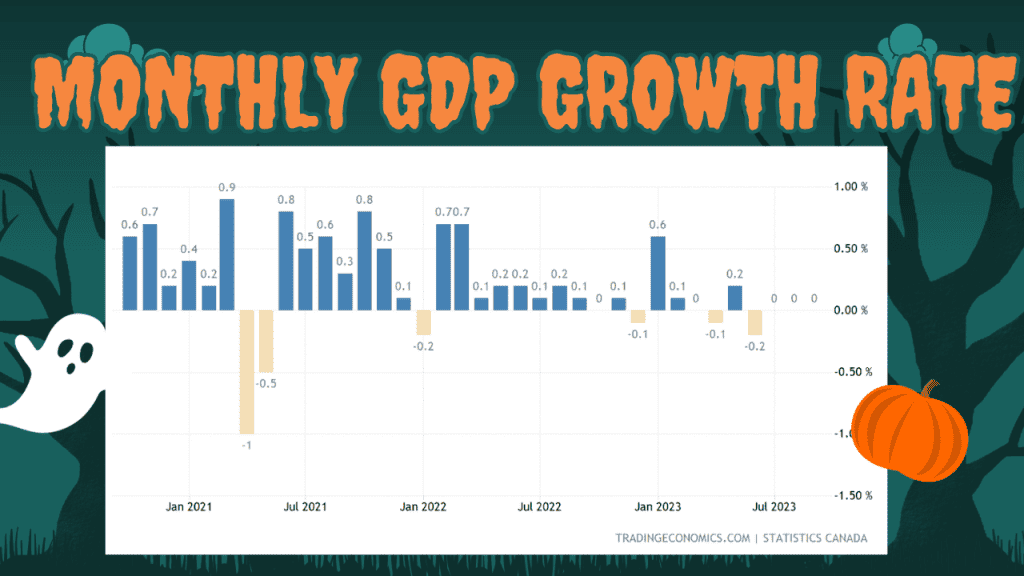

Recession Whispers Getting Louder

The buzz around Canada’s economic corridors is increasingly somber. For Explore Canada’s economic trends from a Calgary perspective. Understand GDP stagnation, job growth, and what stable interest rates mean for homebuyers.two consecutive months, the numbers have told a story that Canadians hoped they wouldn’t have to read: the nation’s economic growth is at a standstill. The consistency of this stagnation is evident in the GDP figures that have consistently fallen short of expectations, not just for a month or two, but for a worrying five months straight.

Adding to the trepidation is the third-quarter projection which suggests an annualized decline of 0.1%. This is not just a minor dip on the economic radar; it’s a noteworthy departure from the optimistic +0.8% annualized growth previously forecasted by the Bank of Canada. Such discrepancies between projections and real outcomes can shake investor confidence and raise questions about the country’s economic stability.

But what is causing this stagnation in an otherwise robust economy? Several culprits have been identified. Inflation, that old economic adversary, has reared its head, potentially eroding consumer purchasing power and discouraging spending. On top of that, Mother Nature seems to have thrown in her cards with forest fires and drought conditions severely impacting industries and livelihoods. Such natural calamities not only strain immediate resources but also signal longer-term economic challenges, especially in sectors dependent on consistent environmental conditions.

Furthermore, high-interest rates, often used as a tool to curb inflation and stabilize economies, may be acting as a double-edged sword. While they can control price rises, they also have the potential to stymie borrowing and investment, critical drivers for economic growth.

A crucial insight into the health of Canada’s economy is the sectoral growth report. A mere 8 out of 20 sectors reported positive growth in the last quarter, hinting at widespread challenges rather than isolated incidents. Such broad-based stagnation paints a rather grim picture of the country’s economic trajectory.

In essence, the whispers of a recession, once faint and in the background, are now becoming increasingly pronounced. Policymakers, businesses, and citizens alike need to brace for potential challenges ahead and make informed decisions to navigate these uncertain economic waters.

Interest Rates and The Economic Outlook

Recent economic indicators have made it clear: Canada is sailing through choppy economic waters. With GDP growth consistently missing its targets and the threat of a recession looming larger, decisions related to monetary policy become critical. One of the most crucial tools at the disposal of central banks, like the Bank of Canada, is the setting of interest rates.

For potential homebuyers in Calgary, these rates play a pivotal role in the decision-making process. Here’s a deeper dive into what the current economic scenario means for you, especially if you’re considering securing a mortgage in the near future.

1. The Silver Lining: The consensus among economists seems clear: given the fragile state of the economy, further interest rate hikes appear to be off the table for now. This stability in rates can be a boon for potential homebuyers. Consistent rates mean predictable monthly mortgage payments, allowing for more precise financial planning.

2. Buyer’s Market?: A combination of economic uncertainty and stable interest rates might make sellers more eager to negotiate. For savvy homebuyers in Calgary, this could translate to better deals and perhaps more favorable terms in their property transactions.

3. Refinancing Opportunities: For existing homeowners, the pause in interest rate hikes might present an opportunity to refinance their mortgages. With the current economic trends, it’s a good time to consult with your mortgage broker about potentially locking in a more favorable rate or exploring other mortgage products that might suit your financial situation better.

4. Caution in the Wind: While stable interest rates can be enticing, remember that they’re a response to broader economic challenges. It’s crucial to evaluate your financial stability before taking on a mortgage. Work closely with your mortgage broker to ensure you’re making a decision that is sustainable in the long term.

5. Localized Impact: Calgary, with its unique economic environment, especially given its ties to the energy sector, might feel the national economic slowdown differently. The local job market, real estate trends, and other regional factors should be considered alongside national trends when deciding to buy.

6. Long-Term Planning: With no imminent rate hikes in sight, it might be tempting to opt for variable-rate mortgages. However, always factor in potential future hikes. Consulting with a seasoned mortgage broker can provide clarity on which mortgage type—fixed or variable—might be best suited for your specific situation.

In conclusion, while the broader economic indicators might be a cause for concern for the nation, they also bring forth potential opportunities for Calgary’s homebuyers. With interest rates expected to remain stable, now might be an opportune time to engage with a trusted mortgage broker and discuss your homebuying aspirations. However, as with all financial decisions, it’s essential to be informed, consider both the short-term and long-term implications, and make choices that align with your financial goals and stability.

In Conclusion

This Halloween, the spookiest story for Canadians might just be the state of our economy. While job creation remains robust, GDP growth is stagnant, leading to concerns about the nation’s economic health. The next few months will be crucial for policymakers and economists alike as they grapple with the challenges of stimulating growth while keeping inflation in check.

For Calgarians, Edmontonians, and Albertans and their mortgages, understanding these broader economic trends is essential. As we move into the final quarter of 2023, keeping a watchful eye on the economic landscape will be vital for those looking to make informed financial decisions.

0 Comments

Trackbacks/Pingbacks