Things are getting HOT in Alberta!

The Spring Market is Definitely Here in Alberta!

Need Some Mortgage Advice?

Our Quick Take

Home values in Alberta are trending upward. Calgary has already exceeded the high point of 2022, and Edmonton isn’t far behind. Housing inventory is low but buyers are coming back out of the woodwork!

Alberta’s Housing Market is HOT!

Strong Market Recovery!

It is Spring Time and things are definitely heating up. Not just with the heat wave, but in Real Estate too!

Today we are going to talk about the housing market in Alberta and Canada.

After a period of uncertainty caused largely by the Bank of Canada raising its rate by more than 3%, it seems the housing markets in Canada are finding their footing once again. In April, we witnessed a significant surge in real estate activity across our major cities. Buyers, buoyed by the Bank of Canada’s decision to halt aggressive rate hikes, are now more confident to embark on their house-hunting journey.

In the coming months, we expect an exciting shift in the market. Sellers, who previously hesitated to enter a downturn, now have a better environment to showcase their homes. This increase in supply should help balance historically low inventories and support the upward trajectory of prices. Additionally, market-timing buyers, sensing the end of price corrections, are eager to make their move.

In Toronto, resale activity soared by 27% in April compared to March, with new listings increased by only 6.5%. This has caused her prices to continue to increase, and likely they will see more listings show up, however with the pricing they’re already so unaffordable, and likely poor affordability will remain a limiting factor for significant additional price appreciation. Vancouver’s story is very similar to Toronto’s. Extremely poor affordability remains a limiting factor for significant price increases but home prices are trending upward again. In April they saw 2.3% month-over-month increase in sale price.

Calgary’s Market is Super Strong!

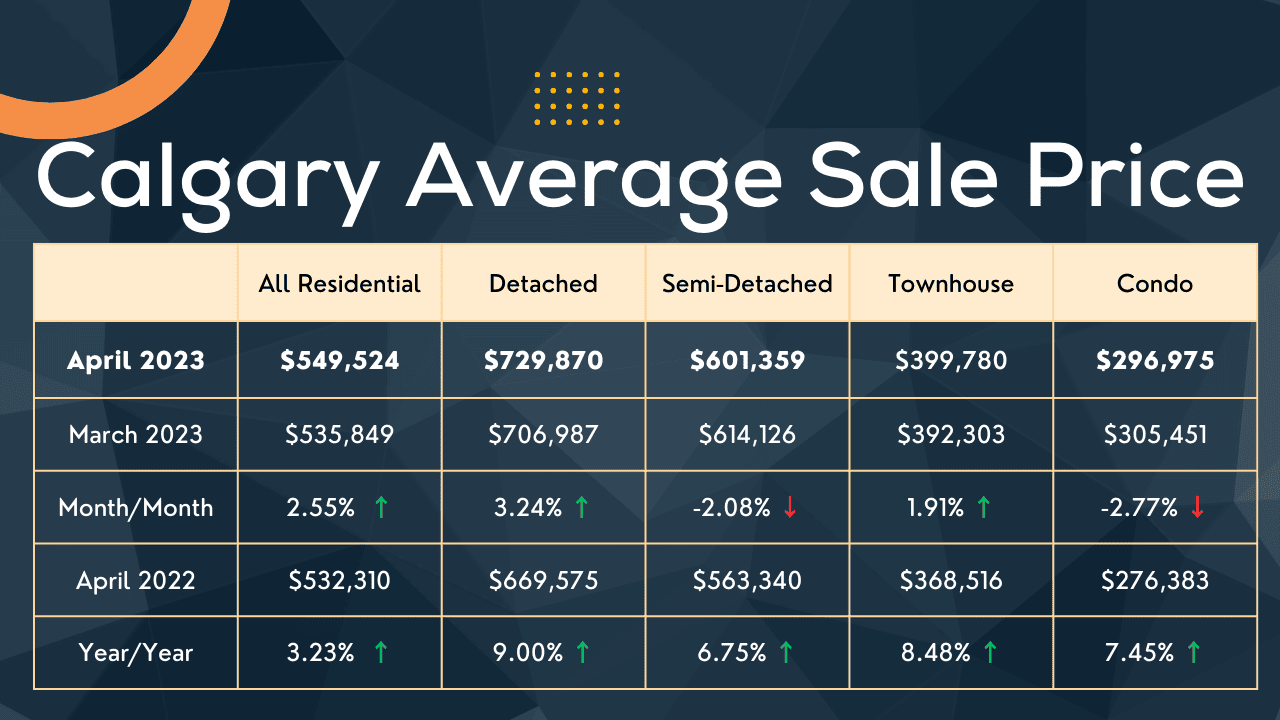

Now, let’s shine the spotlight on Calgary, which is kicking it up a notch. Well, we did see some slowdown in sales and some price reduction in the last half of 2022, both benchmark price and average prices have now exceeded the peak from May 2022. Calgary has experienced a shift in what is selling, with more activity in the condo and townhouse segments than historically normal. This is why the average price increase over the past year is only 3.23%, but each category shows increases between 7% and 9%. Transaction volume is down, but inventory is also very low. With market conditions favouring sellers, prices ticked slightly higher and as market conditions tighten further, we can anticipate continued price appreciation in the coming months.

And last, but not least, Edmonton. Edmonton remains one of the most affordable, major housing markets in the world. Across all housing types, average sale prices are down about 5% from a year ago, but we are seeing some positive upward movement on a month-over-month basis. In April average condo prices were down slightly from March, but that follows a 10% increase in March compared to February.

While the Canadian housing market as a whole displays remarkable resilience, the challenge of affordability continues to loom large in Toronto and Vancouver, especially for first-time buyers but Alberta’s market continues to be more affordable so we can expect continued strength in both of our major cities.

Zooming out and looking at the bigger picture, Canada’s real estate market presents a unique mix of opportunities and considerations. Factors such as record household formation, deficient housing supply, income growth, improving sentiment, and the potential for falling rates are brewing a bullish concoction. However, rising unemployment and stricter mortgage rules could dilute some buying interest. Yet, demand is expected to remain potent enough to at least maintain stable property values until the economic downturn passes.

0 Comments

Trackbacks/Pingbacks