Bank of Canada Keeps Rates Steady

The Bank of Canada made its scheduled rate announcement today and decided to keep the rate unchanged. This is in line with more recent expectations, but as recently as a few weeks ago, there was quite the expectation that interest rates would increase. Yes, I am going to talk about the Bank of Canada and their interest rate announcement, but in today’s video I will also discuss both the Calgary and Edmonton real estate markets and what has been happening in each.

The economic data is finally showing what we all kind of intuitively knew it would show eventually. Wow, the last two years have been a story of battling inflation, and while that is still a concern, the other economic indicators are suggesting that things are not all that rosy. GDP or Gross Domestic Product is one measurement of the economic output. While it is far from a perfect measurement, it is the best we have so we use it. Over the last 20 years, the GDP growth rate in Canada has been between zero and 5.2% except for two years where it dropped below zero. Most recently in 2020 due to COVID-19 and the shutdowns in Canada and around the globe, and before that in 2009 after the global financial crisis caused by irresponsible US Sub Prime Mortgage lending. GDP growth in Canada is about 1% for 2023 and is not expected to recover until 2025.

CPI Inflation is the one where the target is 2%. High Inflation since mid-2021 is the only reason that the Bank has been increasing its rate. In June inflation dropped to 2.8% which is within the 1% tolerance that the bank allows, but it jumped back up to 4% in August before dropping slightly to 3.8% in September. The bank expected this bump which was caused in part by higher fuel prices. The bank is now expecting inflation to hover near 3.5% for the next year before settling where it should be at 2% in 2025.

This feeds into the ongoing “higher for longer” talk where drops to interest rates are now expected to be further into the future and to be more gradual. In 2024, most of the major bank economists expect only a half percent decrease through the year with the first quarter percent drop not happening until after July.

And as always, the bank left the door open to future rate increases if inflation picks up or remains stubbornly high.

Calgary Market Update

Meanwhile – the rising interest rates have really softened the real estate markets in the costliest markets in our country, but not so much here in Alberta. We continue to have the most affordable housing of the six major markets over 1 million people.

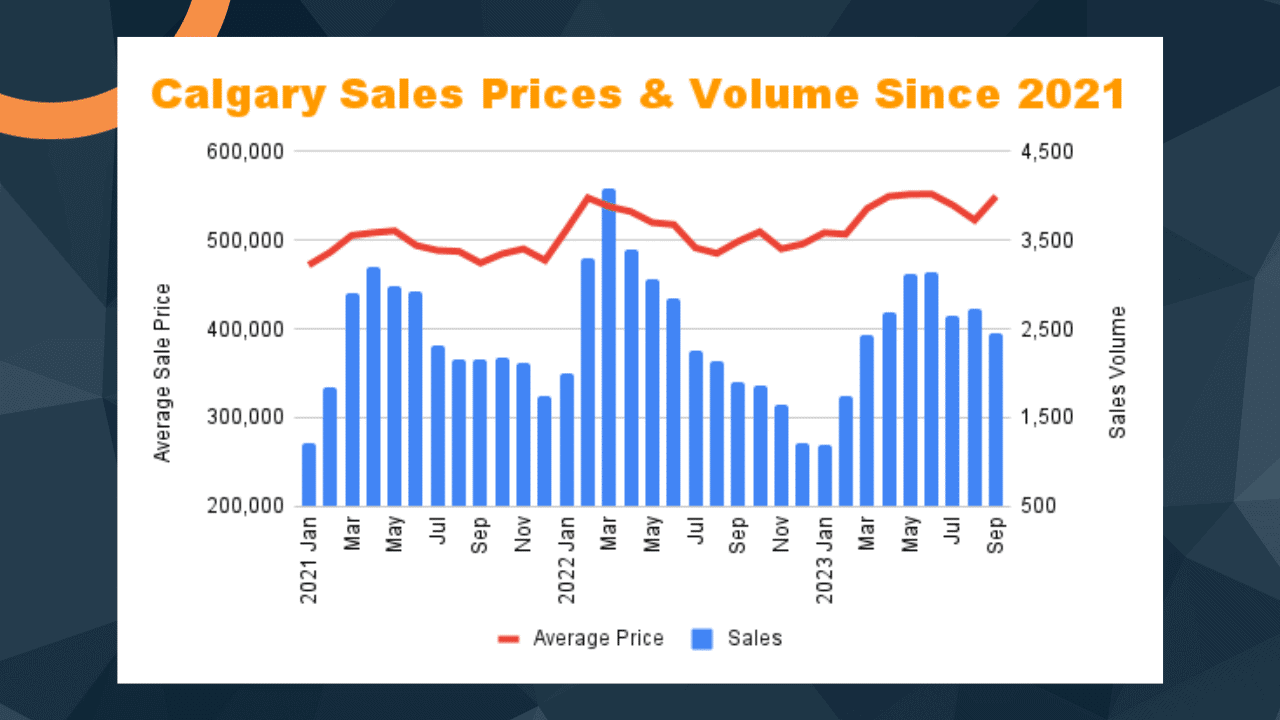

In Calgary, we have continued to see a high level of sales and prices continuing to increase all types of homes. The average sale price of all home types has climbed to $550,000 up from $472,000 in January 2021.

Just like elsewhere in the country, prices peaked in Calgary in March 2022 when the Bank of Canada started aggressively raising interest rates, but that downward price movement bottomed out only a few months later in August 2022 barely dropping below August 2021 prices.

Normally by August each year, we start to see the number of sales each month decrease as the so-called “spring market” ends, and that is no different this year. However, it is interesting to see that the number of sales is higher in July, August and September than it has been in each of the previous two years by a pretty big margin with a 25% increase over those months in 2022.

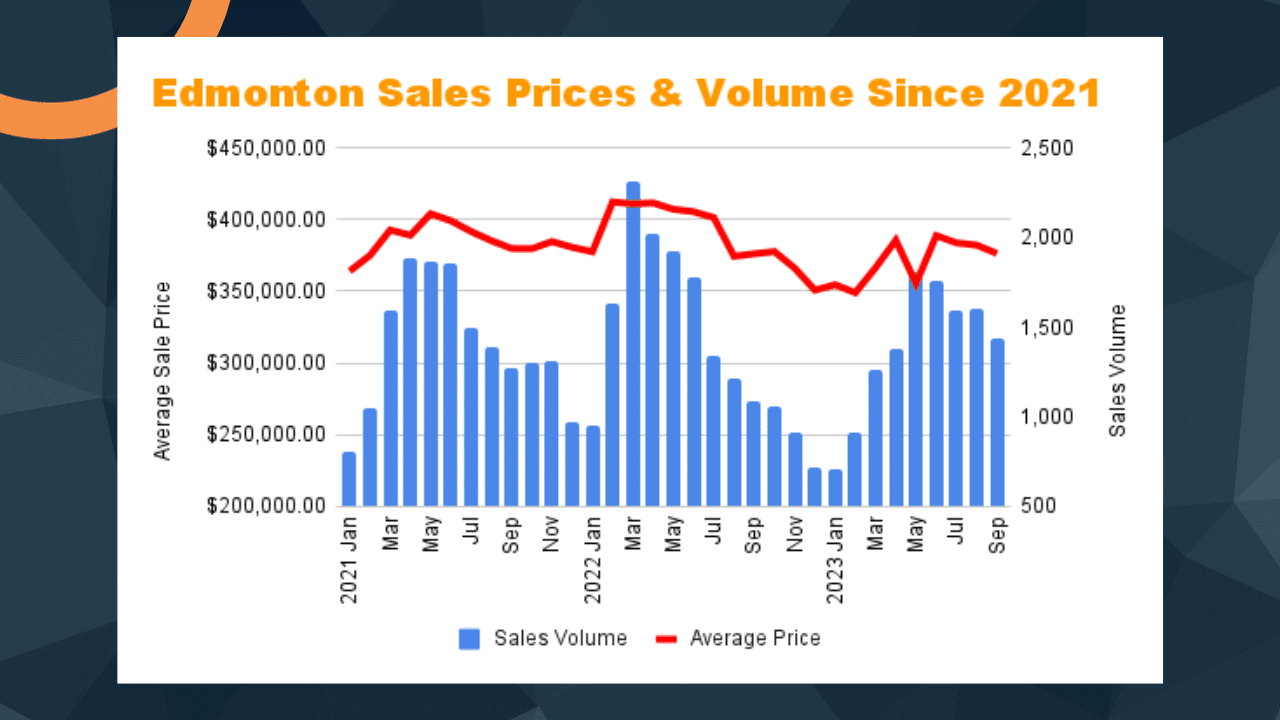

Growth in both Calgary and Edmonton Real Estate prices can be partially attributed to interprovincial migration in addition to international migration. As the ability of a middle-class income earner to purchase a home in Ontario and British Columbia has largely evaporated, many see Alberta as the best opportunity to earn a good living and also own a home with a good work and life balance.

Edmonton Market Update

In Edmonton, home ownership is even more attainable than in Calgary. Average Home Prices have been pretty stable moving up and down within about a 15% variance for the last three years. Prices and the number of monthly sales are above pre-COVID levels, but for those working to get a down payment saved before purchasing a home for the first time, the urgency to get a home before the prices increase even more is not as high as we see in Calgary.

In Edmonton, we are also seeing a higher number of sales in Edmonton from July to September than either of the previous two years with the number of sales also up about 25% from the same three months last year. It will be interesting to see how sales activity moderates over the rest of the year, and how early in 2024 we see things pick up again.

As always, this is just a peek at the information, but if you have a specific question or concern, if you want to see if now is the time to purchase, or if you need to look at options for your existing home or mortgage, please reach out. My team and I are here ready and eager to talk with you and help you.

0 Comments

Trackbacks/Pingbacks