The Final 2022 Rate Adjustment

It’s Finally Here. Can we expect to see a leveling out in 2023?

Need Some Mortgage Advice?

Our Quick Take

The Final Rate Adjustment of 2022 just dropped. Read below for my full take.

Fixed rates have dropped!

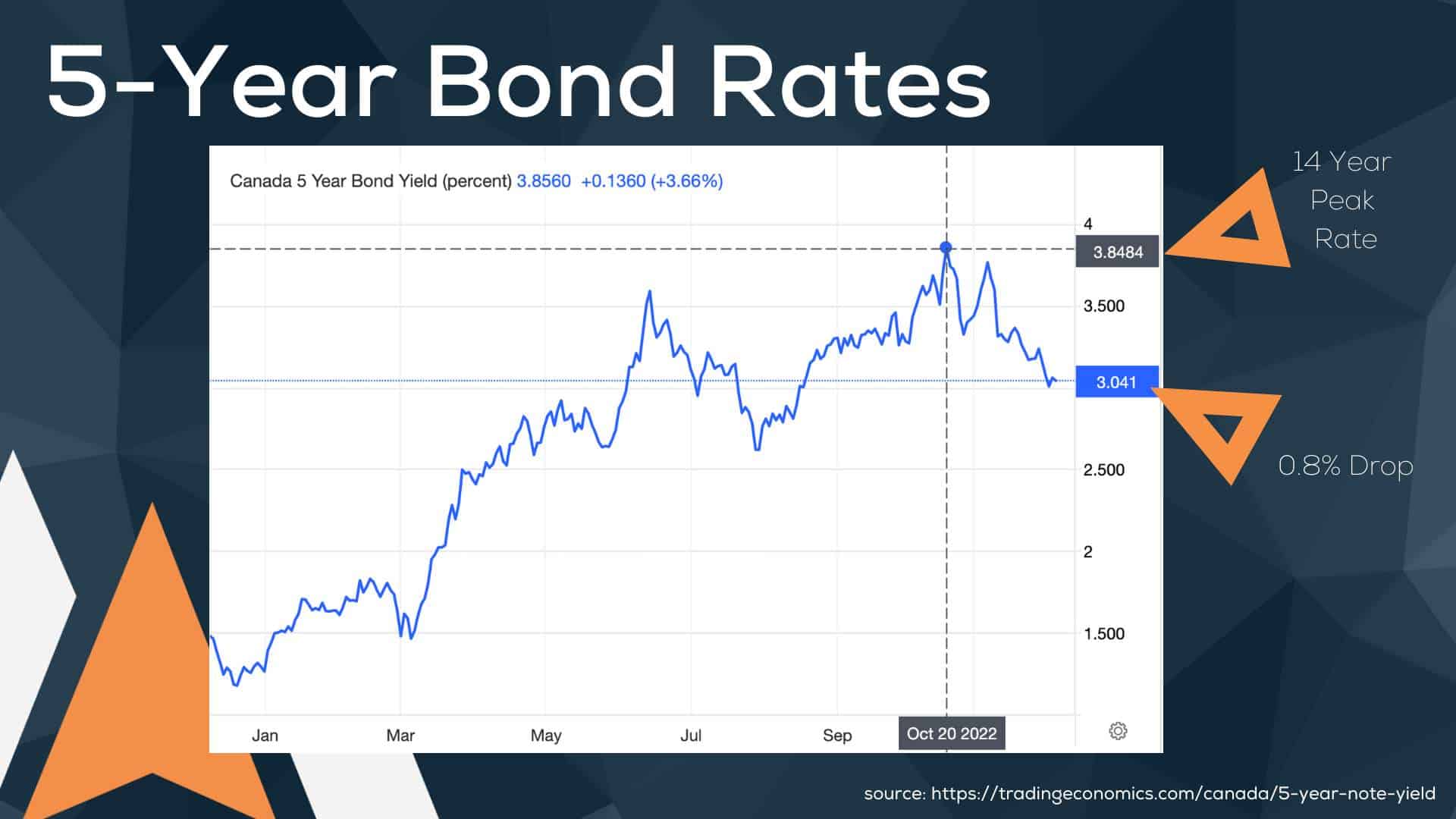

Leading up to the Bank of Canada’s October rate announcement, pricing on the bonds which are the basis for fixed-rate mortgages was increasing. But after that rate announcement was smaller than anticipated by the market, we have seen downward pressure on the Government of Canada’s 5-year Bond Yield.

After peaking on October 20th at the highest rate seen since June 2008, it has dropped more than ¾ of a percentage point, and fixed mortgage rates are trending in the same direction. 5-year fixed mortgages for 5% down purchases were around 5.5%, and they can now be had below 5%! This is positive news, and I will be watching to see if the trend continues and will share more about this in the new year.

Bank of Canada Increased Rates Again!

Meanwhile, today, December 7, 2022, the Bank of Canada made its final rate announcement of the year. In the last week, economists have been pretty split not on whether or not the rate would increase, but on whether it would be a quarter or a half-per cent increase.

The Bank chose a half-percent increase, boldly placing us in a spot where there may be no more need to increase the rate further.

For those of you with Variable Rate Mortgages, this equates to about a $29 per month payment increase for every $100,000 that you owe.

While the Bank won’t tell us that directly, it did point out that they see that the higher rates have slowed consumer spending and housing activity and that price pressures of most everything may be losing momentum. The bank sees the economy stalling as we enter 2023.

This leaves us in a rather unusual position where Fixed Interest Rates are LOWER than the Variable rates on new mortgages! It is usually a safe bet that variable mortgage rates cost less than fixed rate mortgages over the 5-year term of the mortgage. And that may still be true, but the future hasn’t happened yet! I will put together another video next week discussing this odd situation specifically.

Where does this leave us?

Different banks have different predictions of what we will see, but here are a few ideas to consider.

Last week CIBC Senior Economist Andrew Grantham predicted a 0.5% increase today “before the Bank moves to the sidelines in 2023 to observe how the economy is coping with these higher interest rates.”

In a Reuter’s poll of 29 economists last week, all but 3 of them predicted that the rate would peak at 4.25% – leaving the Retail Prime rate at 6.45%. While I don’t have a crystal ball to predict the future, and the data continues to inform policy decisions, it does seem that we are at the end of this historic cycle of rate increases.

I shared last month that the rate might start to decrease as early as a year from now. Let’s hope that proves true!

What does this mean for the housing market?

With rates leveling out now, we can reasonably expect that home prices in Calgary and Edmonton have likely bottomed out – or are very close to that. The most recent data for Calgary shows average prices increasing since August, and leveling out in Edmonton. Over the coming year, if rates remain stable, we should see a corresponding stability return to home prices in Alberta, until it starts to look like rates will head back down which may put upward pressure on home prices. Some economists think that the Bank of Canada may start lowering rates as early as the last part of 2023.

What if I am suffering?

While the banks have been releasing data that suggests that the majority of variable rate holders are in a good position to weather higher rates, that certainly isn’t the case for everyone! If you are struggling, there are options available to your lender to help you out as long as you reach out to them while your mortgage is still in good standing! They can look at skipping payments or stretching your amortization to as many as 40 years if you are at risk of missing payments. But again, you need to start the process before you miss a payment. Each mortgage is different, but reaching out to customer service at your lender can help you understand which options are available to you. If you want or need help knowing where to call, please reach out to me or my office for guidance.

0 Comments