If you are on the verge of buying your first rental property and becoming a landlord, congratulations are in order. You are about to put your money into one of the most time-tested investment options you will ever find. Rental property, if done right, can become the foundation for building personal prosperity and generational wealth.

But the key phrase in that last statement is – if done right. Success as a property investor does not come automatically. It takes work, a whole lot of information on property investing, and having the right kind of people around you. Sadly, most newbie property investors underestimate the amount of effort they need to successfully operate an investment property. That is why most fail.

The majority of would-be property investors never make it past the first stage – getting approval for an investment property loan. Of the few that do make it, most do not survive past their first five years. Only a small minority make it through the early stages to become established landlords. What is the reason for this high failure rate?

Most investors have no idea what they are getting into when they become landlords. Since they have no idea of the challenges that lie ahead, they don’t take the steps to prepare for them. As a result, they make avoidable mistakes that eventually cost them their dreams. But you can be different if you follow the tips highlighted in this post.

10 things you should know before you become a landlord

1. Rental properties have many dimensions

Managing a rental property means you have to become adept at several things. You will often have to wear the cap of a realtor, repairman, debt collector, salesperson, and a lot more. Even if you don’t do these things yourself, you must become skilled at managing the

Managing a rental property means you have to become adept at several things. You will often have to wear the cap of a realtor, repairman, debt collector, salesperson, and a lot more. Even if you don’t do these things yourself, you must become skilled at managing the

people who do them on your behalf.

2. Being a landlord is like a job

Owning a rental is often falsely portrayed as a passive source of income. This is not true; investment properties are only a semi-passive source of income. The property does often require your physical presence. As a matter of fact, you may have to give it as much time as you give to a job.

3. You need a good team

You need a competent team. A few of the experts you need are a cleaner, handyman, attorney, lawn maintenance, roofing expert, tax accountant, and electrical, plumbing and HVAC specialist. In addition to these people, you may need to join your local landlord association in order to get some mentoring.

4. There are laws to follow

Rental properties and landlord-tenant relationships are highly regulated. It is very easy to run afoul of the law or do something that will give tenants an excuse to sue you. What is the acceptable way to screen or evict tenants? What can you do and not do with a tenant’s security deposits? What are the housing safety codes for your area?

5. Have a professional well-written lease

5. Have a professional well-written lease

Your lease agreement will save you from future trouble with tenants. Make sure it is prepared by a professional, specific to the needs of your property, and comprehensive. It should define the terms included in the document and explicitly state all clauses in language that is acceptable to the law and understandable to the tenant.

6. Create opportunities for additional income

Look for other avenues to make money from the property, in addition to the monthly rent. One of the ways to do this is by charging pet fees. Many landlords exclude pets from their property, but you can take a different direction. You may also charge for parking, storage sheds, and garage space.

7. Understand the relevant tax laws

You cannot avoid paying taxes on your property and rental income. How you approach this can make all the difference to how profitable your property will be. There are many deductions landlords can make before paying their taxes. You can take advantage of those to boost your income but you need an accountant for this.

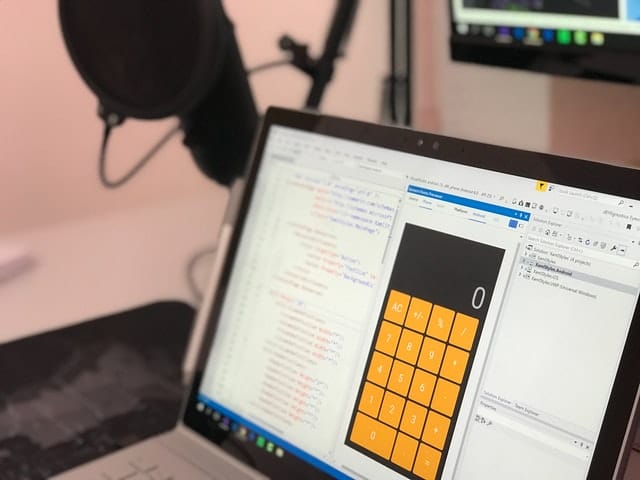

8. Use property management software

Get good property management software and learn how to use it. Property management software automates and simplifies the various aspects of managing a rental property. With a decent online program, you can collect rent or fees online, let tenants register their complaints, handle maintenance issues with ease, and schedule all kinds of tasks.

9. Insurance is vital

You need landlord insurance, at the minimum. But this is not all the insurance you need for the property. In addition to landlord insurance, you need fire and flood coverage, as well as, loss of income insurance, among others. Furthermore, you should make it mandatory for tenants to have renter’s insurance.

10. You must give yourself time to succeed

Regardless of how well-prepared you are, there are things you will only learn after you have become a landlord. Make room for mistakes and give yourself the time to learn and grow. Associate with the right people and keep a tight rein on your finances. Do not be in a hurry.

0 Comments