BMO Economics, yesterday released a revised forecast regarding the anticipated Bank of Canada (BoC) rate drops for the year 2024. The updated forecast suggests a more conservative outlook, now expecting a total of 50 basis points (0.50%) in rate cuts throughout the year, down from the previous estimate of 75 bps. The rate cuts are projected to begin in the third quarter of 2024, followed by a second reduction in the fourth quarter.

This adjustment marks a notable shift in BMO’s expectations from their previous forecast, which initially anticipated the first rate cut to happen in the second quarter of 2024. Michael Gregory, Deputy Chief Economist at BMO, emphasized that the decision is highly data-dependent but stressed the likelihood of the current rates representing cycle peaks. This shift reflects the theme of ‘higher for longer,’ a sentiment echoed due to the continued economic resilience and persistent inflation, albeit less so in the Canadian context.

Similar Trends in the US and their Impact on Canada

Similar expectations of a ‘higher-for-longer’ rate scenario are evolving in the United States as well. The recent Federal Open Market Committee (FOMC) meeting concluded with the decision to maintain the Fed Funds target rate within the range of 5.25-5.50%. This outcome has led to increased expectations of an additional quarter-point rate hike by the Federal Reserve, consequently pushing the anticipated timing of rate cuts further into the future.

Developments in the United States often influence Canadian markets and monetary policy. If the Federal Reserve opts for a rate hike, it raises the odds of a corresponding move by the Bank of Canada, reinforcing the interconnectedness of the two economies.

Impact on Bond Yields and Fixed Rates

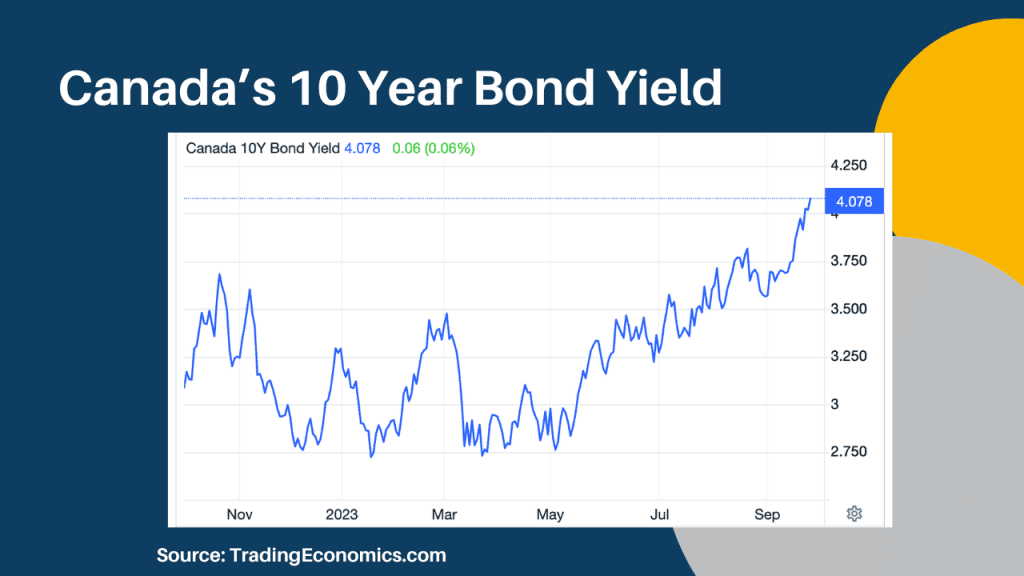

The persistent elevation of inflation has propelled expectations of higher interest rates, exerting upward pressure on bond yields. This, in turn, influences fixed-rate pricing for mortgages. Ten-year Canada yields averaged 3.65% in August, with September projected to reach approximately 3.80%, marking the highest in over 15 years. Additionally, the ‘higher for longer’ theme is observed in 2-year yields, which are expected to average nearly 4.80% in the current month, reaching the highest point in 22 years.

Following higher-than-expected August inflation data, bond yields surged to a 15-year high. As anticipated, certain lenders have already implemented rate increases, with select rates climbing by as many as 30 basis points.

Future Mortgage Rate Expectations

The British Columbia Real Estate Association (BCREA) has released its latest mortgage rate forecast, projecting that average 5-year discounted rates will likely hover near 6% into early 2024, before gradually declining to 5.25% by the year’s end. On the other hand, average variable rates are forecasted to stay at a high of 7.20% throughout the third quarter of 2024.

The rate hikes implemented by the Bank of Canada in June and July of the current year have significantly influenced market expectations regarding the timing of future rate cuts. These adjustments have been pushed further into the future, possibly not occurring until the end of 2024 or even mid-2025. Consequently, long-term interest rates have surged, reaching annual highs, thereby impacting fixed mortgage rates, which are nearing 6%. Additionally, the effect is amplified by an increasingly demanding stress test imposed in the real estate market.

0 Comments

Trackbacks/Pingbacks