June 5th is the next scheduled rate announcement by the Bank of Canada, and there are increasing reasons to believe that it may be the first of the rate cuts from the Bank of Canada since it started increasing its rate in early 2022.

Capital Economics reviewed the latest data, and the Summary of Deliberations from the Bank’s last meeting on April 10th. In their opinion, the data released since April 10th is favouring a rate drop on June 5th

Division Amongst Governing Council Members

The summary revealed a division within the Governing Council. Some members expressed a need for additional certainty to mitigate the risk of stagnation in the reduction of core inflation, while others were concerned that monetary policy might remain excessively restrictive.

The Bank of Canada Deliberation Summary is a fairly recent addition and hasn’t been around long enough to firmly interpret the quantitative implications of terms like “some” members. However, Capital Economics points out, this phrase was similarly used last October to indicate a viewpoint favouring additional rate hikes, which retrospectively represented a minority opinion.

Recent Data Updates Support June Rate Cut

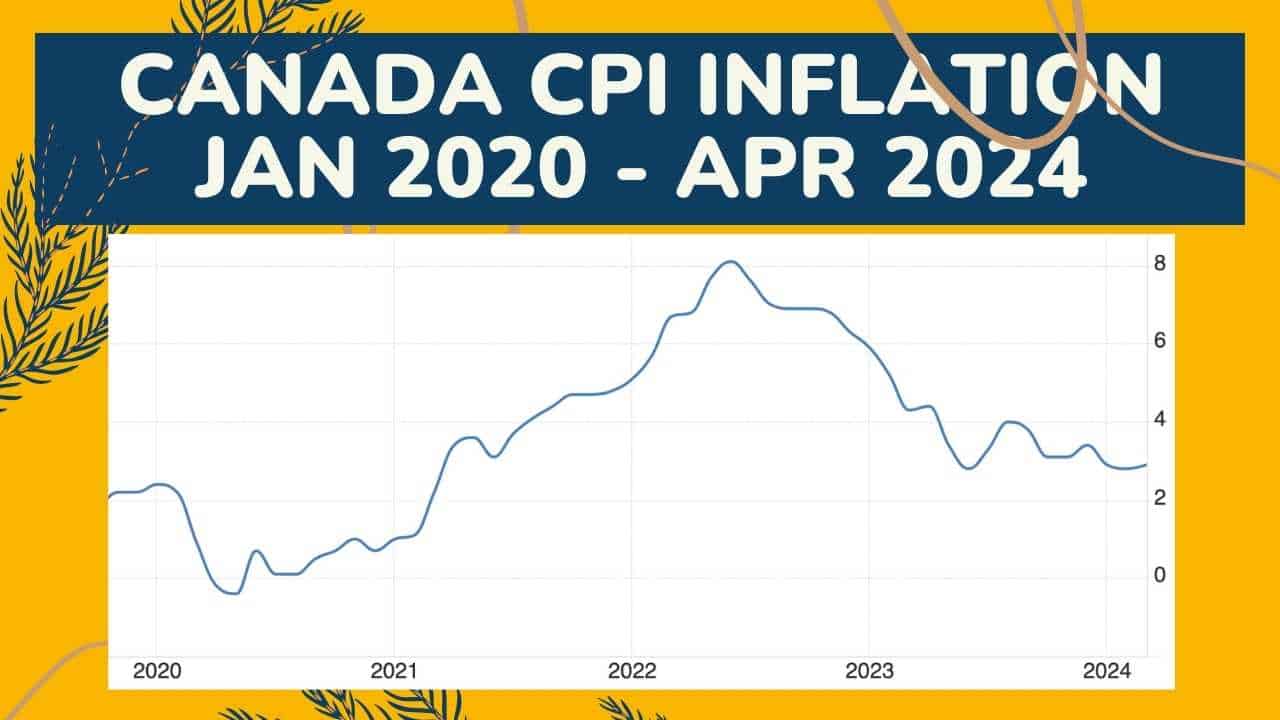

Regardless, the data released since early April might have offered some reassurance. The Summary emphasized the bank’s goal for “further and sustained easing in core inflation.” Members acknowledged the decrease in core inflation in January and February as a sign of ‘further’ easing and hoped this trend would continue. This expectation was met with the March CPI data, which showed that the bank’s preferred core measures, CPI-trim and CPI-median, increased by just 0.1% month-over-month for the third consecutive month.

This week’s data underscored the dangers of maintaining high interest rates. Retail sales volumes were essentially flat in February and March, suggesting a decline in per capita consumption amid rising population growth. Additionally, the Survey of Employment, Payrolls, and Hours (SEPH) indicated a weakening labor demand, with payrolls dropping by 17,700 in February.

Canada’s Housing Crisis – especially Toronto

The Governing Council continues to worry about elevated shelter inflation. However, they recognize that restrictive policies that limit supply may ultimately be counterproductive. According to the industry group BILD GTA, after a brief improvement at the end of 2023, the first quarter of 2024 saw record lows in new home sales in Toronto, consecutively. This trend poses a risk to future housing starts and goes contrary to government goals of increased new home construction.

The Summary highlighted a shift in the Governing Council’s approach to inflation expectations. Previously high consumer inflation expectations were downplayed as largely reflective of past inflation experiences. Instead, the Council now places more emphasis on business inflation expectations as a predictor of future inflation, noting these are aligned with the Bank’s forecasts. This alignment suggests the Bank may proceed with policy adjustments without waiting for the outcomes of its next quarterly consumer and business surveys, which will be released after the June meeting.

Too Soon to Be Certain

However, a rate cut in June is not guaranteed. Potential risks include the possibility that April’s CPI data could show a reacceleration in monthly core price growth similar to recent trends in the U.S., or that strong April housing market data might prompt the Bank to reconsider. Despite these uncertainties, the likelihood of a rate cut seems underestimated by the markets, with overnight interest rates currently suggesting only a 50% chance of a reduction.

As the June 5th rate announcement by the Bank of Canada approaches, several indicators suggest that the central bank might lean towards a reduction in interest rates. The divergent views within the Governing Council, alongside a backdrop of mixed economic signals—from stagnant retail sales to low housing market activities—underline the complexities facing policymakers.

Yet, the bank’s acknowledgment of aligning business inflation expectations with its own outlook, coupled with subdued core inflation measures, points towards a potential easing of policy. While uncertainties such as possible shifts in upcoming economic data persist, the overall trajectory favors a recalibration of rates. This decision would mark a significant shift from the rate hikes that began in early 2022, potentially initiating a new phase of monetary policy aimed at fostering economic stability and growth amidst evolving challenges.

0 Comments