The global economic landscape is an ever-evolving terrain, with various factors and indicators influencing its trajectory. One Desjardins Bank recently released a report highlighting concerning trends in the Canadian economy. Let’s spend a few minutes reviewing the insights provided by Desjardins Bank’s report, outlining key highlights, potential risks, and financial forecasts for Canada.

Economic Slowdown Signals in Advanced Economies

Desjardins Bank’s report acknowledges that growth in advanced economies has been slightly stronger than anticipated. However, it warns that the effects of repeated interest rate hikes may become more pronounced in the coming months. The report also revises China’s growth forecast downward due to disappointing second-quarter performance and a proliferation of deflationary signals.

Robust U.S. Growth with Caveats

The United States, according to the report, has experienced fairly robust real GDP growth, primarily driven by consumer spending. However, Desjardins Bank cautions that the recent surge in gasoline prices could temper this exuberance. Additionally, tight credit conditions are expected to eventually curb both consumer spending and investment.

Canada’s Economy Faces Headwinds

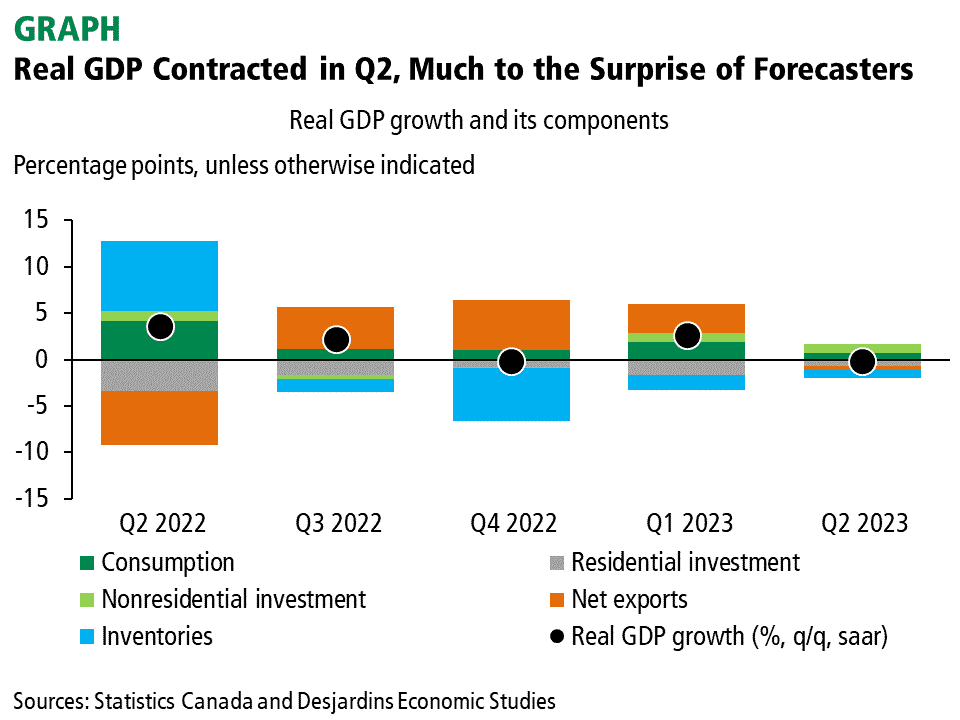

While Canada’s economy has exceeded pessimistic expectations in recent quarters, the Desjardins Bank report points out that recent economic indicators suggest a broad-based slowdown. These indicators include international trade, housing, real GDP, and core CPI inflation. These trends are attributed to the Bank of Canada’s rate hikes, which are beginning to take their toll. Consequently, Desjardins Bank anticipates a recession starting before the end of 2023, lasting into the first half of 2024. Key drivers of this weakness include falling goods consumption, reduced residential investment, and declining exports. This downturn is expected to raise the unemployment rate and depress wage and income growth, prompting the Bank of Canada to consider interest rate cuts in early 2024.

Inherent Risks in the Economic Scenario

Desjardins Bank’s report underscores several inherent risks in the current economic scenario. High and sticky inflation worldwide has led to central banks announcing interest rate hikes. However, the impact of these rate hikes, along with their lagged effects, could be more detrimental to growth than anticipated. China’s muted growth and deflationary signals raise concerns, as does the property market. A downturn in the global economy could adversely affect Canada’s exports and terms of trade, while tighter credit conditions could exacerbate existing challenges. Extreme weather events are also adding to the uncertain macroeconomic environment.

Financial Forecasts

The report notes that sovereign yields have risen throughout the summer, primarily due to better-than-expected economic data, leading to central banks tightening policy rates. However, Desjardins Bank expects both the Bank of Canada and the US Federal Reserve to maintain rates or even cut them in early 2024. Despite this, risks lean towards further tightening, including keeping rates elevated for a longer duration.

Implications for Canada

Implications for Canada

Desjardins Bank’s assessment of the Canadian economy in its report is disconcerting, as it indicates a slowdown that could lead to a recession in the near future. The unexpected contraction in real GDP in Q2 2023, driven by factors such as residential investment and rising savings rates, is a stark reminder of the challenges ahead. The Bank of Canada’s next move, according to the report, is more likely to be a rate cut, possibly in early 2024.

In conclusion, Desjardins Bank’s report provides a comprehensive analysis of the economic situation in Canada, highlighting potential challenges and risks on the horizon. It serves as a crucial resource for policymakers, businesses, and individuals as they navigate the uncertain economic landscape in the coming months.

0 Comments