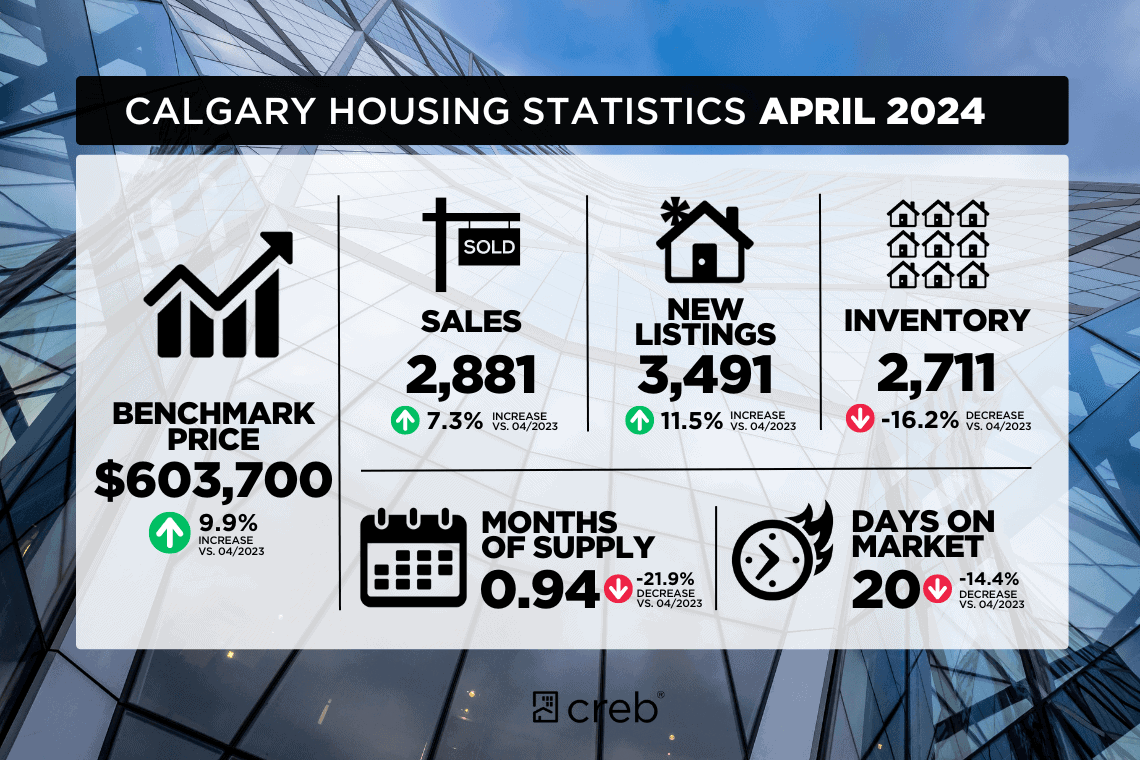

The Calgary Real Estate Board (CREB) recently reported a 7.3% increase in April home sales compared to the previous year, emphasizing a surge in transactions involving more affordable, high-density properties. According to CREB, there were 2,881 units sold in April, with the overall benchmark price for all types of homes reaching $603,700. This price represents a significant 9.9% increase from the same period last year and a 1% rise from March.

This uptick in sales coincides with an 11.5% year-over-year increase in new listings, totalling 3,491 for the month. Despite this increase in listings, the inventory levels were reported at 2,711 units, marking a sharp 16.2% decrease from the previous year and notably lower than typical levels observed in April.

Ann-Marie Lurie, CREB’s Chief Economist, attributed the heightened activity in the housing market to “persistently high-interest rates” which have shifted buyer preferences towards more economically accessible properties. At the same time, these conditions have also spurred an increase in listings for properties valued above $700,000.

Lurie noted a significant decline in the supply of homes priced below $500,000, which fell by 29%. In contrast, there has been a notable supply growth in the segment of homes priced above $700,000. This shift in the market dynamics underscores the impact of economic factors on buyer choices and the types of properties entering the market.

Calgary Homes Selling Faster

Additionally, homes were selling faster, with properties on the market for an average of 20 days before being sold, which is 14.4% quicker than the previous year. This reduction in time on the market indicates a robust demand and a competitive market environment, particularly for more affordable housing options.

In a broader perspective, the CREB’s Monthly Report release highlighted the sustained price growth in Calgary’s real estate market, suggesting that the seller’s market continues to dominate. Despite a slight deceleration in growth pace compared to earlier in the year, April sales were still 37% higher than the long-term trends for the month, primarily driven by sales of affordably priced, high-density properties.

The report also pointed out that while there was an 11% increase in new listings compared to last year, this was only slightly above the long-term trends by 3%. This moderate rise in new listings, juxtaposed with the sales figures, helped prevent further declines in inventory levels. However, inventory remained significantly below past figures, with current levels at half of what is traditionally seen during April.

Tight Supply Favours Sellers

As supply levels continue to decrease, especially among lower-priced homes, the market dynamics are increasingly favouring sellers, leading to continued price increases across the city. With a sales-to-new-listings ratio of 83% and a supply of less than one month, the market conditions are poised to drive further price gains, especially in the more affordably priced districts of the city, where the strongest growth is being observed.

Continuing from the earlier analysis, the Calgary housing market has been showing signs of robust activity, especially in the affordable segments. This trend is supported by the sales-to-new-listings ratio which stood at 83% in April, and a months of supply metric that indicated less than one month’s worth of inventory—both metrics underscoring a strong seller’s market.

Benchmark Price Up 10% over last year

The unadjusted total residential benchmark price in Calgary for April was $603,700, reflecting a near 10% increase from last year and a modest 1% increase from the preceding month. This price escalation was not confined to a specific area but was prevalent across all property types and districts within the city. Notably, the most significant price growth was observed in the city’s more affordable districts, aligning with the heightened demand for economically accessible housing.

Ann-Marie Lurie, Chief Economist at CREB, emphasized the ongoing adjustments in the housing market due to economic pressures, notably the high-interest rates. These rates have not only catalyzed shifts in buyer preference but have also influenced the spectrum of properties coming onto the market. Lurie pointed out that while the higher interest rates have made affordability a critical issue, they have simultaneously fostered a market conducive to selling higher-priced properties.

Hardest for First Time Homebuyers

The decline in inventory, particularly of homes priced below $500,000, is a critical factor that continues to drive prices upward. This decline, amounting to a 29% reduction, starkly contrasts with the growth in listings for homes priced above $700,000, indicating a bifurcated market dynamic where supply and demand are unevenly distributed across different price segments.

Moreover, the average time homes spent on the market in April was significantly reduced, with properties selling in about 20 days, 14.4% faster than the same period last year. This quicker turnover rate indicates strong buyer competition and a brisk pace in the real estate transactions, further evidence of a seller’s market.

This prevailing market condition suggests that while the inventory shortage poses challenges, it also offers opportunities for sellers, particularly in the mid to high-range price brackets. Buyers, especially first-time homebuyers, face a competitive market that requires quick decision-making and often, compromises on preferences.

Calgary’s real estate market in April showed significant vitality, particularly in the segments that cater to affordability. The dynamics of this market, influenced by economic factors and buyer behaviors, suggest a continuing trend of vigorous activity, particularly if the economic variables such as interest rates remain constant. Looking ahead, market participants, including buyers, sellers, and realtors, will need to navigate these conditions with strategic considerations to align with their housing and investment goals.

0 Comments